1. Today’s Trading Playbook

KEY THEMES

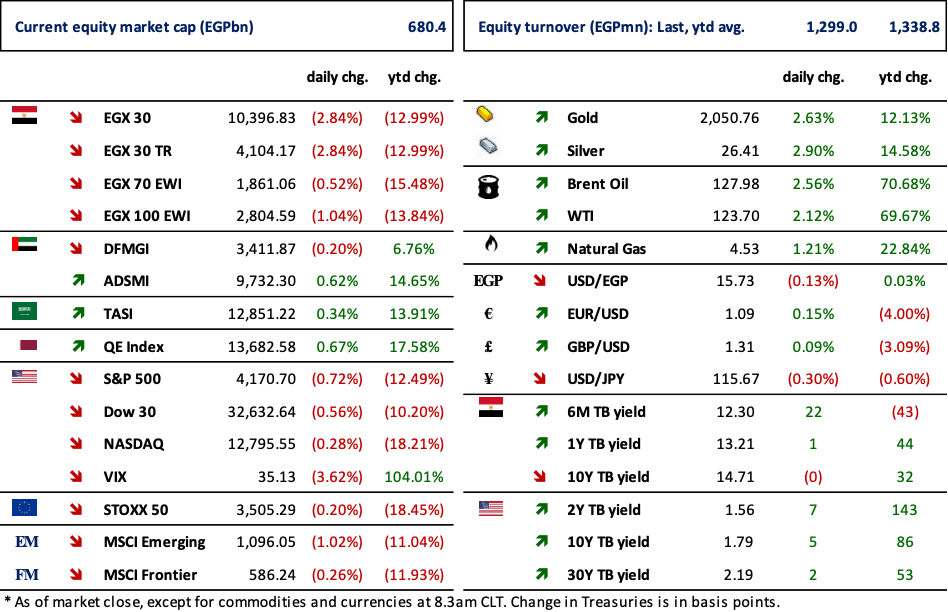

Oil prices continued to rise, with Brent oil prices again above USD130/bbl. This took place after U.S. President, Joe Biden, has ordered a ban on Russian oil and other energy imports. Furthermore, Britain said it would phase out imports of Russian oil and oil products by the end of 2022. Meanwhile, U.S. equities ended yesterday’s session in the red territory, after an edgy trading session that witnessed an early intraday gains. While Asian shares are a mixed bag, U.S. future indices were up in early Wednesday trading.

Here at home, another wave of heavy declines hit the market once more, albeit in a lighter manner than the day before, with the EGX 30 is down for the third consecutive session in a row. The EGX 30 is now at its lowest levels in five months (i.e. since October 2021), which is the month that witnessed the IPO of e Finance [EFIH]. As we speak, the EGX 30 is currently traded at 2022e P/E of only 6x, implying 16.7% in earnings yield.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

The government could consider introducing price controls on unsubsidized bread if sellers continue to raise their prices. The mechanism could be similar to how the government regulates fuel prices across the country. This happened after the price of unsubsidized bread in the Greater Cairo area has risen by as much as 50% in the course of a week in response to global wheat prices. (Enterprise)

The parliament has approved amendments to the Agrarian Reform Act that will unlock agricultural land for national development projects. (Enterprise)

CORPORATE NEWS

SODIC [OCDI] recorded a 5% growth in its net income in 2021 of EGP860mn on a 24% y/y surge in revenue of EGP6.92bn, driven by a strong increase in gross sales of EGP11.36bn (+54%y/y). GPM rose 2pp y/y to 34%. (Company disclosure)

Abu Qir Fertilizers' [ABUK] BoD held on 8 March 2022 announced that the company is studying inaugurating a facility that produces hydrogen and green ammonia in cooperation with French Total. (Company disclosure)

Arab Developers Holdings [ARAB] consolidated net profit after tax in 2021 surged to EGP93mn (+232%y/y) on 28% growth in revenue to EGP1,106mn vs. EGP863mn in 2020 with a higher GPM of 31 % (+3pp). ARAB is currently trading at a 2021 P/E of 5.3x. (Company disclosure)

Palm Hills Developments [PHDC] has reportedly acquired a 7.97% stake in International Company for Leasing [ICLE] at an average share price of EGP41/share. (Mubasher)

Madinet Nasr Housing & Development [MNHD] has posted its results for 2021 with a consolidated net profit of EGP283mn (-72%y/y) vs EGP 1001mn a year earlier. The company reported revenue of EGP2,230mn (-28% y/y) and a gross profit margin of 34% compared to 55% last year. (Company disclosure)

Arab Company for Assets Management’s [ACAMD] has approved the bid placed by Al Rawasy for Real Estate Development to develop a 60,000 sqm land plot in Zefta.(Mubasher)

Aspire Capital [ASPI] net earnings in 2021 were halved to EGP578mn (-47% y/y) on lower income for discontinued operations. Top lien grew marginally to EGP143mn (+2% y/y), while ASPI achieved GPM of 82% vs. GLM a year earlier. (Company disclosure)

Arabian Cement Company [ARCC] reported its figures for 2021, turning to profitability, recording EGP27mn net profit vs. EGP116mn net loss the year earlier. The company achieved a recovery margins, where GPM reached 19% (+6pp y/y), and EBITDA margin 16% (+8.5pp y/y). This recovery was backed up by increase in average selling prices in H2 2021. (Company disclosure)

Central Egypt Flour Mills [CEFM] announced that a fire broke in one of its flour silos caused an explosion in the top of the silo and led to a death of two workers and an injury of ten. (Company disclosure)

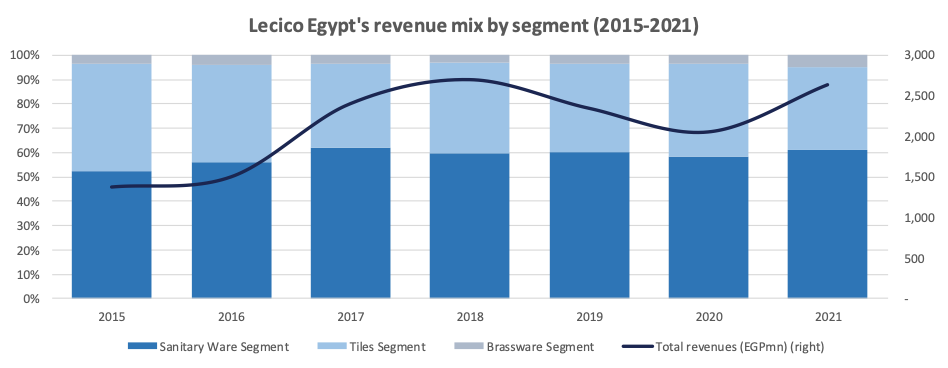

3. Chart of the Day

Abdallah Ismail | Equity Analyst

Source: Company's financials, Prime Research.

The chart shows the steady revenue structure of Lecico Egypt [LCSW] led by the sanitary ware segment. We note that all three segments did not change largely over time despite fluctuating revenues with a 6-year CAGR (2015-2021) of 12%. The chart shows the revenue hike after EGP flotation late November 2016 and the revenue drop with the onset of COVID-19 pandemic early 2020 before revenues began to recover in 2021.