1. Today’s Trading Playbook

TABLE OF CONTENTS

KEY THEMES

Global equities reversed course on Tuesday after going through a short-lived recovery. U.S. equities slipped notably yesterday, whereas Asian shares fell in early Wednesday trading. Incidentally, Brent oil prices broke the USD110/bbl ceiling. The aforementioned market incidents were fundamentally the reasons of investors fretting over yet another wave of tight economic sanctions placed on Russia for invading Ukraine. The U.S. banned Russian flights from using American airspace, as well as EU and Canada. U.S. President, Joe Biden, has mentioned during his State of the Union speech yesterday that Russian President, Vladimir Putin, would "pay a continuing high price" for the invasion of Ukraine. Accordingly, the oil rally is pricing in exceptionally tight market, given the hefty sanctions on Russian banks as traders seek alternative oil sources in an already-tight market.

Elsewhere, Housing & Development Bank [HDBK] reported its separate financials for 2021. The figures showed credit provisions flattening the bank’s net earnings of EGP1.83bn (+1.6% y/y). Growth in total banking revenues did not filter through the bottom line due to higher credit provisions as HDBK had reversed provisions in 2020 amounting to EGP179mn. However, the bank booked credit provisions of EGP162mn in 2021. Accordingly, cost of risk (CoR) inched up to 0.67% (+154bps y/y). While CoR upped y/y, asset quality weakened notably on an annual basis, with non-performing loans (NPLs) surging to 10.0% (+2pp y/y). Hence, NPL coverage declined below 100%, recording 83% vs. 121% a year earlier. In view of 2021 results, we raised our risk rating from Medium to High on concerning above-average NPL ratio. We note that HDBK’s BoD has proposed a DPS of EGP2.5/share, implying a 6% yield. That said, we maintain our 12MPT at EGP49.0/share (ETR +17%); hence, we maintain our Neutral rating. HDBK is currently traded at 2022e P/E and P/B of 3.0x and 0.6x, respectively.

For more details, please read the note published yesterday.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

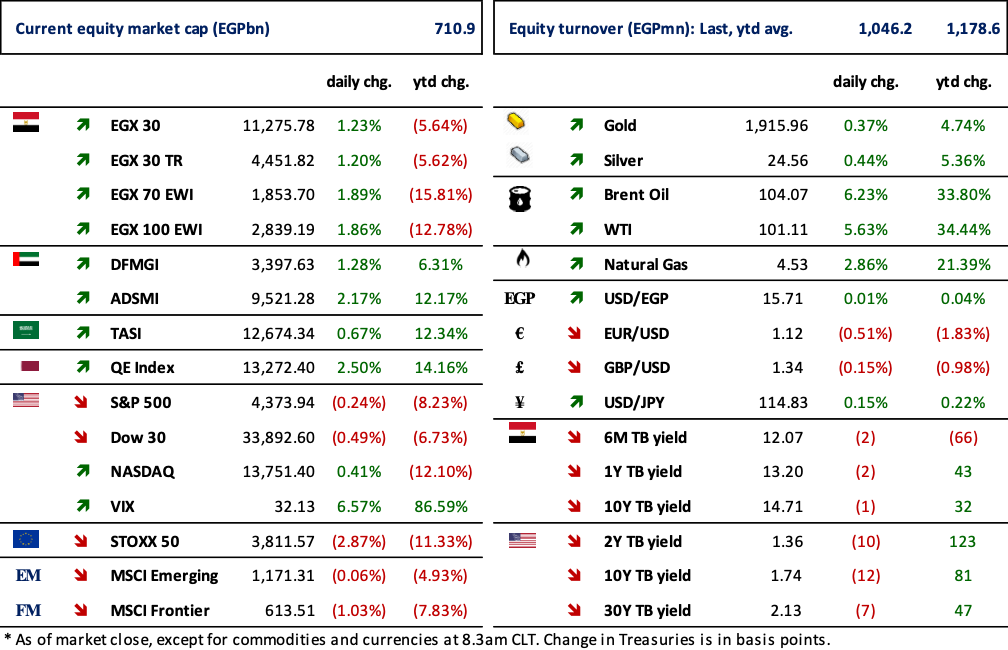

Commercial banks' net foreign assets were still in a liability position of USD11.4bn at the end of January, from USD10bn at the end of December 2021. This occurred despite Egypt's official inclusion in the JP Morgan index for emerging market local debt in January, reflecting the impact of CAD pressures and global monetary conditions on risk aversion. (CBE, Prime Research)

State-owned Administrative Capital for Urban Development (ACUD) is moving forward with plans to list its subsidiaries on the EGX and has hired CI Capital Holding [CICH] as its advisor. (Asharq Business)

Suez Canal revenues jumped in February by 15% y/y to USD545.5mn. The authority hiked transit tolls by 6% for most ships at the start of February, followed by another increase of up to 10% for all transiting vessels from yesterday. (Suez Canal Authority)

The local prices of wheat jumped by about EGP200 per day, since the start of Russia's war against Ukraine last Thursday, and the total increase during the last six days has exceeded EGP1,000/ton. (Al-Borsa)

