Today’s Top News & Analysis

PHAR Q1 2024: Net profits driven by largely expanded FX gains

IDHC Q1 2024: Strong operations and higher FX gains drive strong net profits

ALCN 9M 2023/24: Net profits growth exceed revenue growth

ETRS Q1 2024: Strong operations and FX gains drive strong net profits

EAST Q3 2023/24: A 26% y/y higher net profit

SWDY: FRA approved Electra’s acquisition offer

EFIC Q1 2024: Higher earnings on doubling revenues

TMGH Q12024: Earnings grew 6x on higher revenues & FX gains

AMOC 9M 2023/24: Strong net profits on higher revenues and gross profit margin

CORPORATE

PHAR Q1 2024: Net profits driven by largely expanded FX gains

EIPICO [PHAR] posted a 220% y/y growth in net profits to EGP603mn on:

· Higher revenues of EGP1.5bn (+51% y/y), driven by a 86% y/y growth in local revenues to EGP1.2bn (captured 77% of total revenues vs. 63% in Q1 2023). Meanwhile, the export revenues declined by 6% y/y to EGP348mn (captured 23% of total revenues vs. 37% in Q1 2023).

· Gross profit margin declined by 4pp y/y to 45%.

· Recording FX gains of EGP535mn vs. FX losses of EGP113,015 last year.

Results imply a TTM P/E of 4.6x. (Company disclosure)

IDHC Q1 2024: Strong operations and higher FX gains drive strong net profits

Integrated Diagnostics Holding Co [IDHC] posted a 142% y/y growth in net profits to EGP418mn on:

· Higher revenues of EGP1.2bn (+28% y/y).

· Better gross profit margin to 37% (+1pp y/y).

· Strongly improved SG&A-to-revenues ratio of 16% (+5pp y/y).

· 176% y/y higher FX gains of EGP301mn.

Results imply a TTM P/E of 15.9x. (Company disclosure)

ALCN 9M 2023/24: Net profits growth exceed revenue growth

Alexandria Container & Cargo Handling Co [ALCN] posted a 28% y/y growth in net profits to EGP4.1bn in 9M 2023/24 on higher revenues of EGP4.2bn (+23% y/y). However, the gross profit margin declined by 2pp y/y to 76%. The growth in net profits exceeded the revenue growth due to:

· A 156% y/y growth in interest expenses to EGP727mn.

· A 3% y/y decline in FX translations to EGP428mn.

Results imply a TTM P/E of 10.3x. (Company disclosure)

ETRS Q1 2024: Strong operations and FX gains drive strong net profits

Egytrans [ETRS] posted a 386% y/y growth in net profits to EGP125mn in Q1 2024 due to:

· Higher revenues of EGP186mn (+115% y/y).

· An 18pp y/y higher gross profit margin of 42%.

· Lower SG&A-to-revenues ratio of 14% (+7pp y/y).

· Higher FX gains of EGP71mn (+200% y/y).

Results imply a TTM P/E of 3.4x. (Company disclosure)

EAST Q3 2023/24: A 26% y/y higher net profit

Eastern Co. [EAST] posted a 26% y/y growth in net profits to EGP2.3bn in Q3 2023/24 on higher revenues of EGP5.8bn (+25% y/y) and a 38% y/y higher interest income. However, the gross profit margin slightly decreased to 40% (-1pp y/y).

Results imply a TTM P/E of 7.6x. (Company disclosure)

SWDY: FRA approved Electra’s acquisition offer

The Financial Regulatory Authority (FRA) approved Electra Investment Holding’s offer to acquire a 15-24.5% stake in Elsewedy Electric [SWDY]. In addition, SWDY will have to:

· Send a disclosure to EGX explaining BoD’s view on the offer within the next 15 days.

· SWDY will appoint an Independent Financial Advisor (IFA) to prepare a fair value study.

· The share sale will be through the OPR system for 20 days following the publication of the offer. (Company disclosure: 1, 2)

EFIC Q1 2024: Higher earnings on doubling revenues

Egyptian Financial & Industrial Company [EFIC] reported standalone financials for Q1 2024 with 81% y/y increase in earnings to EGP158.2mn, thanks to 103% y/y increase in revenues to EGP779.6mn and higher gross profit margin of 47% vs. 31% in Q1 2023. (Company disclosure)

TMGH Q12024: Earnings grew 6x on higher revenues & FX gains

Talaat Moustafa Group Holding [TMGH] reported 491% y/y increase in net profit after taxes to EGP4.1bn in Q1 2024 on growth in hotels sector and FX gains.

