Fundamental Thoughts

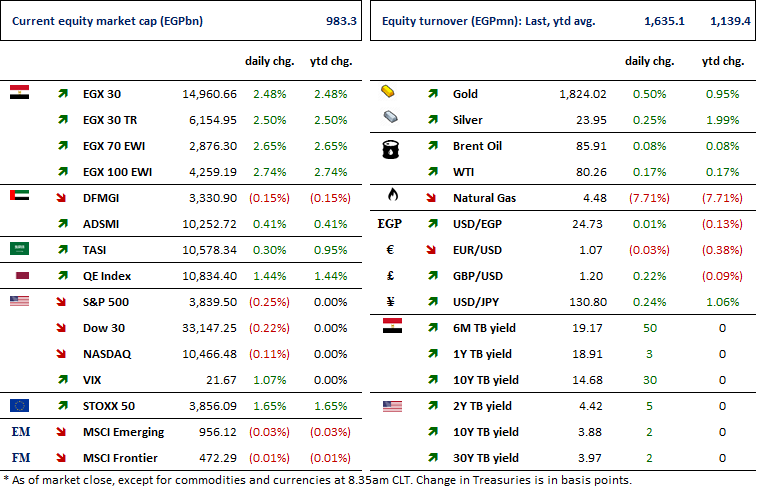

With global and regional markets all resetting the dials back to zero, the first trading day of the new year in Egypt was a welcoming one. Both main market indices jumped 2.5% in the case of EGX 30 and 2.6% in the case of EGX 70 EWI. This suggests that investors could be in for a good start, but taking a closer look at yesterday’s net trading suggests a continuation of a recent trend. Foreign investors were still net sellers, whereas Egyptian and Arab investors were net buyers. What is interesting is that Egyptian institutions, who we would like to call smart money, are buying into the market, albeit making up less than a quarter of market trading. Still, this is a good sign that we hope will continue as the year progresses.

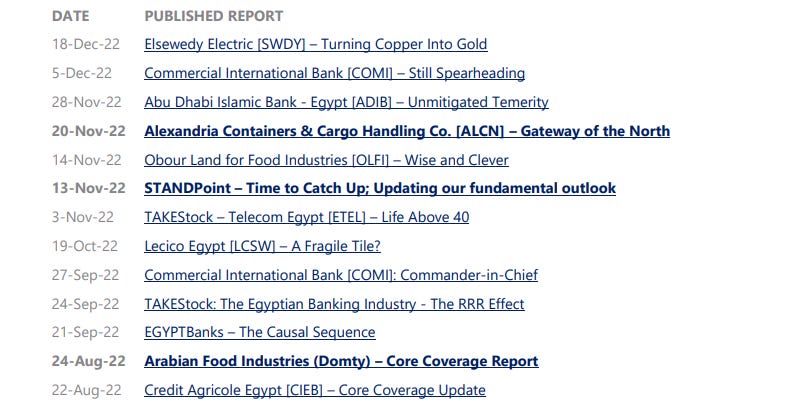

Very soon, we will be publishing our 2023 fundamental outlook note with a handful of stock picks that we think should outperform, so stay tuned!

— Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

Slight NFAs improvement in November

Elsewedy Electric plans to open an industrial

EFG Hermes closes a securitization bond for Misr Italia Properties

TMG Holding records exceptional sales for 2022

ADIB UAE raises its stake in ADIB Egypt

GB Auto approved to sell a stake of GB Lease to Chimera Investments

UNIP resumes its share buyback program

MACRO

Slight NFAs improvement in November

Net Foreign Assets (NFAs) for the Egyptian banking system witnessed a slight improvement of 2% in November reaching negative EGP542bn after three consecutive months of deterioration. (CBE)

CORPORATE

Elsewedy Electric plans to open an industrial

Elsewedy Electric [SWDY] plans to open a 5mn sqm industrial park in the Sixth of October City with EGP20bn worth of investment, housing more than 400 factories, 100 logistics and commercial facilities, a park, and a technical training academy. The park, which is set to be located near the Sixth of October Dry Port, is expected to add 150,000 jobs and EGP5bn to Egypt’s GDP annually once complete. (Enterprise)

EFG Hermes closes a securitization bond for Misr Italia Properties

EFG Hermes Holding [HRHO] closed the second issuance of a securitized bond for Misr Italia Properties worth EGP986mn as a part of the latter’s EGP2.5bn securitization program. The bond was comprised of three tranches (13, 36, and 61 months). (Company disclosure)

TMG Holding records exceptional sales for 2022

TMG Holding [TMGH] announced achieving unprecedented net sales of EGP33.2bn against EGP32.4bn in 2021. The remarkable sales exceeded the company's own initial estimates for the year of EGP24-26bn by 28%. TMGH stated that the strong sales were strengthened by the EGP devaluation, further increasing the investment appeal of real estate market in Egypt. (Company disclosure)

ADIB UAE raises its stake in ADIB Egypt

Abu Dhabi Islamic Bank – UAE [ADX: ADIB] raised its stake in Abu Dhabi Islamic Bank- Egypt [ADIB] from 50.2% to 52.6%. The parent bank purchased 9.6mn shares through a block trade at an average price of EGP16.18/share. (Company disclosure)

GB Auto approved to sell a stake of GB Lease to Chimera Investments

GB Auto [AUTO] approved to sell its indirect stake of 45% in GB Lease to UAE-based Chimera Investments for EGP855mn after AUTO approved the fair value study that valued GB Lease at EGP1.3bn. (Company disclosure)

UNIP resumes its share buyback program

Universal for Paper & Packaging Materials’ [UNIP] BoD approved resuming its share buyback program from 2 January through 30 June 2023. UNIP has already bought back 0.8% of its shares and will continue to buy up to 10% of its outstanding shares at the market price. (Company disclosure)