Fundamental Thoughts

The Central Bank of Egypt did it! The Monetary Policy Committee raised policy rates last Thursday night by 200bps, matching our expectations and most market estimates. Our rationale for the rate hike was highlighted on 12 March (Bumpy Ride Ahead!) and last Thursday morning (Sticking to Our Guns) if you would like to take a read. That said, market participants will likely start to wonder “now what?”

Whether the CBE is done with rate hikes (or not) depends on how effective its latest monetary tightening moves have been so far since early 2022, be it more than doubling interest rates by hiking a cumulative 10 percentage points or raising banks’ required reserve ratio by 4 percentage points to 18%. Let’s agree that current high inflation levels are not demand-driven but rather fueled to a large extent by a stronger U.S. dollar (i.e. imported inflation). But by hiking rates, the CBE is trying to avoid adding fuel to the fire. In other words, hiking rates will not likely bring prices on a disinflationary path but will rather contain inflation from spiraling out of control. We expect inflation rates to peak in March and to average 30%+ for all of 2023.

Meanwhile, local investors, mainly banks, will likely exhibit higher interest in Egypt’s debt market, since the probability of hiking rates is now much lower. However, foreign investors will likely continue to shrug off Egypt’s currently-lucrative local debt market because the FX risk can easily shave off those high yields. Foreign investors often double down on both high yields and FX gains from a strengthening local currency, but the latter bit is still missing. So what about the FX rate, you may ask? This is like asking what the CBE’s governor will eat for Iftar today. We can only guess what the CBE will do with the FX rate, but our base-case scenario for the EGP is to overshoot further, albeit gradually, to EGP32.5/USD by end of Q2 2023 before normalizing downward to EGP30.0/USD by end of 2023. This should be driven by foreign direct investments (FDIs) from the GCC in some of the 32+ state-owned companies that are up for grabs.

Does this mean we should not expect a third double-digit devaluation à la the 21 March and 27 October moves of last year? While this is up in the air, we do not think another double-digit devaluation will do the trick. It’s like moving higher in price along a perpendicular USD supply curve. Raising the FX rate will not increase the supply of U.S. dollars in the market. By now, we think the monetary policy has done enough already. In our opinion, it is now up to the fiscal policy to kick in. This means it’s time to walk the talk and deliver on the promised government offerings program in earnest.

—Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

CBE hikes interest rates by 200bps

Abu Qir Metro winning bid to be chosen mid-April

Egypt's current account records a surplus for the first time in 9 years

Deterioration in NFAs for the second consecutive month

Egypt’s auto sales drop 76% in February 2023

JUFO 2022: Higher revenues and extraordinary net profits

MTIE 2022: Lower earnings on lower revenues

National Paints raised its bid on PACHIN to EGP37.75/share

MCRO OGM approves distributing cash dividends

Macro

CBE hikes interest rates by 200bps

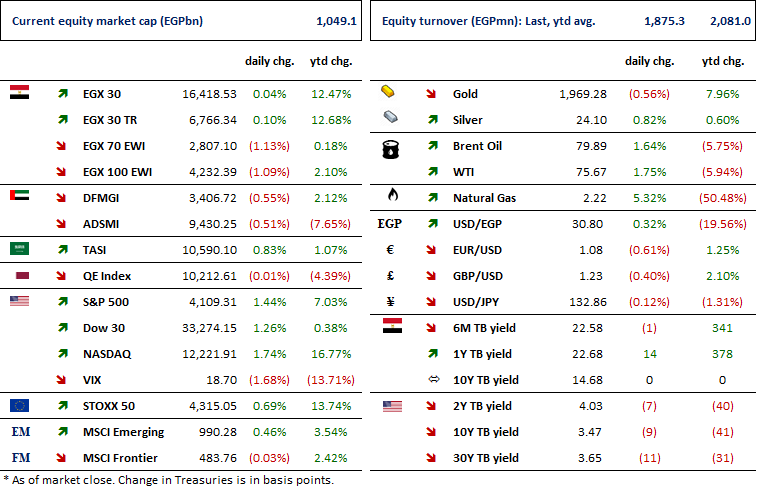

The Monetary Policy Committee (MPC) decided in its second meeting of the year to raise the overnight deposit rate, the overnight lending rate, and the rate of the main operation by 200bps to 18.25%, 19.25 %, and 18.75%, respectively. The discount rate was also raised to 18.75%. The MPC cited that international commodity prices have eased, yet the outlook remains uncertain. Moreover, the recent financial sector issues in advanced economies and the global supply bottlenecks confirm an increased level of uncertainty regarding the global economic outlook. Domestically, the ease in Egypt's real GDP growth to 3.9% during Q4 2022 compared to 4.4% in Q3 2022 was driven by an improvement in tourism, agriculture, and trade. (CBE)

