Today’s Top News & Analysis

PHAR Q2 2024: Declined net profits despite strong operations

ISPH Q2 2024: Strong operations drive net profits expansion

ORWE Q2 2024: Non-recurring other revenues drives net profits growth

GBCO Q2 2024: Net profits decline on higher net finance expenses and lower GPM

POUL Q2 2024: Better operations and net interest income drive higher net profits

MTIE Q2 2024: Strong net profits on higher revenues and GPM

CORPORATE

PHAR Q2 2024: Declined net profits despite strong operations

EIPICO [PHAR] posted a 45% y/y decline in net profits to EGP176mn in Q2 2024 despite:

· A 47% y/y growth in revenues of EGP1.9bn.

· An improved gross profit margin of 51% (+4pp y/y).

· Lower SG&A-to-revenues ratio of 13% (+3pp y/y).

Despite the strong operations, PHAR's net profits saw a decline due to:

· Recording FX losses of 37mn vs. FX gains of EGP203mn last year.

· An increase of 143% y/y in net interest expenses to EGP184mn. (Company disclosure)

ISPH Q2 2024: Strong operations drive net profits expansion

Ibnsina Pharma [ISPH] posted a108% y/y growth in net profits to EGP123mn in Q2 2024 due to:

· Stronger revenues of EGP12bn (+56% y/y).

· Better gross profit margin of 8.4% (+0.3pp y/y).

· Lower SG&A-to-revenues ratio of 3.7% (+0.3pp y/y). (Company disclosure)

ORWE Q2 2024: Non-recurring other revenues drives net profits growth

Oriental Weavers [ORWE] posted a 183% y/y growth in net profits to EGP821mn mainly driven by the one-off other revenues of EGP525mn vs. only EGP4mn last year. On operations level, ORWE posted a 22% y/y revenue growth to EGP5bn and the gross profit margin normalized at 14%, as the management expected. (Company disclosure)

GBCO Q2 2024: Net profits decline on higher net finance expenses and lower GPM

GB Corp [GBCO] posted a 20%% y/y decline in net profits to EGP440mn in Q2 2024 mainly due to a 142% y/y increase in net finance expenses to EGP599mn and the lower gross profit margin of 18% (-4pp y/y). Regarding revenues, GBCO posted a 69% y/y growth to EGP10bn. (Company disclosure)

POUL Q2 2024: Better operations and net interest income drive higher net profits

Cairo Poultry [POUL] posted a 181% y/y growth in net profits to EGP583mn on:

· Higher revenues of EGP3bn (+21% y/y).

· Improved gross profit margin to 26% (+2pp y/y).

· A 23% higher other operating revenues of EGP108mn.

· Recording net interest income of EGP41mn vs. net interest expenses of EGP33mn. (Company disclosure)

MTIE Q2 2024: Strong net profits on higher revenues and GPM

MM Group for Industry & International Trade [MTIE] posted a 73% y/y growth in net profits to EGP246mn on higher revenues of EGP3bn (+35% y/y) and better gross profit margin of 13% (+2pp y/y). (Company disclosure)

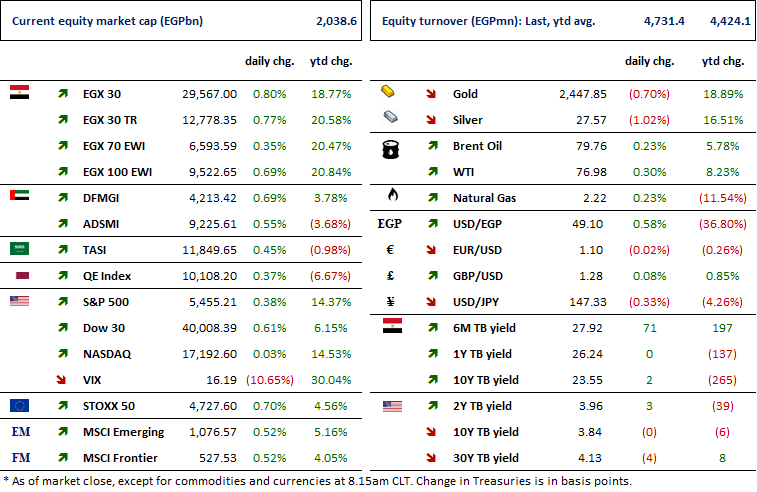

MARKETS PERFORMANCE

Key Dates

17-Aug-24

MFPC: OGM / Considering distributing cash dividends.

18-Aug-24

OFH: OGM / A board reshuffle.

20-Aug-24

ACGC: EGM / Amending some Articles of the company's bylaws.

21-Aug-24

ORAS: Cash dividend / Payment date for a dividend of EGP9.69/Share.

EXPA: Stock dividend / Last date for eligibility for a 0.33-for-1 stock dividend.

22-Aug-24

EXPA: Stock dividend / Date for distributing a 0.33 for-1 stock dividend.

26-Aug-24

BINV: Cash dividend / Deadline for eligibility for a dividend of USD 0.020/Share.

28-Aug-24

TANM: Stock dividend / Last date for eligibility for a 0.2-for-1 stock dividend.

29-Aug-24

TANM: Stock dividend / Date for distributing a 0.2 for-1 stock dividend.

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/Share (2nd installment)

CCAP: OGM / Discussing appointing an additional auditor for the company’s accounts for the current year ending 31 Dec. ,2024.

CCAP: EGM / Discussing the continuation of the company.

SKPC: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

BINV: Cash dividend / Payment date for a dividend of USD 0.020/Share.