Fundamental Thoughts

Happy New Year, everyone, and welcome to another year that no one really knows how it will end. The last couple of years were a case in point when no one predicted the Russia-Ukraine war in 2022 and no one predicted COVID-19 in 2020. This is why we think investors should spend less time predicting the future and more time managing their risk. By reducing their risk as much as possible, we think investors have a better chance to protect their returns.

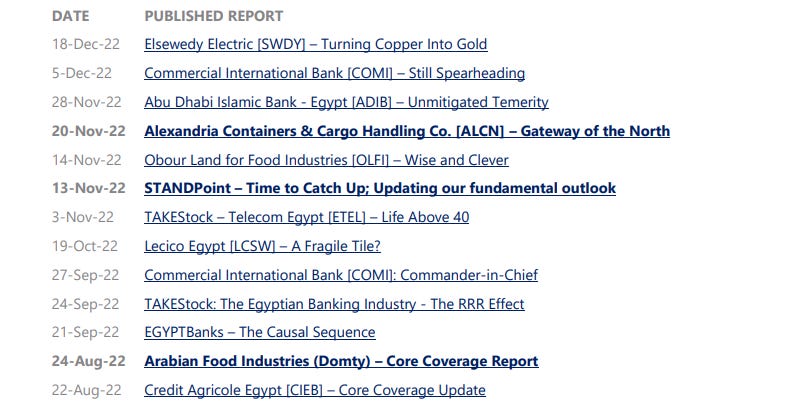

Speaking of which, we are starting the new year with a new section that we are adding to our daily flagship newsletter PRIMETime under the name of Fundamental Thoughts, where we will speak our mind about anything we see of interest, be it globally/local or macro/micro.

With 2022 behind us, we now have 25 years of history for Egypt’s EGX 30 index, so we just wanted to highlight a few takeaways from a quarter of a century of data:

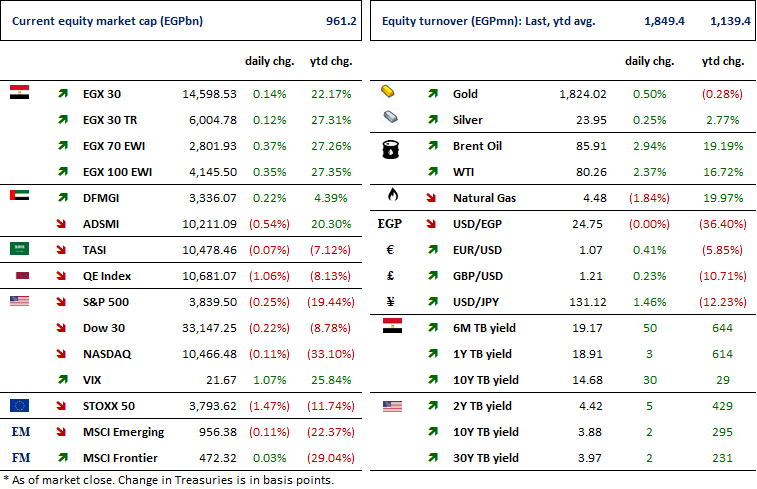

· EGX 30 ended the year up 22.2%, beating all regional markets (the best performer was ADX +20.3%) as well as developed (US -19.4%), emerging (-22.4%), and frontier (-29%) markets. However, EGX 30 is still 21% off its all-time high of 18,414.11 recorded intraday in April 2018.

· In USD terms, EGX 30 was down 22.5% in 2022 and is 74% off its all-time high recorded intraday in May 2008.

· Since its inception in 1998, EGX 30 returned 11.3% p.a., whereas in USD terms, it only returned 2.8% p.a.

· Foreign investors have been net sellers in every month of 2022 with cumulative net outflows of EGP26bn. On the other hand, Arabs have been net buyers, thanks to stake sales of state-owned companies, which also explains to some extent why Egyptians (mainly institutions) have been net sellers.

With the above in mind, we think EGP stability is key before foreign investors tap into Egypt equities once again.

— Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

CBE cancels the use of letters of credit for imports

Cabinet announces the approval of the state ownership policy document

CBE is considering rules for digital currencies

National Council for Wages raises the minimum wage for private-sector

Low demand drives fodder prices down

Part of EFIH's shares transferred to its ESOP program

General Co. for Silos & Storage reports 5M preliminary results

Two block trades on ADIB's shares

EGAS targets net income of EGP309mn in 2023

MACRO

CBE cancels the use of letters of credit for imports

In a circular issued last Thursday, the Central Bank of Egypt cancelled the use of letters of credit (LCs) for imports to clear the backlog in ports. This means banks will return to accepting documentary collection (DCs) to carry out all import operations. (CBE)

Cabinet announces the approval of the state ownership policy document

In a meeting held last Thursday, the Cabinet announced the President's ratification of the state ownership policy document which mainly aims at more inclusion for the private sector. It also sets target investment rates of 25-30% of GDP. (Mubasher)

CBE is considering rules for digital currencies

As a part of its annual financial stability report, the Central Bank of Egypt (CBE) announced considering setting new rules for digital currencies, alongside other main focus points like digital wallets and electronic identification. (Al-Borsa)

National Council for Wages raises the minimum wage for the private sector

In a statement issued last Thursday, the National Council for Wages announced raising the minimum wage for the private sector by 12.5% to EGP2,700/month on the back of higher inflation. (Cabinet)

Low demand drives fodder prices down

Fodder prices have reportedly decreased by 14% to an average of EGP21,000/ton. Despite the fact that fodder raw material costs are still increasing, the demand for fodder have deceased in the recent days. (Al-Borsa)

CORPORATE

Part of EFIH's shares transferred to its ESOP program

A transaction took place on e-finance [EFIH] shares totaling 12.82mn shares worth EGP184.69mn within the context of EFIH’s ESOP program. (Al-Mal)

General Co. for Silos & Storage reports 5M preliminary results

General Co. for Silos & Storage [GSSC] reported its preliminary 5M 2022/23 consolidated net profits of EGP48mn (+28% y/y). (Company disclosure)

Two block trades on ADIB's shares

Last Thursday, two block trades were carried out on Abu Dhabi Islamic Bank - Egypt's [ADIB] shares. The first was for 9.6mn shares at an average price of EGP16.2/share, while the second was on rights issue for 2.4mn rights at an average price of EGP6.5/right. (Mubasher)

EGAS targets net income of EGP309mn in 2023

Egypt Gas [EGAS] targets a net income of EGP309mn in 2023, which implies a forward P/E of 11.6x. The company expects total revenues to reach EGP8.6bn in 2023. We note that EGAS's net income recorded EGP153mn in 9M 2022 (+260% y/y). (Arab Finance)