Results Flow

Stocks mentioned: TMGH, HRHO, CIRA, CLEO, HELI, MFPC, RMDA, MICH, FWRY, ATLC, ORHD, EMFD, SAUD, MOIL, MOSC

Today’s Top News & Analysis

MSCI Index quarterly review

New governmental incentives for healthcare investment initiatives

RMDA Q1 2024: Lower net profits on lower GPM and higher net finance expense

MICH 9M 2024: Earnings grew by 16% y/y

FWRY Q1 2024: Earnings surged 149% y/y

ATLC Q1 2024: Weaker GPM muted earnings growth

ORHD Q1 2024: Recurring earnings jump 53% y/y to EGP1.4bn

EMFD Q1 2024: Earnings leapt 157% y/y on higher FX gains

SAUD Q1 2024: Earnings increased 24% y/y

MOIL Q1 2024: Turning into earnings vs. losses in the comparable period

MOSC 9M 2023/24: Lower net profits despite better revenues

MACRO

MSCI Index quarterly review

In its quarterly index review, MSCI updated Egypt constituents, which will take place as of the close of May 31, 2024:

· In its global standard index, TMG Holding [TMGH] will replace EFG Holding [HRHO]

· In its global small cap index, EFG Holding [HRHO] will be added, while CIRA Education [CIRA], Cleopatra Hospital [CLEO], Heliopolis Housing & Development [HELI], and MOPCO [MFPC] will be deleted. (MSCI)

New governmental incentives for healthcare investment initiatives

The Ministry of Health and the General Authority for Freezones & Investment agreed on providing several incentives to encourage investment in the healthcare sector. To determine which incentives the projects have access to there will be a 12-point rating criteria with a score out of 100. (Enterprise)

CORPORATE

RMDA Q1 2024: Lower net profits on lower GPM and higher net finance expense

Rameda [RMDA] posted its Q1 2024 full results with a 14% y/y decline in net profits attributable to the parent company to EGP57mn despite a 16% y/y increase in revenues to EGP456mn and recording a 138% y/y growth in FX gains to EGP46mn. The decline in net profits is attributable to:

· A lower gross profit margin of 43% (-2.3pp y/y).

· Higher SG&A-to-revenues ratio of 25% (-3.2pp y/y).

· Posting a massively high net finance expense of EGP45mn vs. only EGP15mn a year earlier.

RMDA's TTM P/E based on yesterday's closing price is 12.54x. (Company disclosure)

MICH 9M 2024: Earnings grew by 16% y/y

Misr Chemical Industries [MICH] reported 9M 2024 results with a 16% y/y increase in earnings to EGP506.5mn, supported by higher investment income and FX gains of EGP122.8mn vs. EGP59.6mn in 9M 2023. Revenues declined 3% y/y to EGP655.2mn with a 10% y/y decline in gross profit. Results imply a trailing PE of 4.3x. (Company disclosure)

FWRY Q1 2024: Earnings surged 149% y/y

Fawry for Banking Technology & Electronic Payments [FWRY] reported a 149% y/y increase in earnings to EGP307.1mn in Q1 2024 backed by:

· 61% y/y increase in revenues on expansion across all business segments.

· Higher gross profit margin of 65.8% vs. 62% in Q1 2023.

· EBITDA more than doubled to EGP506.6mn.

· Results imply a trailing PE of 24.6x.

On the operational level, throughput value and the number of transactions increased to EGP116.2bn (+69% y/y) and 441.6mn transactions (+24% y/y), respectively. (Company disclosure)

ATLC Q1 2024: Weaker GPM muted earnings growth

Al Tawfeek for Financial Lease [ATLC] reported a 7% y/y increase in consolidated earnings in Q1 2024, backed by a 35% y/y increase in top line figures, higher interest income, and FX gains. Growth in earnings was muted by a weaker gross profit margin of 19% in Q1 2024 vs. 31% in Q1 2023. (Company disclosure)

ORHD Q1 2024: Recurring earnings jump 53% y/y to EGP1.4bn

Orascom Development Egypt [ORHD] reported a net loss of EGP1.2bn due mainly to recording an FX loss of EGP2.2bn. Excluding non-recurring items, net income increased 53% y/y to EGP1.4bn, thanks to:

· A 41% y/y increase in revenues to EGP4.2bn.

· A 35% y/y increase in EBITDA recording EBITDA margin of 38%.

· A 218% y/y increase in real estate sales to EGP8.8bn the highest ever. (Company disclosure)

EMFD Q1 2024: Earnings leapt 157% y/y on higher FX gains

Emaar Misr for Development [EMFD] reported 157% y/y increase in earnings in Q1 2024 to EGP5.7bn, backed by a higher gross profit margin and FX gains, which more than offset lower revenues (-15% y/y) to EGP1.6bn. Results imply a trailing PE of 2.3x that is abnormally low due to one-off FX gains.

