Today’s Top News & Analysis

Egypt to export renewable energy to Italy

Infinity Power's wind farm to start construction in Q1 2025

Fuel subsidies raised to EGP130bn

Drive, GB Corp's subsidiary closed an EGP1.4bn securitized bond issuance

Beltone intends to acquire SODIC's securitization subsidiary

MACRO

Egypt to export renewable energy to Italy

The UAE-based K&K Group signed a MoU agreement with the Italy-based CESI for developing a subsea link between Egypt and Italy. The link will ship 3GW of renewable power generated in Egypt, covering 5% of Italy's peak electricity demand. (Enterprise)

Infinity Power's wind farm to start construction in Q1 2025

Infinity Power's CEO said that the company's wind farm construction will start in Q1 2025 in cooperation with the UAE-based Masdar and Hassan Allam Utilities. The project should be worth USD11bn of investments and to be launched by 2027. The CEO added that around 70-80% of the project's investments will gathered from international institutions. (Enterprise)

Fuel subsidies raised to EGP130bn

The Egyptian government raised the targeted subsidies for petroleum materials by 9% y/y to EGP130bn through FY24. It is worth mentioning that the government previously targeted EGP119bn. (Asharq Business)

CORPORATE

Drive, GB Corp's subsidiary closed an EGP1.4bn securitized bond issuance

GB Corp [GBCO] announced that Drive, its auto financing arm closed a securitized bond issuance worth EGP1.4bn. Drive has a three-year EGP5bn securitization program, with this as its first issuance being 1.7x oversubscribed. The securitization program is structured to be at three tranches as follows:

- EGP498mn.

- EGP696mn.

- EGP274mn. (Company disclosure)

Beltone intends to acquire SODIC's securitization subsidiary

Beltone Financial Holding [BTFH] plans to ease the securitization of its non-banking financial portfolios where it signed a letter of intent to acquire SODIC's licensed securitization subsidiary. BTFH and SODIC are waiting for the result of the due diligence on the subsidiary. (Company disclosure)

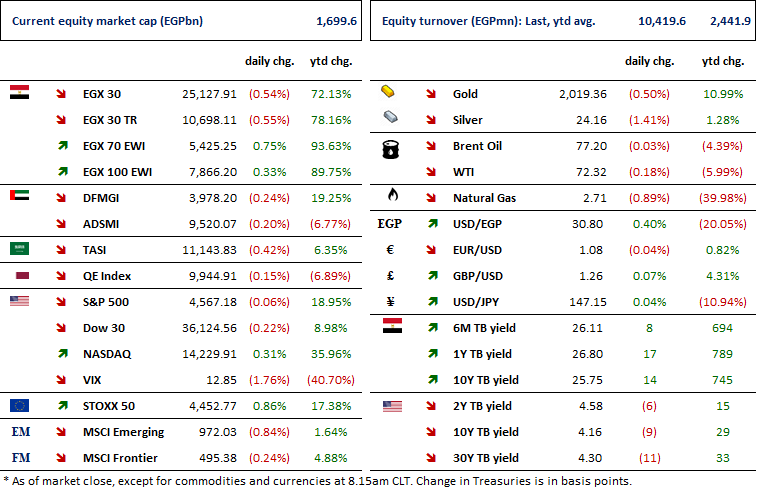

MARKETS PERFORMANCE

Key Dates

11-Dec-23

LCSW: OGM / Considering the distribution of treasury shares.

12-Dec-23

ARCC: OGM / Discussing dividends distribution.

13-Dec-23

EFIH: EGM / Amending some articles of the Company's bylaws.

14-Dec-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

19-Dec-23

CIRA: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

20-Dec-23

MCQE: Cash dividend / Payment date for a dividend of EGP0.50/share (2nd installment).

21-Dec-23

EAST: OGM / A board reconstitution.

EAST: EGM / Amending Articles No. 7 & 21 of the company's bylaws.

MPC Meeting / Determining the CBE's policy rate.

26-Dec-23

ELEC: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

ACGC: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

27-Dec-23

EHDR: EGM / Approving increasing the issued capital & amending ArticleS No. 6 & 7 of the company's bylaws.

28-Dec-23

ABUK: Cash dividend / Payment date for a dividend of EGP3.00/share (2nd installment).

EAST: Cash dividend / Payment date for a dividend of EGP1.75/share (2nd installment).