Today’s Top News & Analysis

CBE keeps key policy rates unchanged

Egypt's PMI hits a five-month low

Cabinet approves new restrictions on FY24 budget

Ministry of Planning has better expectations for FY24 and FY25

Egypt issued USD500mn samurai bonds

The government raised the fuel prices

Israeli gas to flow to Egypt again

COMI Q3 2023: Still thriving

ALCN Q1 2023/24 prelim.: Strong net profits of higher revenues

JUFO Q3 2023: Extraordinary net profits on strong revenues and other income

MACRO

CBE keeps key policy rates unchanged

On Thursday, the Central Bank of Egypt's Monetary Policy Committee (MPC) decided in its seventh meeting of the year to maintain the overnight deposit rate, the overnight lending rate, and the rate of the main operation at 19.25%, 20.25%, and 19.75%, respectively. (CBE)

Egypt's PMI hits a five-month low

Egypt’s Purchasing Manager’s Index (PMI) for the non-oil private sector saw a five-month low of 47.9 in October vs. 48.7. The increasing inflationary pressure further pushes the index into the contraction territory. (S&P Global)

Cabinet approves new restrictions on FY24 budget

The cabinet approved enforcing limits on spending through FY24 as follows:

· FX limits: new projects that need FX will be delayed.

· Unnecessary spending: All governmental entities should delay any spending that is not extremely necessary.

· No non-essential spending: Travel budgets for government personnel, marketing, attending conferences, and hosting events should be canceled.

· Boost revenues: Each governmental entity is obliged to boost its revenues. (Enterprise)

Ministry of Planning has better expectations for FY24 and FY25

The Ministry of Planning announced FY24 budget expectations where the economic growth is expected to grow by 4.2% vs. 4.1% in July's forecasts. Meanwhile, the ministry plans for the growth to reach 6% in FY25. (Enterprise)

Egypt issued USD500mn samurai bonds

The Ministry of Finance announced on Thursday the issuance of a five-year USD500mn samurai bond with an annual 1.5% yield. (Asharq Business)

The government raised the fuel prices

The Egyptian government announced raising the fuel prices of 95, 92, and 80 by 9-14%. Meanwhile, the diesel prices have not changed. (Enterprise)

Israeli gas to flow to Egypt again

An Egyptian official said that gas imports from Israel have increased by 133% w/w to 350mn scf per day which is still lower than the normal levels of 800mn scf per day before the current conflict in Gaza. (Asharq Business)

CORPORATE

COMI Q3 2023: Still thriving

Commercial International Bank [COMI] announced the financial results for Q3 2023. Here are our main takeaways:

· COMI recorded net income of EGP7.6bn increasing by 71% y/y yet declining by 6% q/q. This pushed the annualized ROAE down a bit to 41.5% from 49% in Q2 2023, yet still one the highest in the market.

· This was on the back of a 72% y/y increase in net interest income (NII) to EGP13.8bn. Which in turn, maintained the annualized NIM at 7.5%.

· The bank recorded huge Losses on financial investments of EGP1.3bn this quarter due to impairments in investments in associates and subsidiaries. This comes against profits of EGP22mn in Q2 2023, which is the main reason for the q/q decline in the bottom line this quarter.

· COMI almost did not book any provisions this quarter, which came at only EGP36mn (-86% q/q, -85% y/y). However, coverage ratio is still maintained at 233% as NPLs stand at 5% like the previous quarter.

· COMI’s loan book witnessed minor q/q growth of 1.2% to EGP254bn (16.4% ytd including devaluation effect) given the elevated interest rates. The slight increase is credited to corporate overdrafts and direct corporate loans.

· As for deposits, growth was much stronger, recording 26% increase ytd to EGP668bn. Unlike loans, growth in deposits is attributable to individual deposits that increased 34% ytd thanks to the new innovative products the banks manages to offer. This brings the GLDR to 38%. (Bank disclosure)

ALCN Q1 2023/24 prelim.: Strong net profits of higher revenues

Alexandria Container Handling Co. [ALCN] posted its preliminary Q1 2023/24 net profits of EGP979mn (+46% y/y) on higher revenues of EGP1.1bn (+29% y/y) and improved gross profit margin of 76.7% (+2.4pp y/y). (Company disclosure)

JUFO Q3 2023: Extraordinary net profits on strong revenues and other income

Juhayna Food Industries [JUFO] posted its Q3 2023 consolidated results recording extraordinary net profits of EGP324mn (+109% y/y) on:

· Strong revenues of EGP4.5bn (+50% y/y).

· Improved gross profit margin to 24% (+1.1pp y/y).

· Improved SG&A-to-revenues ratio to 13% (+1.5pp y/y).

Other income growing to EGP53mn (+65% y/y). (Company disclosure)

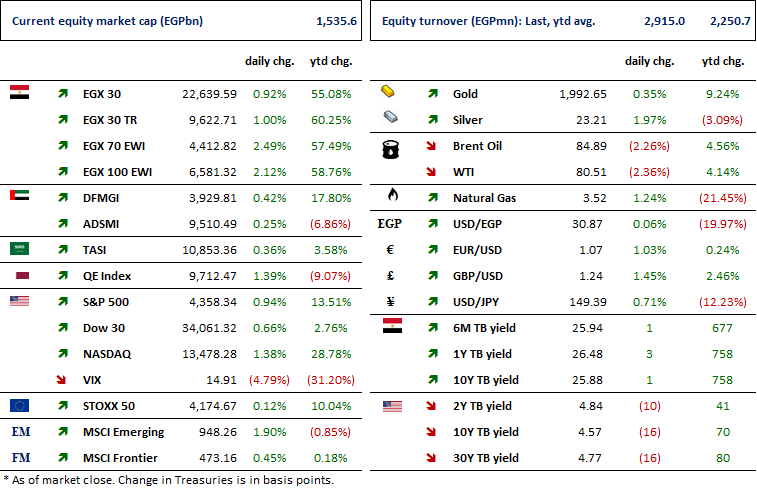

MARKETS PERFORMANCE

Key Dates

5-Nov-23

Egypt PMI / October 2023 reading.

EFID: OGM / Approving proposed dividends for 31 Dec. 2022.

AMOC: Cash dividend / Deadline for eligibility for a dividend of EGP0.65/Share.

6-Nov-23

EFIH: Cash dividend / Deadline for eligibility for a dividend of EGP0.177/Share.

7-Nov-23

EFIH: Cash dividend / Ex-dividend date for EGP0.177/Share.

CIRA: Cash dividend / Deadline for eligibility for a dividend of EGP0.24/Share.

8-Nov-23

AMOC: Cash dividend / Payment date for a dividend of EGP0.45/share (1st installment).

9-Nov-23

EFIH: Cash dividend / Payment date for a dividend of EGP0.177/share

DOMT: OGM / Approving the proposed dividends.

12-Nov-23

CIRA: Cash dividend / Payment date for a dividend of EGP0.24/share

14-Nov-23

MSCI: MSCI's November 2023 Semi-Annual Index Review Announcement.

23-Nov-23

TALM: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

26-Nov-23

EFID: EGM / Discussing capital reduction & amending Articles No. 3, 6 & 7 of the company's bylaws.

30-Nov-23

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).