Today’s Top News & Analysis

Five projects are granted the Golden License

Abu Dhabi Fund for Development may grant Egypt a loan for wheat purchasing

Egypt's GDP grew 4.2% last fiscal year

COMI Q2 2023: From better to best

MOIL Q1 2023: Revenues bring up bottom-line

Palm Hills Developments closes its second securitization this year

MACRO

Five projects are granted the Golden License

The Egyptian Cabinet approved granting the Golden License to five projects specializing in:

· Health & medical: Gennecs, a pharma company, will operate its Gennvax factory in Suez Canal Economic Zone for USD150mn.

· Waste management: EnviroProcess, a recycling plant in Minya, will be set up for EGP74mn.

· Home appliances: A subsidiary of Chinese Midea Electric, a home appliance factory, will operate in Al-Sadat City for USD105mn.

· Packaging: BALM & Africa, a medical manufacturer, will build a packaging factory in Ismailia for EGP885mn.

· Infrastructure industries: Fayoum Co. for Storage & Warehouses will operate a strategic warehouse in El-Fayoum for EGP1.34bn. (Enterprise)

Abu Dhabi Fund for Development may grant Egypt a loan for wheat purchasing

The Ministry of Supply & Trade announced that it is expecting a USD400mn loan from Abu Dhabi Fund for Development to support Egypt’s wheat purchase. The loan, to be granted in four tranches of USD100mn each, is aimed to finance grain and other commodity purchasing from UAE-based Dahra. (Enterprise)

Egypt's GDP grew 4.2% last fiscal year

Preliminary figures for Egypt's economy show real GDP growing by 4.2% y/y in FY23, down from 6.6% the year before. The preliminary surplus came in at EGP164.3bn (1.7% of GDP). (Enterprise)

CORPORATE

COMI Q2 2023: From better to best

Commercial International Bank – Egypt [COMI] announced its Q2 2023 financial results. Here are our main takeaways:

· Again, COMI breaks its own quarterly earnings record of Q1 2023, as net income increased to EGP8bn (+32% q/q, +128% y/y).

· This was on the back of a 20% q/q increase (+83% y/y) in net interest income (NII) to EGP12.9bn, which in turn pushed annualized NIM up to 7.5%.

· Although net trading income recorded only EGP474mn this quarter against EGP1.8bn in Q1 2023, the drop was mitigated by a 31% q/q decline in other operating expenses to EGP1.3bn and a 72% q/q decline in booked provisions to EGP265mn.

· COMI’s loan book witnessed minor q/q growth of 3.2% to EGP251bn (+15% ytd including the devaluation effect) given elevated interest rates. The slight increase is credited to corporate overdrafts and direct corporate loans.

· NPLs stand now at 5% (20 bps lower than Q1 2023) with a comfortable coverage ratio of 236%.

· Meanwhile, deposit growth was much stronger, recording +14% q/q to EGP656bn (+24% ytd). Unlike loans, deposit growth is attributable to individual deposits that increased 31% ytd, thanks to the new innovative products the bank managed to offer. This brings the GLDR to 38%.

· ROAE is now as high as 49% from 39% in the previous quarter.

COMI is now traded at an annualized P/E of 4.7x and a P/B of 2.2x. (Bank disclosure)

MOIL Q1 2023: Revenues bring up bottom-line

Maridive & Oil Services [MOIL] reported its Q1 2023 consolidated results recording net profits of USD8mn (vs. a net loss of USD10mn in Q1 2022 and a net loss of USD77mn in Q4 2022), driven by a 102% y/y increase in revenues to USD41.6mn (+59% q/q) and a GPM of 42% (vs. a gross loss of USD5mn in Q1 2022). The improved revenue performance was driven by:

· A 257% y/y increase in project revenues to USD26.8mn (a 64% revenue contribution) and a segment GPM of 53% (vs. a gross loss of USD3.6mn in Q1 2022).

· A 14% y/y increase in rent revenues to USD 15mn (a 36% revenue contribution) and a segment GPM of 24% (vs. a gross loss of USD1.8mn in Q1 2022). (Company disclosure)

Palm Hills Developments closes its second securitization this year

Palm Hills Developments [PHDC] closed its second receivables securitization this year worth EGP472.5mn. EFG Holding [HRHO] acted as the bookrunner for the issuance. (Enterprise)

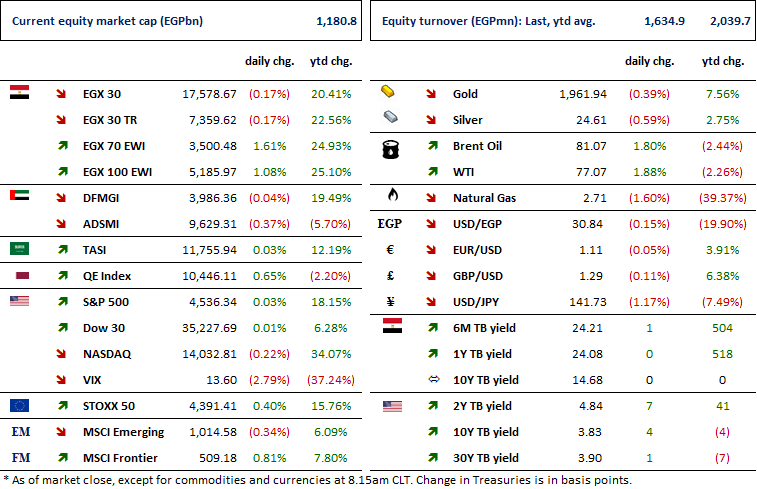

Markets Performance

Key Dates

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

31-Aug-23

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).