Fundamental Thoughts

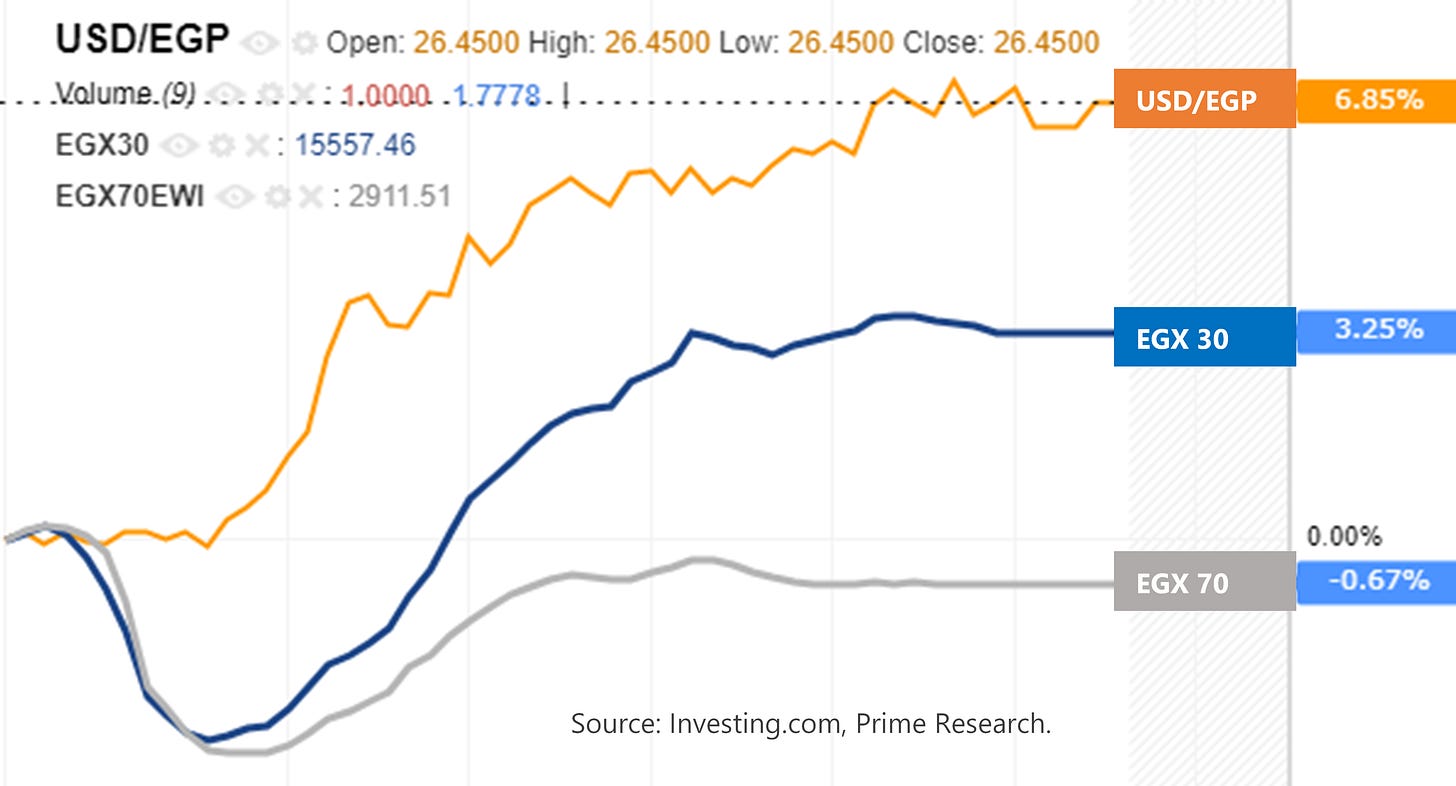

Yesterday’s trading on the EGX was a case in point, exhibiting how a heightened level of volatility can push investors to either make or lose a fortune. Early morning, the two state-owned banks, National Bank of Egypt and Banque Misr, surprised the market with the issuance of a new 25% p.a. 1y CD despite having refuted the idea just weeks ago. This in itself meant that investors’ opportunity cost is now higher, which made them sell off their stock holdings, pulling EGX 30 down 3.1% by around 11 am.

