Today’s Top News & Analysis

Annual core inflation rose to 31.2% y/y in January

Moody's downgrades deposit ratings of five Egyptian banks

Egypt's External debt repayment expected to reach USD35.1bn between Jan. and Sep.

FDI in Alamein refinery worth USD7bn

The Cabinet denies establishing an electricity pricing committee

Ezz Steel and Heliopolis for Housing have been added to MSCI Global Small Cap index

FX gains push FAIT's 2022 net income to an all-time high

SODIC's 2022 results shows a 39% y/y drop in net income

Sheeni's H1 2022/23 net income back to the positive territory

Overcrowding ends in Alexandria Container Handling Co. terminal

MACRO

Annual core inflation rose to 31.2% y/y in January

Annual core inflation rose to 31.2% y/y from 24.4% y/y in December. Monthly core CPI inflation also rose to 6.3% in January compared to 2.6% in December 2022. (Al-Mal)

Moody's downgrades deposit ratings of five Egyptian banks

In an anticipated move that followed the downgrade of Egypt's credit rating last Wednesday, Moody's downgraded the long-term bank deposit ratings of five Egyptian banks by one notch each. National Bank of Egypt (NBE), Banque Misr (BM), Banque Du Caire [BQDC] and Commercial International Bank [COMI] were downgraded from B2 to B3, while Bank of Alexandria was downgraded from B1 to B2, all with a stable deposit outlook. (Moody's)

Egypt's external debt repayments to reach USD35.1bn between January and September

Egypt’s external debt repayments are expected to reach USD35.1bn in the period between January and September 2023, with debt repayment peaking at USD9.2bn in March. (CNN Business)

FDI in Alamein refinery worth USD7bn

Egypt’s Prime Minister announced that investments in the El-Alamein Complex for Refining & Petrochemicals have amassed up to USD7bn in foreign direct investments. The complex will utilize crude oil from wells in the Western Desert for refining and use in petrochemicals. (Hapi Journal)

The Cabinet denies establishing an electricity pricing committee

Last week, news sources reported that the Egyptian government was considering creating an electricity pricing committee similar to the fuel pricing committee. The Cabinet’s Information & Decision Support Center released a statement denying such claims and reassured the public that electricity bills have not changed. (Cabinet)

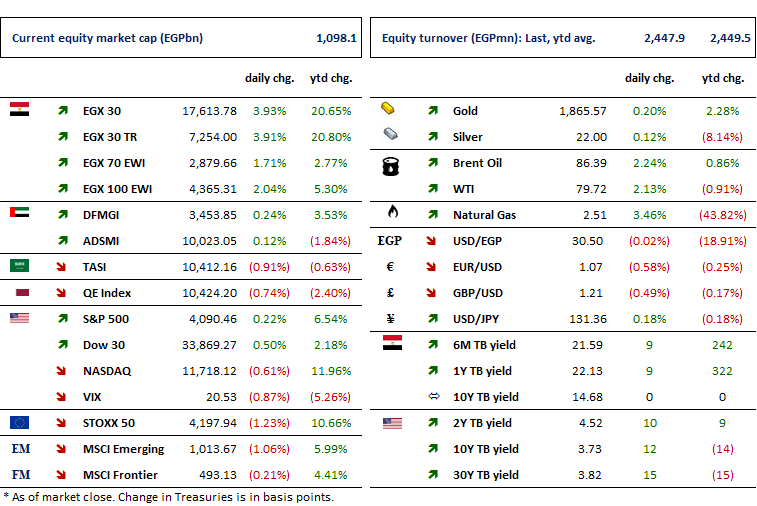

Russia to cut oil production in March

Russia’s Deputy Prime Minister announced that his country plans to reduce its crude oil production in March by 500,000 bbl/day, equivalent to about 5% of its output. Russia is trying to combat the EU’s latest price cap on its fuel products. Following the announcement, Brent reached USD86.39/bbl (+2.2% for the day) while US oil reached USD79.72 (+2.1% for the day). Two OPEC+ delegates said that OPEC+ would not change its output levels after the announcement. Oil prices have been posting weekly gains (Brent +8.1% w/w, US oil +8.6% w/w) as a result of supply chain fears after the closure of Turkey’s oil-export terminal at Ceyhan following the earthquake. Meanwhile, the cost of shipping gasoline and fuel on tankers surged this week after the latest sanctions on Russia. Daily earnings of small Atlantic fuel tankers increased by 400% for the week to USD55,857 as more tankers choose to ship for Russia, leaving fewer vessels serving other petroleum exporters. (Reuters, Barron’s, Bloomberg)

