Today’s Trading Playbook

KEY THEMES

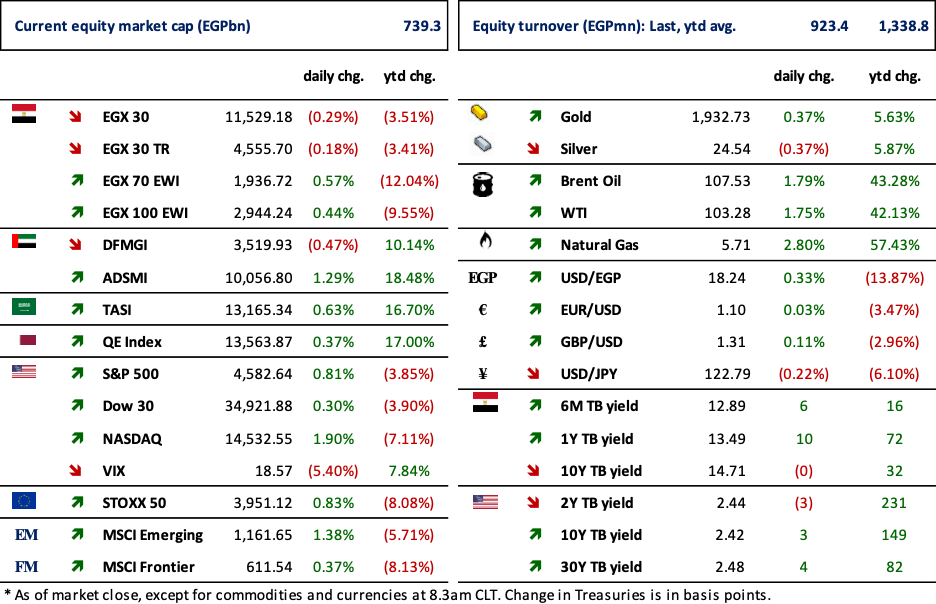

Asian equities rose to a 5-week high, in sync with the gains witnessed over U.S. equities yesterday. Moreover, the U.S. dollar strengthened globally in light of the prospect of a fresh wave of economic sanctions placed by the U.S. on the Russian economy. This has led Brent oil prices to rebound, hovering around the USD109/bbl mark, whereas gold prices retreated on a stronger greenback. It’s worth noting that the spread between the U.S. 2-year and 10-year Treasury yield still point to a slight inversion in the yield curve.

Here at home, Egypt’s PMI for March 2022 indicated a solid decline in the health of the non-oil economy that was the sharpest recorded since June 2020. The index reading fell to 46.5, down from 48.1 in February 2022, as non-oil Egyptian firms suffered the worst declines in output, new orders and stocks of purchases since the first wave of the COVID-19 pandemic.

Elsewhere, the EGX30 dropped marginally yesterday, slipping by 0.28%. Meanwhile, the index is up so far in April by c.2.6%. We note that April has been historically good when it comes to EGX 30 performance. Since 2005, the EGX 30 has had a total of 17 April readings. Historically, the index's monthly performance averaged +3.1% in April over that period where it was 35.3% of the time (i.e. 6 times) negative (averaging -3.7%) and 64.7% of the time (i.e. 11 times) positive (averaging +6.8%).

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Egypt’s PMI indicated a solid decline in the health of the non-oil economy in March that was the sharpest recorded since June 2020. The index fell to 46.5, down from 48.1 in February, as non-oil Egyptian firms suffered the worst declines in output, new orders and stocks of purchases since the first wave of the COVID-19 pandemic. (Markit)

The government is working with the Federation of Egyptian Chambers of Commerce to publish a list setting fair prices for basic food commodities to ensure that retailers aren’t using current inflationary pressures to hike prices unfairly. (The cabinet statement)

Saudi Arabia’s sovereign wealth fund could take stakes in military-owned Wataniya Petroleum (a national operator of filling stations) and the three Siemens-built power plants as part of its proposed USD10bn investment in Egypt, the head of Egypt’s wealth fund said yesterday. (Enterprise)

The state-owned El Nasr Automotive will sign contract next week with a Chinese company to assemble electric vehicles locally, according to El Nasr’s CEO. (Enterprise)

CORPORATE NEWS

A subsidiary of Saudi Telecom (STC) is trying to get the majority stake in the Giza system with an 89.5% stake. (Enterprise)

El-Sewedy Electric [SWDY] wins a bid among nine other companies to supply cables to the Egyptian Electricity Holding Company. (Al-Mal)

Egypt Aluminum [EGAL] has reportedly raised its local selling prices by EGP7,500/ton. (Al-Mal)

Ibnsina Pharma [ISPH] sold 120,000 of treasury shares yesterday. (Egyptian exchange)

Bank Du Caire [BQDC] has decided to up the investments in its Ugandan subsidiary to USD20.2mn. (Arab Finance)

Cemex is planning to cut back spending in Egypt and UAE from a planned USD20mn to only USD10-15mn, according to Carlos Emilio Gonzalez, CEO of Cemex Group. (Asharq News)

GLOBAL NEWS

The United States stopped the Russian government on Monday from paying holders of its sovereign debt more than USD600mn from reserves held at American banks, in a move meant to ratchet up pressure on Moscow and eat into its holdings of U.S. dollars. (Reuters)

Yearly inflation in Turkey hit 61.14% on Monday, climbing to a new 20-year high and deepening a cost of living crisis for many households. (ABC News)

3. Chart of the Day

Abdelkhalek Mohamed | Equity Analyst

AAbdelkhalek@egy.primegroup.org

Source: Cement Egypt, Prime Research.

Cement prices increased 80% y/y due to the increase in fuel prices which contributes 50% to total COGS of cement production. Meanwhile, other factors will keep prices high, including low utilization rates and a weaker EGP, as cement producers import packaging materials and fuels in foreign currency.