Results Flood

Stocks mentioned: HRHO, CANA, HDBK, FAIT, FWRY, EFIH, AIH, MCRO, ISPH, EAST, ORWE, ETRS, PHDC

Today’s Top News & Analysis

EFG Holding Q3 2023: Annually strong, quarterly modest

CANA Q3 2023: Strong earnings associated with high risk

HDBK Q3 2023: Balance sheet recovery

FAIT Q3 2023: Improved profitability, yet shrinking deposits

FWRY Q3 2023: A fintech savvy

EFIH Q3 2023: New quarterly records

AIH Q3 2023: A weak quarter

MCRO Q3 2023: Stronger net profits on higher revenues and other income

ISPH Q3 2023: Higher finance expenses slightly mute the net profits growth

EAST Q1 2023/24: Net finance income and other income mutes the net profits decline

ORWE Q3 2023: Higher net profits on higher revenues

Egytrans 9M 2023: Higher net profits despite the decline in revenues

PHDC Q3 2023: Finance expense mutes the net profit growth

CORPORATE

EFG Holding Q3 2023: Annually strong, quarterly modest

· EFG Holding [HRHO] Q3 2023 net income surged 24% y/y to EGP395mn on the back of 27% y/y growth in topline to EGP2.9bn. Revenues came mostly dominated by the Investment Bank platform that grew by 30% y/y to EGP1.4bn. However, from a quarterly perspective, top line declined by 4% q/q and bottom line declined by 2% q/q.

· We note that the Investment Bank platform strong performance took place in view of (1) Brokerage revenues increasing by 110% y/y to EGP815mn (2) asset management revenues increasing by 104% y/y to EGP198mn (3) private equity revenues increasing 76% y/y to EGP57mn

· Meanwhile, the NBFS segment revenue growth came at 0% y/y to EGP666mn. The flat annual performance came despite a massive leap in valU portfolio and top line, where the consumer finance company recorded top line of EGP314mn (+105% y/y). However, a 28% y/y decline in the micro-finance arm Tanmeyah’s revenues to EGP258mn and a 34% y/y decline in the leasing revenues to EGP73mn caused the total top line of the NBFS segment to remain flat y/y.

· Finally. The commercial banking operations (i.e. aiBank) bottom line grew 214% y/y to EGP176mn. The bank’s revenues surged by 53% y/y to EGP890mn.

· We note that revaluations in FV-P&L investments recorded profits of EGP138mn against losses of EGP32mn last year. In addition to a 68% y/y increase in other revenues to EGP293mn. (Company disclosure)

CANA Q3 2023: Strong earnings associated with high risk

Suez Canal Bank [CANA] announced Q3 2023 results. Here are our main takeaways:

· Net income increased by 56% y/y to EGP729mn on the back of a 66% y/y increase in net interest income (NII) to EGP841mn. This marks a new quarterly earnings record for CANA, where this quarter represents 53% of the 9M 2023 earnings.

· Another reason to the strong bottom line would be the EGP508mn of gains on financial investments (+68% q/q), coupled with low booked provisions of only EGP168mn (-45% q/q).

· Also, a drop in effective tax rate to 27% from 40% in Q2 2023 elevated a lot of pressure from the bottom line.

· Deposits rebounded back to the levels of EGP75bn after it dropped to EGP73bn in Q2 2023. This makes the ytd growth at 14%, with GLDR maintained at 48.6%.

· Loans also rebounded to EGP36.5bn after dropping to EGP35bn last quarter. This recovery came at the cost of higher NPL ratio that increased to 9.6% from 6.1% and coverage ratio dropped to 78%.

· This brings CANA’s annualized ROAE up to 42.5% from 26% in Q2 2023, and fortunately, the bank’s CAR increased to 15.29%, up from 13.78% in Q2 2023. (Bank disclosure)

HDBK Q3 2023: Balance sheet recovery

· Housing and Development Bank [HDBK] announced Q3 2023 results where net income increased by 156% y/y to EGP1.4bn (-17% q/q) on the back of a 111% y/y (+11% q/q) increase in net interest income (NII) to EGP2.77bn.

· This brings HDBK’s annualized NIM and ROAE to 11.6% and 43.4%, respectively.

· On the balance sheet side, HDBK loan book grew by 12% ytd to EGP42.8bn equally driven by both retail and corporate loans, with a NPL ratio of 7.2%.

· Deposits, on the other hand recovered this quarter to EGP95.5bn, mainly on the back of retail deposits, after the setback to EGP91bn last quarter. This makes deposits’ growth 7% ytd and maintains the GLDR to 45% (Bank disclosure)

FAIT Q3 2023: Improved profitability, yet shrinking deposits

· Faisal Islamic Bank [FAIT] announced the results for Q3 2023, where net income increased by 38% q/q to EGP770mn. Which pushed the annualized ROAE to improve a little from 9% in Q2 2023 to 13% this quarter

· Net interest income remained almost flat q/q at EGP1.4bn for the second quarter in a row.

