Today’s Top News & Analysis

EGAS to tender 12 new oil and gas exploration blocks next week

Egypt fertilizers exports to Europe tripled in 10M 2022

A surge in beet and sugar cane prices

CSAG denies any stoppage of flows between Nuweiba and Al-Aqaba

PACHIN to respond to National Paints offer by January – decides to delist GDRs

AMOC mulls stopping renewal of GDRs listing

MACRO

EGAS to tender 12 new oil and gas exploration blocks next week

Energy companies can bid for 12 new oil and gas exploration blocks in the Mediterranean and Nile Delta starting next week in an international tender set to be launched by state-owned Egyptian Natural Gas Holding Company (EGAS). (Enterprise)

Egypt fertilizers exports to Europe tripled in 10M 2022

Egypt's fertilizers export to Europe increased to EUR1.5bn during 10M 2022 vs. only EUR521bn a year earlier. This took place as one of the repercussions of the Russia-Ukraine war. (Asharq Business)

A surge in beet and sugar cane prices

Reportedly, the Ministry of Supply & Internal Trading raised beet and sugar cane prices to EGP1,000/ton (+43% y/y) and EGP1,100/ton (+36% y/y) respectively. We note that the higher beet and sugar cane prices could drive private sugar producers to pass on the increased costs to end consumers. (Al-Borsa)

CORPORATE

CSAG denies any stoppage of flows between Nuweiba and Al-Aqaba

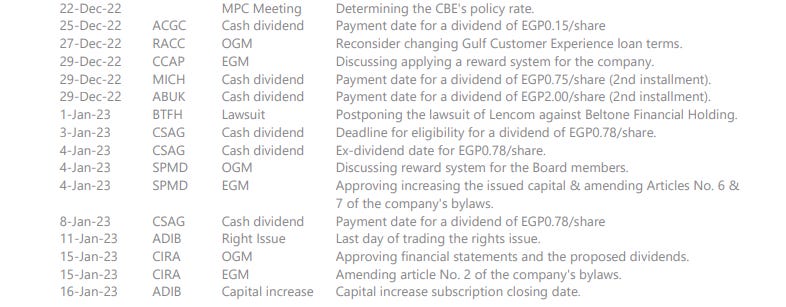

Canal Shipping Agencies [CSAG] denied the news about the stoppage of work flow between Nuweiba Port and Port of Aqaba in Jordan for the second time this week. (Mubasher)

PACHIN to respond to National Paints offer by January – decides to delist GDRs

Paints & Chemical Industries (PACHIN) [PACH] is going to respond to National Paints Holding offer by January, according to news sources. We note that National Paints Holding offered to buy 100% of PACH for EGP29.0/share. In other news, PACH shareholders approved to delist the company's GDRs from the London Stock Exchange. (Enterprise, Company disclosure)

AMOC mulls stopping renewal of GDRs listing

Alexandria Mineral Oils' [AMOC] BoD has decided not to renew listing its GDRs on London Stock Exchange, pending shareholders’ approval. This comes as the company is aiming to cut unnecessary costs. (Company disclosure)