Shortly after, the Central Bank of Egypt (CBE) seems to have given the signal to banks to release some of the pressure on the price of USD which in turn started rising gradually from EGP24.75 all the way to EGP26.43, as per the CBE’s website. This is a 6.8% jump for the USD and a 6.4% drop for the EGP, all in one day. At one point, the USD hit EGP26.55 intraday, as per Investing.com. This signaled to investors to reverse gears and bid stock prices higher again to the point that EGX 30 closed up 3.25% on the day, having risen by 6.9% from intraday low to high.

EGX 70 EWI, on the other hand, fell as low as 3.3% before paring some of its losses to close down 0.7% for the day. The above chart illustrates how it all played out during the day. Who bid the market higher, you may wonder?

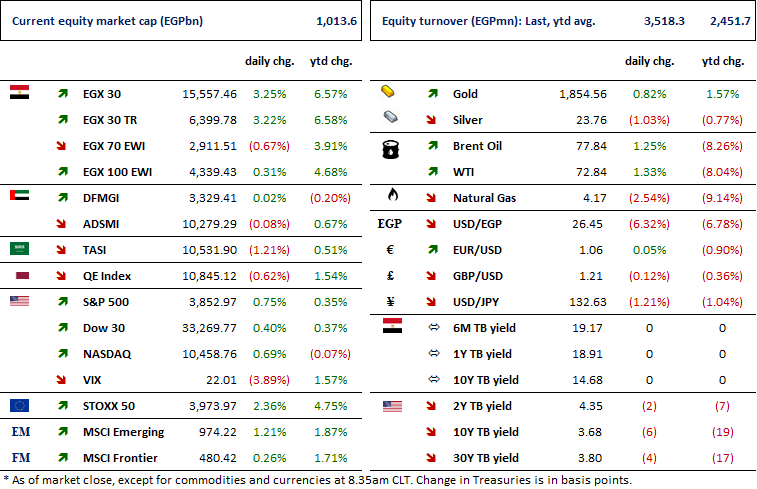

Well, it’s still that broken record you have been hearing from us for the past couple of days. Foreign investors were net sellers, Egyptian and Arab investors were net buyers, and so were Egyptian institutions. At any rate, the EGX made a record yesterday with total market capitalization reaching EGP1.014 trillion for the first time, an all-time high, but unfortunately in EGP terms. Convert this to USD, and it’s only USD38.3bn. This is more than 70% off its USD-based all-time high of USD135bn in February 2008 (according to Bloomberg), almost 15 years ago!

Egypt’s total market capitalization in USDmn

Source: Bloomberg.

As for the two stocks we mentioned yesterday: Misr Hotels [MHOT] and Pyramisa Hotels [PHTV]. MHOT rose as high as 2.7% before it was sold off to end the day down slightly lower (-0.6%). On the other hand, PHTV rose 10%, albeit with thin trading. Both stocks should benefit, among others, from a stronger USD.

Speaking of which, let’s read off the “Stronger USD, Weaker EGP” chapter in our trading book, which suggests investors should be buying COMI, FAIT/FAITA, ABUK, EKHO/EKHOA, MFPC, EGCH, EFIC, SKPC, ESRS, MICH, EGAL, SWDY, ORAS, MOIL, ALCN, CSAG, LCSW, CERA, ECAP, cement exporters, AMOC, CCAP, ORWE, DSCW, SUGR, RACC, EGSA, and ETEL (where we think a repricing of its Vodafone Egypt stake more than offsets a revalued USD-denominated debt). On the flip side, investors should be selling/avoiding consumer names, except for ORWE.