· The main reason for bottom line’s improvement would be provisions reversal of EGP156mn.

· After remaining flat at EGP133bn in Q2 2023, Deposits dropped this quarter to EGP130bn, reflecting how much of a negative effect the fierce competition from other banks has on FAIT. This makes ytd growth in deposits at only 5.3%.

· Gross loans remained almost flat q/q at EGP15.7bn (+8% ytd), with GLDR still at 12%. (Bank disclosure)

FWRY Q3 2023: A fintech savvy

Fawry for Banking Technology & Electronic Payments [FWRY] announced strong Q3 2023 results. FWRY’s net income grew by 183% y/y to EGP203mn. Meanwhile, top line grew by 42% y/y to EGP873mn on the back of strong growth in FWRY’s banking services segment to EGP329mn (+63% y/y) that contributed 49% to the y/y growth. This has maintained the GPM at 62.5%. Besides revenues, the following items contributed to net profit growth:

1. 96% y/y increase in credit interest to EGP121mn on yield from treasury bills. In addition to a 6.8x y/y higher gains on sale of fixed assets EGP4.2mn.

2. a 41% increase in other revenues to EGP2.1mn .

This comes despite booking credit provisions of EGP4.3mn against reversals of EGP2.6mn last year. (Company disclosure)

EFIH Q3 2023: New quarterly records

E-Finance For digital and Financial Investments [EFIH] announced Q3 2023 results, where net profit grew by 111% y/y to EGP429mn. This was on the back of:

Strong y/y growth in top line of 52% to EGP1bn. This growth was driven by:

· strong y/y growth of 46% in e-finance Digital Operations revenues of EGP905mn on cloud hosting and transaction based revenues.

· 43% y/y increase in eKhales revenues to EGP24.4mn.

· 206.6% y/y increase in eAswaaq revenues to EGP53mn

· 33% y/y increase in enable revenues to EGP32.2mn.

· Which all offset the 48% decline in eCards’ revenues to EGP68mn.

· We note that a 56.5% y/y increase in financing income to EGP132mn also contributed to bottom line growth. This marks a new quarterly high for both of EFIH's top and bottom line. (Company disclosure)

AIH Q3 2023: A weak quarter

Arabia Investments Holding [AIH] announced the results of Q3 2023, where net income declined to EGP5.3mn against EGP10mn last year. This decline is mainly attributable to:

(1) Almost y/y flat revenues of EGP335mn, with the same GPM of 18%

(2) EGP17mn of impairment of projects under construction

(3) Bad debts of EGP5.5mn

(4) Income taxes of EGP4.7mn.

On a quarterly basis, this quarter is also weak as net income declined by 59% q/q and revenues remained almost flat increasing by 2% q/q. (Company disclosure)

MCRO Q3 2023: Stronger net profits on higher revenues and other income

Macro Group Pharmaceuticals [MCRO] 9M 2023 net profits dropped by 24% y/y to EGP98mn despite a 13% y/y increase in revenues to EGP590mn. The net profits drop is attributable to:

· The gross profit margin declined by 5pp y/y to 72%.

· Finance expense massively increased to EGP47mn (+367% y/y).

Regarding Q3 2023, MCRO's performance was strong posting an 18% y/y growth in net profits to EGP69mn on:

· Higher revenues of EGP252mn (+17% y/y).

· Higher other income or EGP6mn vs. only EGP61,960 last year.

However, the gross profit margin declined to 73% (-4pp y/y). (Company disclosure)

ISPH Q3 2023: Higher finance expenses slightly mute the net profits growth

Ibnsina Pharma [ISPH] reported its consolidated 9M 2023 net profits of EGP174mn (+45% y/y) on:

· Higher revenues of EGP24bn (+51% y/y).

· Better gross profit margin of 7.8% (+0.2pp y/y).

· Better SG&A-to-revenues ratio of 3.9% (-1.1pp y/y).

· Booking FX gains of EGP33mn vs. only EGP10mn last year.

The net profit growth was subdued by the increase in finance expenses to EGP734mn (+128% y/y).

Regarding Q3 2023, ISPH posted a 36% y/y growth in net profits to EGP42mn on:

· Higher revenues of EGP9bn (+64% y/y).

· Better SG&A-to-revenues ratio of 3.7% (-1.2pp y/y).

· Posting higher other income of EGP2mn vs. only EGP507,317 last year.

However, the net profit growth was slightly muted by:

· The gross profit margin slightly slipped to 7.4% (-0.3pp y/y).

· Booking FX losses of EGP2mn vs. FX gains of EGP1mn last year.