CORPORATE

Ezz Steel and Heliopolis Housing & Development added to MSCI Global Small Cap index

The MSCI Semi-Annual Index Review resulted in the inclusion of Ezz Steel [ESRS] and Heliopolis Housing & Development [HELI] in MSCI Global Small Cap index. The rebalancing will take place as of 28 February 2023 closing. (Al-Mal)

Faisal Islamic Bank of Egypt’s 2022 net income hits an all-time high on FX gains

Faisal Islamic Bank of Egypt [FAIT] announced 2022 results. Below are our key takeaways:

· Net income reached an all-time high of EGP4.5bn (+67% y/y) on the back of sky-high FX gains of EGP2.5bn due to the EGP devaluation. As we noted before on several occasions, FAIT has a huge net long foreign currency position that now represents 35% of its total equity.

· This record-breaking earnings came despite the 19% y/y decrease in net interest income (NII) to EGP4.4bn because of the much higher cost of funds. Interest expense increased by 42% y/y, while interest income increased by only 11%, hence the decrease in NII.

· The bank reversed some credit provisions or EGP153mn in 2022 against booked provisions of EGP206mn in 2021.

· The effective tax rate decreased significantly from 38% in 2021 to 27% in 2022, as the bank was able to generate more interest income from other sources than Treasury bills.

· In terms of balance sheet growth, the loan book grew by only 5% y/y to EGP14.5bn by end of 2022 on the back of foreign-currency loans, with an almost doubled NPL ratio of 2.9% and a much lower coverage ratio of 149%. Meanwhile, deposits grew by 13% y/y to EGP123.6bn, similarly due to foreign-currency deposits.

· As usual for FAIT, debt securities represented the biggest share of total assets of 58% in 2022 although lower than the year before due to 26% higher interbank assets of EGP23.5bn.

· FAIT's positive asset repricing gap widened to 12% of total assets, which makes the bank a bigger beneficiary of upcoming interest rate hikes.

· FAIT’s NIM declined by 1.5pp to 3.7% on a lower NII, while ROAE widened to 23% from 17% a year earlier.

· FAIT’s BoD proposed distributing a cash dividend of EGP1.98/share, implying a 7.4% yield and a payout ratio of 27%.

· FAIT is currently traded at a P/E of 3.4x and a P/B of 0.7x. (Bank disclosure)

SODIC's 2022 net income drop 39% y/y

SODIC [OCDI] 2022 results showed the following:

· A drop of 39% y/y in net income to EGP520mn, on a higher provision charges.

· Revenues came in at EGP7.8bn compared to EGP6.9bn a year before (+12.8% y/y), where:

o Real estate sales increased by 16.9% y/y to EGP7.2bn.

o Management of compounds revenues increased by 7.7% y/y to EGP406mn.

o Real estate investment revenues increased by 30% y/y to EGP54mn.

o Revenues from clubs decreased 67% y/y to EGP101mn.

· GPM dropped to 28% (-5.8pp y/y), affected by an EGP542mn provision charge related to a revaluation of its backlog in view of higher inflation, higher interest rates, and the EGP devaluation.

· Net financing income grew 7x y/y to EGP60mn. (Company disclosure)

Sheeni's H1 2022/23 net income back to the positive territory

The General Co. for Ceramics & Porcelain Products’ (Sheeni) [PRCL] H1 2022/23 results showed net profits of EGP46.5mn compared to a net loss of EGP28.5mn the previous year. Despite having incurred a gross loss of EGP7mn in 2022 (implying a GPM of -5.8%), PRCL generated an operating profit, mainly due to EGP62.4mn in other revenues. Revenues increased by 15% y/y to EGP120.5mn powered by selling 2,263,000 sqm of ceramics (+7% y/y). (Company disclosure)

Overcrowding ends in Alexandria Container Handling’s terminal

The overcrowding of export containers last Thursday in the terminal of Alexandria Container Handling [ALCN] in Alexandria Port has reportedly been solved. The issue was solved by supplying additional storage space for containers in the terminal. (Al-Mal)