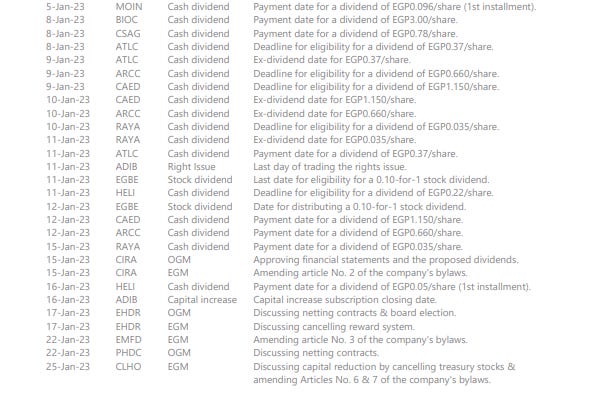

Today is the deadline for eligibility for AT Lease’s [ATLC] cash dividend of EGP0.37/share.

— Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

State-owned banks issue new 1y 25% p.a. CDs

USD strengthens 6.8% to EGP26.43

Vehicle sales drop y/y across the board in 11M 2022

Italy offering Egypt an electricity interconnection project worth USD2.8bn

Compass Capital enters the bidding war on PACHIN with a fifth acquisition offer

KABO to pay off its loan to EXPA earlier than expected

MACRO

State-owned banks issue new 1y 25% p.a. CDs

National Bank of Egypt (NBE) and Banque Misr announced new high-yield 1y CDs that offer either 25% p.a. paid as a lump sum at the end of the year or 22.5% p.a. paid monthly. This comes after the Central Bank of Egypt’s (CBE) decision to hike interest rates by 300bps to further curb inflation and to counter dollarization. (Al-Shorouk)

USD strengthens 6.8% to EGP26.43

Yesterday, the Egyptian pound slipped by 6.4% to EGP26.43/USD as per the CBE website. The Egyptian government hopes that the issuance of the 25% one-year CDs will encourage savers to convert their USD holdings into EGP, which would also help contain inflation by absorbing any excess liquidity. (Bloomberg, CBE)

Vehicle sales drop y/y across the board in 11M 2022

Car sales in Egypt declined by 32.4% y/y in 11M 2022 to 176.8 thousand vehicles, compared to 261.5 thousand units a year before. According to data issued by the Automotive Market Information Council (AMIC), sales of passenger cars decreased by 33% y/y to 128.3 thousand units, compared to 192.9 thousand cars a year before. Meanwhile, bus sales fell 31% y/y to 15.9 thousand units, with truck sales falling 29% y/y to 32.5 thousand units. (Economy Plus)

Italy offering Egypt an electricity interconnection project worth USD2.8bn

The Ministry of Electricity has reportedly received an offer from the Italian government to implement a joint electricity interconnection project with investments amounting to USD2.5bn. The electrical capacities that could be exchanged between the two countries range between 2,500 and 3,000 megawatts. Italy has also included a commitment to acquire the funds for the project from Italian and European financing agencies. Egypt’s position as a net exporter of natural gas and electricity has made it an attractive trading partner for many countries seeking new electrical sources. Egypt is already working on an electricity interconnection project with Saudi Arabia worth USD1.8bn with an estimated electrical exchange capacity of 3,000 megawatts per year starting 2025. (Asharq Business)

CORPORATE

Compass Capital enters the bidding war on PACHIN with a fifth acquisition offer

Paints & Chemical Industries (PACHIN) [PACH] received an acquisition offer from Compass Capital to buy 51-90% of PACH's shares at EGP30/share. PACH received five acquisition offers in the last six months, with only three remaining on the table, including last week's offer from Eagles Chemicals to acquire 76-100% of PACH at EGP29.5/share, and the UAE-based National Paints Holding offer to buy up to 100% of PACH shares for EGP29/share which was made in November. We think the bidding war on PACH shares is related to the change of purpose of the company’s land in Al-Qouba from industrial to residential, which should increase its value substantially. (Al-Mal)

KABO to pay off its loan to EXPA earlier than expected

El Nasr Clothing & Textiles [KABO] decided to make an early repayment of its EGP9mn loan borrowed from Export Development Bank of Egypt [EXPA], which was scheduled to be repaid during the period from 1 January through 31 December 2023. (Company disclosure)