Local auto market suffers from a severe shortage of a large number of models for some cars brands. Many distributors have reported that it will be shortage in the units supplied during the coming months in light of the irregular movement of imports. Accordingly, many car distributors have stopped selling some brands to dealers. (Al-Mal)

CORPORATE NEWS

Misr Fertilizers Production Co. [MFPC] preliminary stand-alone 2021 EPS grew 37% y/y to EGP6.76/share, driven by a 44% growth in revenues to EGP3.4bn. (Company disclosure)

Misr cement – Qena [MCQE] reported its consolidated figures for 2021 with net profit at EGP146mn (+332% y/y), while top line remained almost unchanged. GPM has increased by 6.4pp to 19.2%. This increase in margins was driven by higher cement prices and more efficient cost control. BoD has suggested cash dividend distribution of EGP0.50/share, implying a yield of 4%. (Company disclosure)

Lecico Egypt [LCSW] reported consolidated financials for 2021 with net losses narrowing to EGP36mn vs. EGP221mn in net losses a year earlier. Meanwhile, top line recorded 29% growth y/y to EGP2.6bn. Lower net losses came due to significant improvement in GPM to 18.3% (+7.2 pp). (Company disclosure)

The BoD of GB Capital Financial Investments, a subsidiary of GB Auto [AUTO], approved the appointment of Arqam Capital Limited to act as financial advisor for GB Capital. This aims to explore strategic investments options in GB Capital's subsidiaries that may include partial selling of GB Capital's stake in MNT Investments. (Company disclosure)

Eastern Company’s [EAST] BoD held on 28 February 2022 has ratified a number of price hikes regarding EAST’s local cigarettes brands, provided that the new prices will be effective since the beginning of March 2022. (Company disclosure)

Cairo Poultry’s [POUL] net earnings in 2021 surged to EGP184mn (+76% y/y) on 20% growth in top line to EGP4.9bn, amid a stable GPM y/y of c.12%. Furthermore, lower borrowing cost (-44% y/y) as well as a lower effective tax rate decorated bottom line growth. (Company disclosure)

GLOBAL NEWS

Factories around the world sustained a brisk recovery in February amid signs the Omicron variant was having less of an impact, but the Ukraine crisis has rapidly emerged as a risk to supply chains and is likely to exacerbate cost pressures. (Reuters)

Nickel prices rose on Wednesday, buoyed by fears of disruptions to supply from Russia amid low global inventories as sanctions ramped up against the country following its invasion of Ukraine. Russia supplies around 10% of global nickel, which is used to make stainless steel and batteries for electric vehicles. (Reuters)

Palladium rose on Wednesday, extending gains after hitting a seven-month peak in the previous session as the Russia-Ukraine crisis worsened, while gold fell after the dollar strengthened. (Reuters)

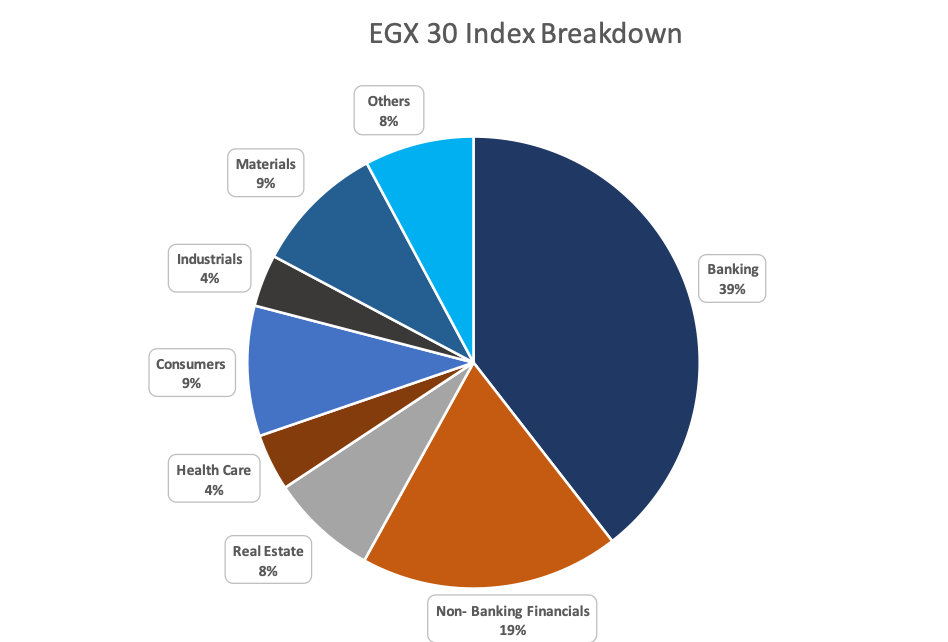

3. Chart of the Day

Hossain Zaman | Equity Analyst

Source: EGX, Prime Research.

The combined weight of banking and non-banking financial sectors has collectively more than 50% of total EGX 30 index.