NEW RESEARCH

Egypt Aluminum [EGAL]: Business As Usual

The one and only: Established in 1976 and listed on the EGX in 1997, Egypt Aluminum [EGAL] is the sole producer of aluminum and aluminum products in Egypt, with a total production capacity of 320,000 tons per annum of pure aluminum. EGAL imports alumina, the raw material used to make pure aluminum, and smelts it into pure aluminum. EGAL directs 40% of its production to fulfill the local market needs and exports the remaining production to the European market.

Underweight / High Risk, 12MPT EGP42.7/share (-9%): EGAL’s simple business model does not only benefit from a highly-rich FX cash inflow but also from strong global demand and high barriers to entry, making EGAL well positioned strategically. Yet, the risks of cyclicality, high capex needs, and electricity price hikes put a lot of pressure on EGAL’s future cash flows. We valued EGAL using two methods: (1) a 10-year, 3-stage DCF model, which yielded a fair value of EGP33.4/share, and (2) a relative valuation approach using regional and global peers’ EV/ton, which yielded a fair value of EGP31.0/share. We set our fair value as the average of both methods, yielding a fair value of EGP32.2/share and a 12MPT of EGP42.7/share. Our 12MPT implies 2023/24 P/E of 3.0x and EV/EBITDA of 2.4x but offers a downside potential of 9%, hence our Underweight rating. EGAL is currently traded at a relatively low 2023/24 and 2024/25 P/E of 5.3x and 3.4x, respectively, which may appear cheap. Yet, we think that this is the Molodovsky Effect, with a low P/E indicating a cyclical peak.

For the full report, please click here.

Today’s Top News & Analysis

Chevron to invest USD3bn in Egypt's Nargis field

ADQ to acquire additional stakes in Ethydco

SEIC raises its stake in EFIH to 25.01%

EFIH to sell its treasury shares in the market

A consortium offered DSCW an MTO

EIPICO to participate in MUP's capital increase; no official acquisition offers received

CI Capital denies Emirati acquisition rumors

MACRO

Chevron to invest USD3bn in Egypt's Nargis field

U.S.-based Chevron will invest USD3bn over 2 years starting H1 2024 to develop Egypt's Nargis gas field, according to media sources. Chevron and Italian Eni last year announced a “significant” gas discovery at the 1.8k sq km offshore block, without disclosing how the size of the discovery. (Enterprise)

CORPORATE

ADQ to acquire additional stakes in Ethydco

Abu Dhabi Holding (ADQ) is reportedly looking to acquire additional stakes in Egyptian Ethylene & Derivatives Company (Ethydco) from National Investment Bank and partially from Banque Misr and Al-Ahly Capital. The three shareholders will likely transfer ownership to The Sovereign Fund of Egypt to finalize the transaction with ADQ. (Al-Mal)

SEIC raises its stake in EFIH to 25.01%

The Saudi Egyptian Investment Co (SEIC), owned by the Saudi Public Investment Fund (PIF), has increased its stake in E-finance [EFIH] to 25.0156%. According to unnamed sources, SEIC plans to continue increasing its share until it holds approximately 28%. (Company disclosure, Asharq Business)

EFIH to sell its treasury shares in the market

E-Finance [EFIH] started the sale of its 900,000 treasury shares that were purchased a year ago. The sale will run from 18 September 2023 through 7 June 2024 at market price. (Company disclosure)

A consortium offered DSCW an MTO

Dice Sport & Casual Wear [DSCW] received a Mandatory Tender Offer (MTO) from a consortium of Toma for Commercial & Industrial Investments and Maged Samir Toma to acquire up to 90% of DSCW shares (1,607,980,303 shares) at a price of EGP0.65/share, valuing DSCW at EGP1.16bn. (Company disclosure)

EIPICO to participate in MUP's capital increase; no official acquisition offers received

EIPICO [PHAR] said it will participate with EGP84mn in the capital increase of Medical Union Pharmaceuticals (MUP), in which PHAR has a 10% stake. On a separate note, PHAR said it did not receive any official offers from Reliance Life Sciences, adding that the company is an important partner in EIPICO III in terms of technological developments. (Company disclosure: 1, 2)

CI Capital denies Emirati acquisition rumors

CI Capital Holding [CICH] denied the circling rumors of receiving an acquisition offer from Emirati investors. (Company disclosure)

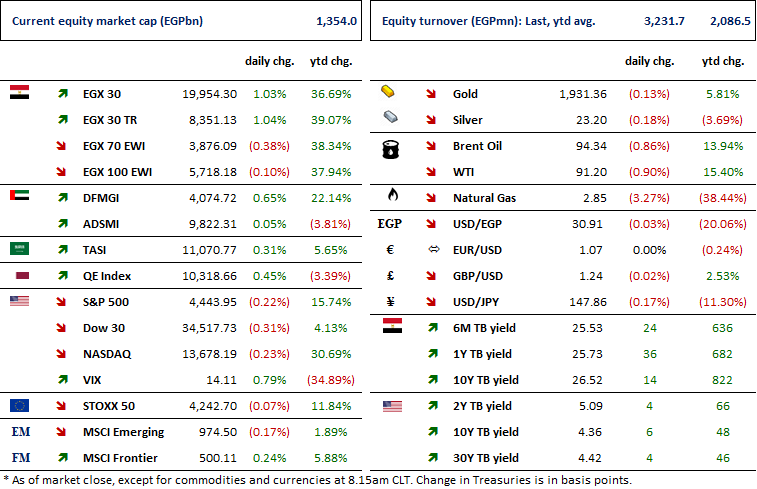

MARKETS PERFORMANCE

Key Dates

19-Sep-23

EXPA: EGM / Amending Article No. 5 of the bank's bylaws.

IRAX: Voluntary delisting / Voluntary delisting starting date.

20-Sep-23

MCQE: Cash dividend / Payment date for a dividend of EGP0.25/share (1st installment).

RMDA: Stock dividend / Last date for eligibility for a 0.52-for-1 stock dividend.

21-Sep-23

RMDA: Stock dividend / Date for distributing a 0.52 for-1 stock dividend.

MPC Meeting / Determining the CBE's policy rate.

25-Sep-23

IRAX: Voluntary delisting / Voluntary delisting ending date.

26-Sep-23

MICH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ODIN: OGM / Approving financial statements ending 30 June 2023.

ODIN: EGM / Amending Article No. 7 of the company's bylaws.

TAQA: OGM / A board reshuffle.

TAQA: EGM / Amending Article No. 24 of the company's bylaws.

27-Sep-23

BTFH: OGM / Discussing netting contracts.

28-Sep-23

EAST: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

30-Sep-23

ABUK: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ABUK: EGM / Amending Articles No. 8, 16, 21 & 39 of the company's bylaws.

AMOC: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

IFAP: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

1-Oct-23

CIRA: OGM / Discussing dividends distribution.

3-Oct-23

Egypt PMI / September 2023 reading.

4-Oct-23

SKPC: Cash dividend / Payment date for a dividend of EGP0.40/share (2nd installment).

11-Oct-23

ORAS: EGM / Discussing the dividend distribution of USD0.2750/share.

EFIH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

12-Oct-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.