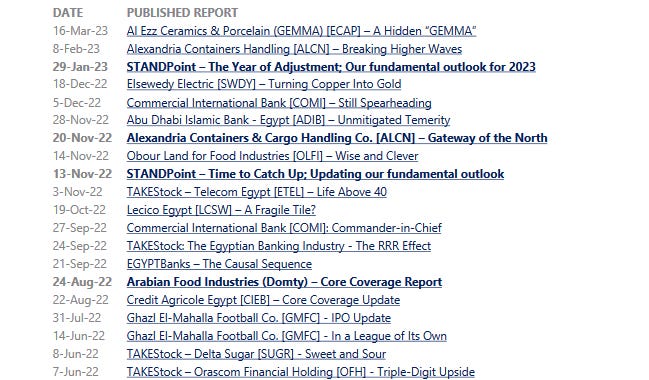

New Research

Al Ezz Ceramics & Porcelain (GEMMA) [ECAP]: A Hidden “GEMMA”

Our bullish view on Al Ezz Ceramics & Porcelain (GEMMA) [ECAP] published in our Core Coverage report dated 30 December 2021 was due to its growth potential and relatively low multiples. Today, we affirm our positive view on ECAP, adding to the mix its higher utilization rates and selling prices, despite the lower purchasing power and higher imported costs. Although pressured in 2022 on a strong USD, ECAP’s margins stood strong as it managed to pass on the higher costs to its end customers. We updated our financial model, which resulted in a 12MPT of EGP35.3/share (138% higher than our previous 12MPT of EGP14.8/share). Thus, we reiterate our Overweight / Medium Risk rating for ECAP.

For the full report, please click here.

Today’s Top News & Analysis

The Ministry of Transportation and AD Ports sign several agreements to operate terminals

Egypt to sell more than 10% in Safi and Wataniya; more listings on the way

Egypt may not withdraw the UN grains treaty

Egypt to deal in local currencies with India and China

TSFE is looking to sell El Salhiya For Development & Agricultural Investment

Dice to buy back 5.04% of its outstanding shares

Macro

The Ministry of Transportation and AD Ports sign several agreements to operate terminals

The Ministry of Transportation signed a contract with AD Ports, a subsidiary of ADQ Holding, to operate, manage, service, and rebuild the infrastructure of several ports, including Safaga 2 terminal in Safaga Port, Ain Sokhna Port, and East Port Said Port, alongside building and operating an industrial and logistics area. Moreover, the ministry also signed several agreements to operate and manage the piers and terminals for cruise ships in Sharm El-Sheikh and Hurghada ports. (Al-Mal)

Egypt to sell more than 10% in Safi and Wataniya; more listings on the way

The Sovereign Fund of Egypt (TSFE) said it is possible to sell more than 10% stakes in National Co. for Natural Water (Safi) and National Petroleum Co. (Wataniya) to investors, with no maximum limit. To recap, it was reported that an Emirati investor is interested in investing into Wataniya, while GCC sovereign wealth funds showed interest in investing in both Safi and Wataniya. In similar news, TSFE also reported that Egyptian Linear Alkylbenzene Co. (ELAB) will be the first offering in Egypt’s planned IPO program. Moreover, eight more undisclosed companies joined the pre-IPO fund that will be offered soon. (Al-Borsa)

Egypt may not withdraw the UN grains treaty

Reportedly, the Egyptian government have received several letters from the Grains Trade Convention (GTC) that made the government rethink the withdrawal from the treaty. The Egyptian supply minister said that Egypt is not benefiting from the treaty now, however the government incurs paying around USD58,000/year. (Enterprise)

Egypt to deal in local currencies with India and China

Egypt is currently considering completing its commercial dealings with China and India in local currencies, which should help increase trade between the countries. (Economy Plus)

Corporate

TSFE is looking to sell El Salhiya For Development & Agricultural Investment

The Sovereign Fund of Egypt (TSFE) started to promote ElSalhiya for Development & Agricultural Investment (SDAI) to strategic investors in the GCC region. The sources ruled out putting the company on the money market. (Economy Plus)

Dice to buy back 5.04% of its outstanding shares

Dice Sports & Casual Wear [DSCW] will start a share buyback program, buying 90mn treasury shares (equivalent to 5.0374%) of its outstanding shares for EGP0.35/share. The program will start Tuesday, 21 March 2023 and will continue for five days. (Company disclosure)