· Revenues grew 53% y/y to EGP6.8bn.

· Backlog amounted to EGP180bn vs. EGP85.5bn in comparable period.

· Contractual real estate sales amounted to EGP61.8bn vs. EGP20.2bn in Q1 2023.

As of 29 May 2024, contractual real estate sales increased 2.7x to EGP115.3bn and backlog amounted to EGP232bn to be delivered over 4-5 year. (Company disclosure: 1, 2)

AMOC 9M 2023/24: Strong net profits on higher revenues and gross profit margin

Alexandria Mineral Oils Company [AMOC] posted a 18% y/y growth in net profits to EGP1.3bn in 9M 2023/24 on higher revenues of EGP22.7bn (+28% y/y). However, AMOC reported a lower gross profit margin of 7% (+3pp y/y).

Results imply a TTM P/E of 7.7x. (Company disclosure)

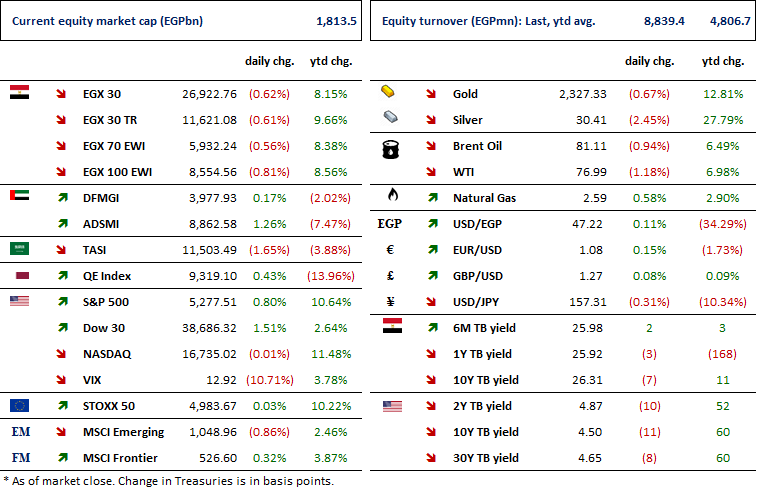

MARKETS PERFORMANCE

Key Dates

2-Jun-24

CSAG: OGM / Approving the estimated budget of FY 2024/2025.

DSCW: Cash dividend / Deadline for eligibility for a dividend of EGP0.167/Share.

3-Jun-24

MSCI / MSCI's May 2024 Semi-Annual Index Review Effective Date.

JUFO: Cash dividend / Payment date for a dividend of EGP0.20/Share.

4-Jun-24

Egypt PMI / May 2024 reading.

5-Jun-24

DSCW: Cash dividend / Payment date for a dividend of EGP0.167/Share.

6-Jun-24

ALCN: OGM / Approving the use of Corporate reserve shown in the audited financial statements.

ALCN: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

8-Jun-24

ESRS: OGM / Approving financial statements ending 31 Dec. 2023 and netting contracts.

ESRS: EGM / Discussing capital reduction.

9-Jun-24

BINV: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

BINV: EGM / Amending Article No. 19 of the company's bylaws.

CCAP: OGM / Approving financial statements ending 31 Dec. 2023.

10-Jun-24

HELI: Cash dividend / Deadline for eligibility for a dividend of EGP1.34/Share.

11-Jun-24

GBCO: Conference Call / Discussing Q1 2024 financial results.

12-Jun-24

EGCH: EGM / Amending Article No. 4 of the company's bylaws.

IDHC: EGM / Amending Article No. 3 of the company's bylaws.

13-Jun-24

HELI: Cash dividend / Payment date for a dividend of EGP1.34/Share.

23-Jun-24

EGTS: OGM / Approving financial statements ending 31 Dec. 2023.

24-Jun-24

BTFH: EGM / Amending Article No. 4 of the company's bylaws.