On a separate note, EMFD’s BoD approved the submission of a non-binding offer to Albro North Coast for Developments’ shareholders to acquire 75% of the company to raise EMFD’s stake to 100% through a share swap. In addition EMFD’s BoD approved the submission of a non-binding offer to Skytower for Real Estate Developments’ shareholders to acquire a 25% stake in cash with the possibility of acquiring the remaining 75% through a share swap. (Company disclosure: 1, 2)

SAUD Q1 2024: Earnings increased 24% y/y

Al Baraka Bank Egypt [SAUD] posted a 24% y/y increase in consolidated earnings to EGP553mn in Q1 2024. ROAE decreased from 26% in 2023 to 24% in Q1 2024. Results imply a P/B of 0.8x. (Company disclosure)

MOIL Q1 2024: Turning into earnings vs. losses in the comparable period

Maridive & Oil Services [MOIL] reported financial KPIs for Q1 2024, turning into profits of USD47.7mn vs. losses of USD106.3mn in the comparable period. Earnings growth was backed by:

· An 82% y/y increase in revenues to USD186.5mn on higher average prices and increased operations of high-prices marine units.

· A higher gross profit margin of 48% vs. 29% in Q1 2023 on efficient cost management. (Company disclosure)

MOSC 9M 2023/24: Lower net profits despite better revenues

Misr Oils & Soap [MOSC] posted its 9M 2023/24 results with a 70% y/y decline in net profits to EGP275 thousand despite the better revenues of EGP2.4bn (+11% y/y). In addition, MOSC's SG&A-to-revenues ratio increased by 0.3pp y/y to 0.7%. TTM P/E based on yesterday's closing price is 0.01x. (Company disclosure)

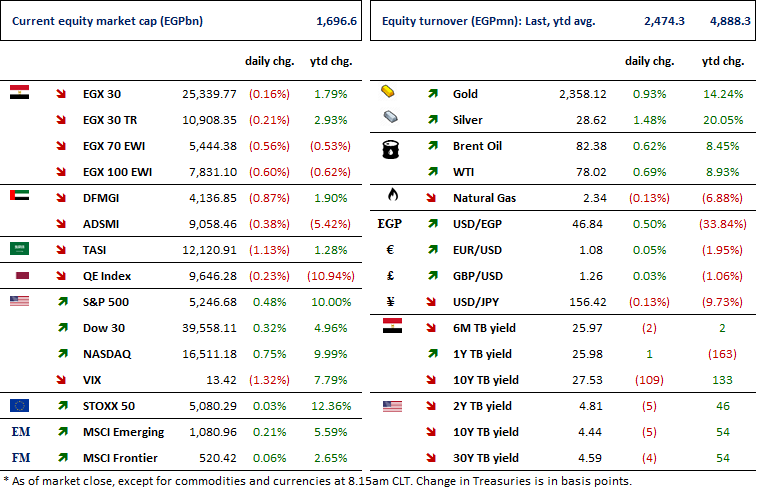

Markets Performance

Key Dates

18-May-24

HRHO: OGM / Approving financial statements ending 31 Dec. 2023.

ISPH: BoD meeting / Discussing financial results.

20-May-24

ORAS: OGM / Approvig financial statements ending 31 Dec. 2023 and the proposed dividends.

23-May-24

HELI: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

MPC Meeting / Determining the CBE's policy rate.

26-May-24

OIH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

SKPC: Cash dividend / Deadline for eligibility for a dividend of EGP1.25/Share.

OFH: OGM / Approving financial statements ending 31 Dec. 2023.

MCRO: OGM / Approving financial statements ending 31 Dec. 2023.

CICH: Cash dividend / Deadline for eligibility for a dividend of EGP0.2169/Share.

SWDY: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

27-May-24

TMGH: Cash dividend / Deadline for eligibility for a dividend of EGP0.22/Share.

MASR: Cash dividend / Deadline for eligibility for a dividend of EGP0.20/Share.

ZMID: Cash dividend / Deadline for eligibility for a dividend of EGP0.150/Share.

29-May-24

SKPC: Cash dividend / Payment date for a dividend of EGP0.75/Share (1st installment)

CICH: Cash dividend / Payment date for a dividend of EGP0.2169/Share.

AMIA: Stock dividend / Last date for eligibility for a 0.10-for-1 stock dividend.

SWDY: Cash dividend / Payment date for a dividend of EGP0.50/Share.

30-May-24

MASR: Cash dividend / Payment date for a dividend of EGP0.10/Share (1st installment)

AMIA: Stock dividend / Date for distributing a 0.10 for-1 stock dividend.

CCAP: OGM / Discussing agenda items.

TMGH: Cash dividend / Payment date for a dividend of EGP0.11/Share (1st installment)

ZMID: Cash dividend / Payment date for a dividend of EGP0.05/Share (1st installment)