1. Today’s Trading Playbook

KEY THEMES

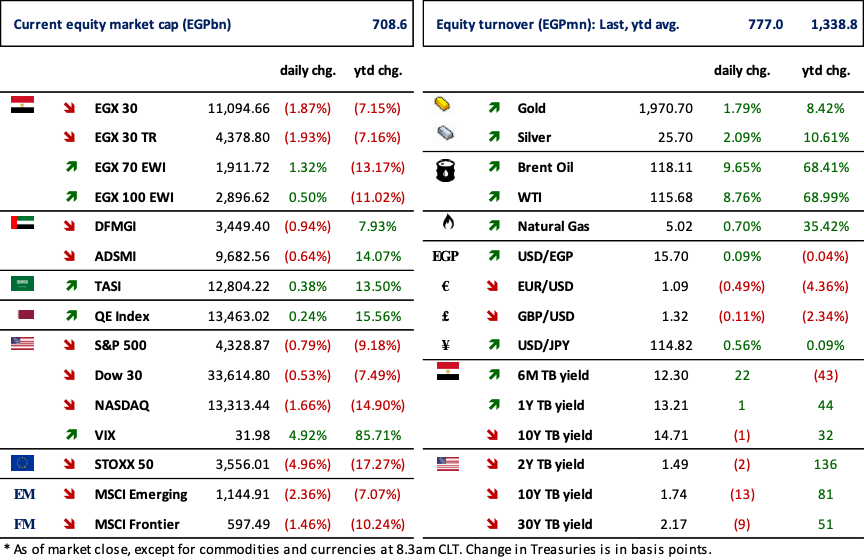

Oil prices are surging yet another day, flirting with the USD130/bbl mark, and trading very close to its historical level back in 2008. The oil rally found additional fuel as buyers are pricing in a western boycott to Russian crude, intensifying the pressure on global supply. Fears of global inflation are affecting sentiment for risk assets, with Asian equities slipping on fears of untamed inflation waves.

Elsewhere, yesterday we published our note regarding Net International Reserves (NIR). Egypt's official NIR remained stable at USD40.99bn in February 2022, having increased by only USD14mn. Despite the marginal increase, the breakdown revealed pressures on NIR's foreign currency liquidity stock, which fell by USD2.56bn, the most since August 2021. Foreign currency reserves have fallen to USD31.59bn, the lowest level since July 2017. The significant decline in foreign currency was largely offset by the appreciation of gold, which increased by USD2.7bn in February to a record high of USD6.9bn. However, we believe that the significant increase in gold indicates that the CBE has accelerated the shift away from the USD (which currently accounts for the majority of the CBE's foreign currency reserves) toward gold in order to build more resilient buffers for the upcoming Fed monetary tightening. For more details, please check out our note from yesterday.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Rising global wheat prices could cost the government an additional EGP15bn this fiscal year, Minister of finance said. (Asharq business)

It is expected that the Industrial Development Authority will submit the strategy for the advancement and localization of the automotive industry to the President within a few days, to be implemented by April. (Al-Mal)

CORPORATE NEWS

GB Auto’s [AUTO] BoD approved the cancellation of the GDR program, pending shareholders agreement. (Company disclosure: 1, 2)

Egypt Gas [EGAS] net earnings rose to EGP166mn (+95% y/y). Strong earnings growth came as a result of 35% growth in top line of EGP5.4bn, coupled with GPM improving to 6.3% vs. 2.4% a year earlier. Earnings growth came despite investment income slipping by 59% y/y. (Company disclosure)

Misr Fertilizers Production Company [MFPC] standalone 2021 EPS grew 37% y/y to EGP6.76/share. EPS growth was caused by 44% growth in revenues to EGP3.4bn.(Company disclosure)

Macro Group Pharmaceuticals’ [MCRO] 2021 KPIs showed net income of EGP148mn (+10% y/y) on higher revenues of EGP594mn (+38% y/y) and higher GPM of 80% (+120bps y/y). MCRO’s BoD has approved buying treasury shares effective 15 March 2022 and for a period of 3 months up to 10% of MCRO’s total shares. (Company disclosure)

Beltone Financial Holding [BTFH] net losses widened to EGP170mn vs. EGP132mn a year earlier. This comes on the back of 21% lower net revenues of EGP221mn. (Company disclosure)

Obour Land Food Industries’ [OLFI] OGM has approved cash dividend distribution of EGP0.65/share, implying 11% in dividend yield. (Mubasher)

EgyTrans [ETRS] bought 136,057 treasury shares by the end of Thursday 3 March 2022 trading session. This comes in light of ETRS’s plan of buying treasury shares amounting to 3.1mn shares to support the share price. (Company disclosure)

GLOBAL NEWS

The United States and European allies are exploring banning imports of Russian oil, U.S. Secretary of State Antony Blinken said on Sunday, and the White House coordinated with key congressional committees moving forward with their own ban. (Reuters)

Oil prices soared and shares sank in frantic trading on Monday as the risk of a U.S. and European ban on Russian product and delays in Iranian talks triggered what was shaping up as a major stagflationary shock for world markets. (Reuters)

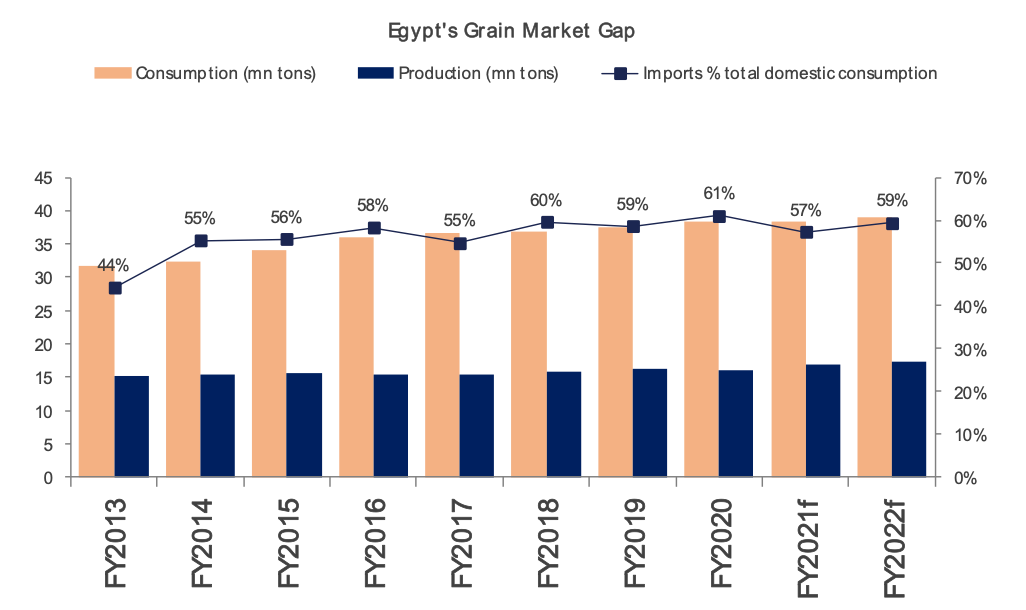

3. Chart of the Day

Source: International Grains Council (IGC), Prime Research.

Egypt's reliance on imported grains makes the country extremely vulnerable to the current escalation in the Black Sea conflict and its impact on global grain prices.