Abu Qir Metro winning bid to be chosen mid-April

The Ministry of Transportation is going to select the winning bid mid-April to build the new Abu Qir Metro project in Alexandria. We note that Orascom Construction [ORAS] and Elsewedy Electric [SWDY] are some of the bidders for the EUR1.8b project. (Al-Borsa)

Egypt's current account records a surplus for the first time in 9 years

Egypt's current account balance has recorded a surplus of USD1.4bn in Q2 2022/23 for the first time since Q3 2013/14, despite the current account recording a deficit during Q1 2022/23 of USD3.2bn. (Economy Plus)

Deterioration in NFAs for the second consecutive month

Net Foreign Assets (NFAs) for the Egyptian banking system declined by USD1.3bn in February 2023, to reach negative USD23bn against negative USD21.7bn in January 2023. (Economy Plus)

Egypt’s auto sales drop 76% in February 2023

According to Automative Marketing Information Council (AMIC), Egypt’s auto sales volumes declined to 6,076 vehicles in February 2023 (-76% y/y) as:

· Passenger car sales volume fell to 4,263 vehicles (-78.4% y/y).

· Truck sales volume fell to 1,047 vehicles (-75.4% y/y).

· Bus sales volume fell to 766 vehicles (-53.5% y/y). (Al-Mal)

Corporate

JUFO 2022: Higher revenues and extraordinary net profits

Juhayna Food Industries [JUFO] reported 2022 net profits of EGP638mn (+21% y/y) on higher revenues of EGP11.4bn (+29% y/y), driven by higher prices (+60% y/y). Meanwhile, the gross profit margin decreased by 3pp y/y to 26% due to continuous increases in commodity prices, global supply chain disruptions, and the EGP devaluation. However, SG&A decreased as a percentage of revenues by 2pp y/y due to the company’s cost optimization strategy.

Regarding Q4 2022, the same reasons resulted in net profits growing by 353% y/y to EGP164mn on higher revenues of EGP3.2bn (+40% y/y). GPM declined by 1.2pp y/y to 25%, while SG&A as a percentage of revenues decreased by 5pp y/y to 13%. (Company disclosure)

MTIE 2022: Lower earnings on lower revenues

MM Group for Industry & International Trade [MTIE] reported 2022 net profits of EGP343mn

(-7% y/y) on lower revenues of EGP6.9bn (-23% y/y). Meanwhile, gross profit margin widened by 1pp y/y to 12%.

Regarding Q4 2022, net profits grew to EGP127mn (+218% y/y) despite a 6% y/y decline in revenues to EGP1.8bn. The increase in net profits came in due to the following:

(1) Gross profit increased by 31% y/y to EGP247mn with GPM expanding by 4pp y/y to 14%.

(2) FX gains of EGP31mn compared to EGP0.4mn in Q4 2021.

(3) Profits from investments in sister companies of EGP4mn compared to a loss of EGP32mn in Q4 2021.

On a separate note, MTIE's BoD approved to distribute a 25% stock dividend worth EGP150mn at a par value of EGP0.62, raising MTIE's paid-in capital to EGP749mn to be funded from retained earnings. Additionally, MTIE’s BoD approved to contribute to the capital increase of Basata Financial Holding by EGP31mn, raising its contribution limit to EGP156mn. We note that MTIE has a 50.9% stake in Basata Financial Holding. (Company disclosures: 1, 2)

National Paints raised its bid on PACHIN to EGP37.75/share

National Paints Holding (NPH) raised its bid to buy up to 100% of Paints & Chemical Industries (PACHIN) [PACH] to EGP37.75/share, up from its last offer of EGP36/share and compared to Eagle Chemicals’ offer of EGP37/share. (Al-Mal)

MCRO OGM approves distributing cash dividends

Macro Pharmaceutical Group’s [MCRO] OGM approved distributing a cash dividend of EGP0.1067/share, implying a 3% yield. (Company disclosure)