Today’s Top News & Analysis

Egypt may buy 1mn ton of Russian wheat but through the government

12 new concessions for oil exploration

MTIE to enter the Saudi market

Palm Hills denies receiving offers

CANA to raise its capital by EGP1bn through a 27.8% stock dividend

MACRO

Egypt may buy 1mn ton of Russian wheat but through the government

After the Russian withdrawal from the last private wheat tender with Egypt, the Egyptian government is in talks with the Russian government to buy 1mn ton of Russian wheat without any further information. (Asharq Business)

12 new concessions for oil exploration

According to media sources, at least 6 international companies are competing for research and exploration deals for 12 concessions in the Mediterranean Sea and the Nile Delta. According to the statement, a wide range of concessions include that the winning companies must invest a total investment in exploration of approximately USD281mn and have to drill at least 12 wells through the exploration phases. (Economy Plus)

CORPORATE

MTIE to enter the Saudi market

MM Group for Industry & International Trade [MTIE] BoD approved launching a 100% owned subsidiary in Saudi Arabia but did not mention its capital yet. On a separate note, MTIE plans to start its new factory's operations by Q1 2024. (Company disclosure, Al-Mal)

Palm Hills denies receiving offers

Palm Hills Developments [PHDC] has noted that it didn't receive any notes of an acquisition offer from The Saudi Public Fund (PIF) on Arab African International Bank (AAIB) stake in PHDC. (Company disclosure)

CANA to raise its capital by EGP1bn through a 27.8% stock dividend

Suez Canal Bank [CANA] announced raising its paid-in capital by EGP1bn to EGP4.6bn (a 27.8% increase). The capital increase will take place through distributing 27.8% stock dividend, offering 100mn new shares at a par value of EGP10/share. (Bank disclosure)

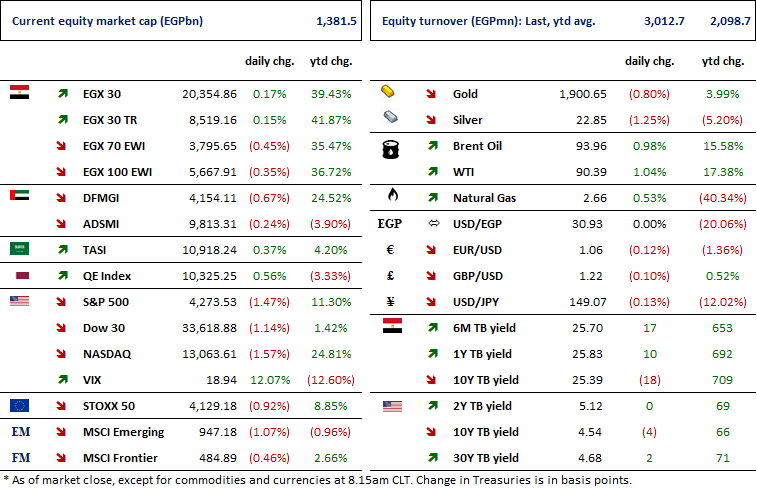

MARKETS PERFORMANCE

Key Dates

27-Sep-23

BTFH: OGM / Discussing netting contracts.

28-Sep-23

EAST: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

30-Sep-23

ABUK: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

ABUK: EGM / Amending Articles No. 8, 16, 21 & 39 of the company's bylaws.

AMOC: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

IFAP: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

1-Oct-23

CIRA: OGM / Discussing dividends distribution.

3-Oct-23

Egypt PMI / September 2023 reading.

4-Oct-23

SKPC: Cash dividend / Payment date for a dividend of EGP0.40/share (2nd installment).

DAPH: Stock dividend / Last date for eligibility for a 0.1-for-1 stock dividend.

5-Oct-23

DAPH: Stock dividend / Date for distributing a 0.1 for-1 stock dividend.

11-Oct-23

ORAS: EGM / Discussing the dividend distribution of USD0.2750/share.

EFIH: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

12-Oct-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

EGCH: OGM / Approving financial statements ending 30 June 2023.

EGCH: EGM / Amending Article No. 3 & 21 of the company's bylaws.

17-Oct-23

POUL: OGM / Discussing dividends distribution.