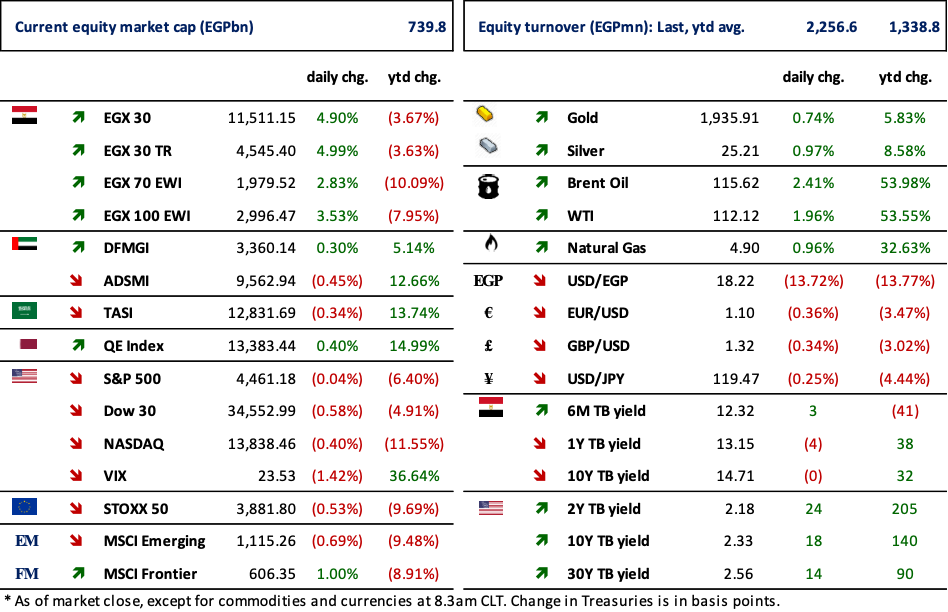

1. Today’s Trading Playbook

KEY THEMES

Yesterday, the EGX 30 leaped nearly 5%, achieving the biggest single-day gain since 22 March 2020—since almost two years. Trading volumes were notably robust, given the impactful EGP weakness on valuation levels for the entire market. Many investors may opt to see yesterday’s price action and the overall situation through the lenses of the 2016 flotation. However, we beg to differ. We believe comparing the recent 14% weakness in EGP to its full-blown devaluation in November 2016 overlooks obvious dissimilarities that we summarize below:

(1) The magnitude of the movement: A 14% weakness in the local currency is no match to a whopping 32% correction, as the reference for the FX rate back in November 2016 was EGP13.0/USD. Sure, a 14% weakness in EGP makes the market more attractive, but in comparison, the magnitude is on a different level. To put it into perspective, for yesterday’s movement to replicate the first day of floatation in 2016, the FX rate should have jumped to EGP23/USD.

(2) Different economic positioning: Back in 2016, the mindset towards the EGP movement was different. We were on the verge of kicking of a promising economic reform program, while the floatation was viewed as a necessary pain for the gain of long-term economic prosperity. Now, the reason for depreciating the EGP is entirely different, as the global atmosphere necessitates a flexible exchange rate in order to maintain Egypt’s competency as a reliable emerging market. While our external debt is way bigger today vs. six years ago, our external reserves are in a much better shape.

(3) Global markets are not the same: Back then, the Fed and the European Central Bank (ECB) were preparing to end QE II once and for all, with global tightening looming. Interestingly, right now we are within the same narrative of considerable global tightening, yet the difference is the phasing out of heightened global inflation in the aftermath of COVID-19 alongside geopolitical unrest.

Below are a few interesting charts. The EGX 30 in USD terms is at its lowest levels since June 2021. It makes absolute sense for the EGX 30 to slip in USD terms post a 14% devaluation. However, what’s more interesting is that post the aforementioned recent depreciation, the EGX 30 in USD terms is at its lowest levels since only nine months!

The most important question is whether the market will continue to adjust upward only to close the gap that took place in USD terms (i.e. 14%), or the movement will be overwhelming enough for large caps to boldly re-rate off their current low valuation levels. Regardless the answer, we reiterate our focus on companies with resilient balance sheets to tolerate both FX and interest rate hikes, alongside names with exposure to the export market.

Source: EGX, Prime Research

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

The government announced a package of incentives that would see EGP130bn in tax relief while moving up the timeline of already-planned social safety measures. This package includes: slashing the capital gains tax (CGT) on IPOs by 50% for a two-year period, introducing amendments to the Income Tax Act designed to spur activity on the EGX, and Manufacturers will receive a three-year real estate tax holiday. (Enterprise)

The government is re-introducing the monthly customs exchange rate, setting it at EGP16/USD for imports of basic commodities and materials used for manufacturing. The rate will be fixed until the end of April. (Enterprise)

The government is looking to spend EGP190.5bn on expediting annual salary increases,as of the beginning of April. (Enterprise)

The government will be unlocking an incentives wave that aim to support the atmosphere for trading and investing in the EGX. (Enterprise)

The government is also spending EGP2.7bn to bring 450,000 new families under the umbrella of the Takaful and Karama. (Enterprise)

CORPORATE NEWS

News sources point to possible sale of governmental stakes in EGX listed stocks to Abu Dhabi Developmental Holding Company (ADQ). The list includes an 18% stake in CIB [COMI], as well as a stake in Fawry [FWRY]. This comes as part of an USD2bn program to capture lucrative investment opportunities in Egypt. (Enterprise)

Heliopolis Housing & Development’s [HELI] BoD has agreed to sell a financial portfolio of EGP409mn to Export Development Bank of Egypt [EXPA] to finance its investment and ongoing projects. (Arab Finance)

Banque Misr has reportedly announced that around EGP4bn were submitted to buy the brand new 1-year 18% Certificate of Deposit (CD). (Mubasher)

GLOBAL NEWS

Federal Reserve Chair Jerome Powell on Monday delivered his most muscular message to date on his battle with too-high inflation, saying the central bank must move "expeditiously" to raise rates and possibly "more aggressively" to keep an upward price spiral from getting entrenched. (Reuters)

Federal funds rate futures on Monday raised the chances of a half percentage-point tightening by the Federal Reserve at the next policy meeting in May, after hawkish comments from Fed Chair. (Reuters)

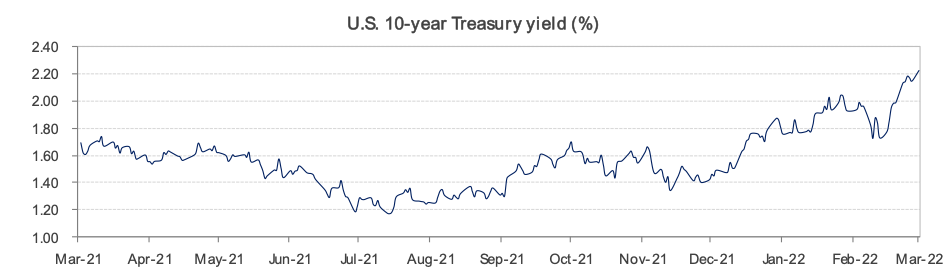

3. Chart of the Day

Research Team

Source: Bloomberg.

The yield on the benchmark U.S. 10-year Treasury note retreated back near a 2-year high of 2.23% after a slight fall to 2.15% last week.