· Finance expenses increased to EGP291mn (+110% y/y). (Company disclosure)

EAST Q1 2023/24: Net finance income and other income mutes the net profits decline

Eastern Co. [EAST] posted its Q1 2023/24 full results recording a 20% y/y decline in net profits to EGP1.1bn on:

· Lower revenues of EGP3.1bn (-32% y/y).

· A lower gross profit margin of 31% (-20pp y/y).

However, the decline in net profits was slightly muted by:

· Other income growing by 15% y/y to EGP113mn.

· Posting net finance income of EGP10mn vs. net finance expenses of EGP8mn last year. (Company disclosure)

ORWE Q3 2023: Higher net profits on higher revenues

Oriental Weavers [ORWE] posted 9M 2023 net profits of EGP1.4bn (+162% y/y) due to:

· Higher revenues of EGP12.9bn (+36% y/y).

· Higher gross profit margin of 14% (+4pp y/y).

· Treasury returns increased to EGP149mn (+58% y/y).

· Finance income increased to EGP73mn (+129% y/y).

Regarding Q3 2023, ORWE posted a 651% y/y growth in net profits to EGP596mn on:

· Higher revenues of EGP4.5bn (+50% y/y).

· Higher gross profit margin of 15% (+6pp y/y).

· Treasury returns increased to EGP44mn (+52% y/y).

· Finance income increased to EGP35mn (+192% y/y).

· Posting FX gains of EGP17mn vs. FX losses of EGP2mn last year. (Company disclosure)

Egytrans 9M 2023: Higher net profits despite the decline in revenues

Egytrans [ETRS] 9M 2023 net income came at EGP38mn (+22% y/y) despite the 5% y/y decline in revenues to EGP276mn. The increase in net profits is attributable to the 3.8pp increase in the gross profit margin to 25.1%, Other income grew by 62% y/y to EGP1.2mn, and booking finance income of EGP28mn (+84% y/y). (Company disclosure)

PHDC Q3 2023: Finance expense mutes the net profit growth

Palm Hills Development [PHDC] 9M 2023 net income came at EGP1bn (+15% y/y) on revenues of EGP11bn (+18% y/y) while the gross profit margin came in flat 33.7% (+0.2pp y/y).

Regarding Q3 2023, PHDC posted a 25% y/y growth in net profits to EGP441mn on higher revenues of EGP4bn (+66% y/y) while the gross profit margin was flat at 33.5% (+0.1pp y/y). We note that the net profit growth was muted by the 146% y/y increase in finance expenses to EGP364mn. (Company disclosure)

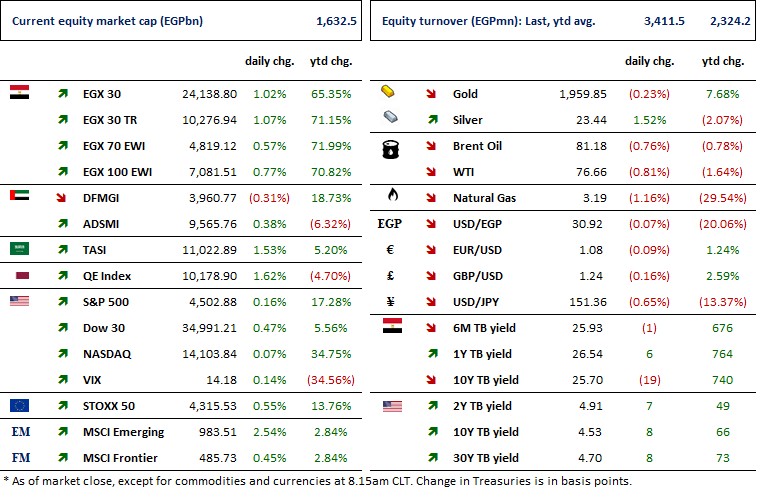

MARKETS PERFORMANCE

Key Dates

20-Nov-23

EGAL: Cash dividend / Deadline for eligibility for a dividend of EGP6.5/Share.

23-Nov-23

EGAL: Cash dividend / Payment date for a dividend of EGP6.5/share.

CSAG: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

CSAG: EGM / Approving increasing the issued capital & amending Article No. 3 of the company's bylaws.

TALM: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

EFID: Conference Call / Discussing Q3 2023 financial results.

26-Nov-23

EFID: EGM / Discussing capital reduction & amending Articles No. 3, 6 & 7 of the company's bylaws.

27-Nov-23

ETEL: EGM / Amending Article No. 5 of the company's bylaws.

EFID: Cash dividend / Deadline for eligibility for a dividend of EGP0.428/Share.

DOMT: Cash dividend / Deadline for eligibility for a dividend of EGP0.20/Share.

30-Nov-23

DOMT: Cash dividend / Payment date for a dividend of EGP0.20/share.

EFID: Cash dividend / Payment date for a dividend of EGP0.428/share.

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).