Fundamental Thoughts

It’s been a phenomenon that Egypt’s stock market gets sick when world markets just sneeze. And world markets did not just sneeze once over the last few days; they sneezed twice! First, it was Silicon Valley Bank (SVB) that went under following a classic bank run. Second, it was Credit Suisse Group (CSG) that was said to have lost further support from Saudi Arabia. Let’s take the two sneezes one by one.

SVB: A self-fulfilling “bank run”

Banks, unlike companies, do not control a good part of their balance sheets, namely demand deposits on the liability side. Once clients start pulling their demand deposits out, banks would have to liquidate their assets to fund those demands. While SVB had a duration mismatch in its balance sheet, that mismatch was not discovered all of a sudden. SVB’s balance sheet showed significant unrealized losses in September 2022 (USD2.7bn) that were even higher than what was reported in December 2022 (USD2.5bn). So this was not all new to the market. However, panic ensued after depositors began withdrawing USD42bn in cash from a bank that was well-capitalized. What triggered the withdrawals was the failure to shore up USD2.25bn in capital, USD500mn of which was already secured and subject to the successful offering of new common and mandatory convertible preferred shares. In addition, SVB had ample liquidity of around USD180bn to tap into, including a borrowing capacity of USD65bn, which can well cover its deposits base of USD173bn. But again, it’s panic that led to the bank failure. Any bank, no matter how big its size is, has a probability of failure in the case of a bank run, unless the central bank steps in to ensure depositors, which is what the Federal Reserve did in SVB’s case.

CSG: One SNB vs. another SNB

Yesterday, another panic ensued after media reports stating that Saudi Arabia’s SNB Alahli has given up on CSG, in which it owns a 9.88% stake, and will not provide it with further capital injections. Later, it was clarified that the comments made regarding this were taken out of context. It turns out that SNB Alahli will not, for the time being, be providing further capital to CSG because this would mean increasing its stake beyond 10%, which would require clearance and further disclosures. Later on in the day, it was reported that the CSG secured a USD54bn loan from the Swiss National Bank (SNB), Switzerland’s central bank, part of which will be used to buy back USD3bn worth of debt. This sent a message to the markets, which pared their losses, that central banks will not allow for another “Lehman moment”.

What does this all mean for the EGX?

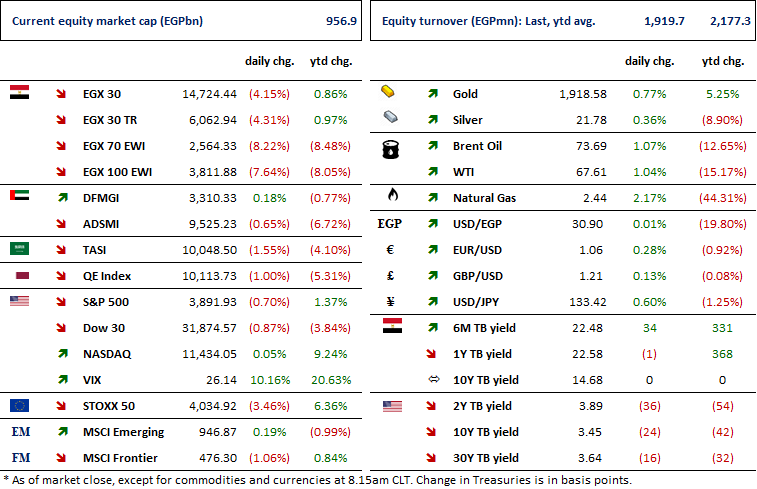

Last Sunday, we said that we expect to witness a “bumpy ride ahead”, and we had quite a ride so far. Since last Thursday, EGX 30 and EGX 70 EWI lost 10.5% and 16.2%, respectively. This compares to a drop of only 0.7% for the S&P 500, the main index of the U.S. market where the first sneeze took place, and a drop of 3.9% for the SMI, the main index of the Swiss market where the second sneeze took place. What particularly happened yesterday on the EGX was similar to a bank run! Many investors were running for the exit, with some deciding to offload their stocks at market, while others were forced to sell to meet their margin requirements which may continue into the early hours of today’s trading. This was evident with individual Egyptian investors ending the day as net sellers, making up alone 60% of total equity trading! But as always, such panic creates entry points at much cheaper levels. With no direct impact from either SVB or CSG on the market, we think investors should reduce their leverage and invest for the long term.

—Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

TSFE to offer 10-20% of Misr Insurance Holding

President El-Sisi inaugurates the nitrogenous fertilizers complex in Ain Sokhna

Gulf Sovereign Funds show interest in investing into Wataniya and Safi

The Egyptian government to begin selling state-owned companies to investors in April

Egypt’s automotive imports fall 44% in 2022

The Egyptian government inked agreements to build new terminals

Hilton plans to almost double its Egyptian property portfolio

MFPC consolidated 2022: Higher profits despite lower margins

Macro

TSFE to offer 10-20% of Misr Insurance Holding

The Sovereign Fund of Egypt (TSFE) is reportedly planning to offer 10-20% of the state-owned Misr Insurance Holding Co. to strategic investors. It was said that such a sale will not affect the plan to float the company on the EGX. (Al-Borsa)

President El-Sisi inaugurates the nitrogenous fertilizers complex in Ain Sokhna

Yesterday, President El-Sisi inaugurated the nitrogenous fertilizers complex in Ain Sokhna. The complex, one of El Nasr for Intermediate Chemicals', consists of six main large plants with planned production capacity of 400ktpa of ammonia, 300ktpa of liquid urea, 300ktpa of granulated urea, 165ktpa of nitric acid, and 200ktpa of ammonium nitrate. (Masrawy: 1, 2)

Gulf Sovereign Funds show interest in investing into Wataniya and Safi

Reportedly, Gulf Sovereign Funds showed interest in investing in National Co. for Natural Water (Safi) and National Petroleum Co. (Wataniya) after promoting the offerings started yesterday. The share of strategic investors in both companies may reach 25-30%. (Al-Mal)

The Egyptian government to begin selling state-owned companies to investors in April

Yesterday, the Egyptian Minister of Finance said that:

· The Egyptian government will start selling some of the state-owned companies destined for privatization to investors in April.

· Eight more names may be added to its list of companies intended for privatization.

· Five banks, including ALEXBANK, may be offered within the program. (Asharq Business)

Egypt’s automotive imports fall 44% in 2022

According to Automotive Marketing Information Council (AMIC), Egypt’s automotive imports fell to USD2.43bn in 2022 (-44% y/y) as:

· Passenger car imports fell to USD1.92bn (-48% y/y).

· Bus imports fell to USD6.1mn (-90% y/y).

· Truck imports fell to USD373.9mn (-19% y/y).

· Special-use vehicle imports fell to USD135.9mn (-25% y/y). (Al-Mal)

The Egyptian government inked agreements to build new terminals

The Ministry of Transportation inked two agreements with a consortium of Hutchison Ports, Cosco, and CMA-CGM to construct, operate, and maintain a new terminal in Sokhna and El-Dekheila ports for 30 years. The agreements are worth USD1.6bn and are expected to create 2,000 new jobs. (Cabinet)

Hilton plans to almost double its Egyptian property portfolio

Hilton is planning to almost double the number of properties it operates in Egypt over the next 3-5 years to 27 properties. It is planning to launch two new locations this summer: Waldorf Astoria Cairo Heliopolis and Hilton Cairo Nile Maadi. (Enterprise)

Corporate

MFPC consolidated 2022: Higher profits despite lower margins

Misr Fertilizers Production Co. [MFPC] published its full consolidated results for 2022, where:

· Net profit increased by 51% y/y to EGP7.2bn on the back of an 84% y/y higher revenues of EGP18.8bn, mainly due to higher global urea prices and the EGP devaluation.

· Exports sales increased 87% y/y to EGP13.3bn, contributing 72% to total revenues growth.

· GPM declined by 3pp y/y to 53% as blended selling price declined y/y due to a higher local quota in 2022 along with a higher USD natural gas cost.

· Financing income reached EGP231mn vs. financing expenses of EGP65mn a year before.

· Q4 2022 was very strong with net profits increasing 25% q/q to EGP2.2bn on the back of a 79% q/q higher top line of EGP6.5bn.

With an ROE of 21%, MFPC is currently traded at a P/E of 4.4x. (Company disclosure)