Today’s Top News & Analysis

The Egyptian Parliament approves FY24 budget of EGP4.35tn

Treasury bill yields surpass 24%

India to provide Egypt with a credit line

Two transactions to help Egypt reach its USD2bn target

Sidpec’s acquisition of ETHYDCO is yet to be finalized

National Investment Bank lowers its stake in Misr Beni Suef Cement

Aldar Properties denies plans to acquire Imkan Misr

MACRO

The Egyptian Parliament approves FY24 budget of EGP4.35tn

The Egyptian Parliament approved Egypt’s FY24 budget at EGP4.35tn, 35% higher than FY23 budget. As per FY24, GDP is expected to reach EGP11.84tn, with the budget allocated as follows:

· Wages: EGP470bn.

· Purchase of goods and services: EGP139bn.

· Costs of debt: EGP1.12tn.

· Subsidies and grants: EGP529bn.

· Governmental investments: EGP587bn.

· Asset acquisition: EGP42bn.

· Local and foreign debt repayments: EGP1.32tn. (Al-Mal)

Treasury bill yields surpass 24%

Pretax yields on Egypt’s 1-year and 6-month Treasury bills exceeded 24% in the latest auction by the Central Bank of Egypt worth EGP54.4bn vs. EGP39.5bn initially planned. (Masrawy)

India to provide Egypt with a credit line

India will provide Egypt with a credit line to boost the economy; however, the value of the credit line is not revealed yet. (Bloomberg)

Two transactions to help Egypt reach its USD2bn target

The Egyptian government is planning to sell a part of or the full stake of Telecom Egypt’s [ETEL] subsidiary, Vodafone Egypt [VODE], or sell the Beni Suef Electric Power Plant to complete its target of securing USD2bn from the IPO program. (Al-Borsa)

CORPORATE

Sidpec’s acquisition of ETHYDCO is yet to be finalized

Regarding circulating news about its acquisition of the Egyptian Ethylene Production Co. (ETHYDCO), Sidi Kerir Petrochemicals (Sidpec) [SKPC] clarified that the financial advisor still has not submitted the final report for the share swap agreement. (Company disclosure)

National Investment Bank lowers its stake in Misr Beni Suef Cement

The National Investment Bank lowered its stake in Misr Beni Suef Cement [MBSC] from 20.1% to 15.02% by selling 4.9mn shares with an average price of EGP31.5/share or a total transaction value of EGP154mn. (Company disclosure)

Aldar Properties denies plans to acquire Imkan Misr

Aldar Properties denied circulating news of its acquisition of Imkan Misr, a wholly-owned subsidiary of Abu Dhabi Capital. (Asharq Business)

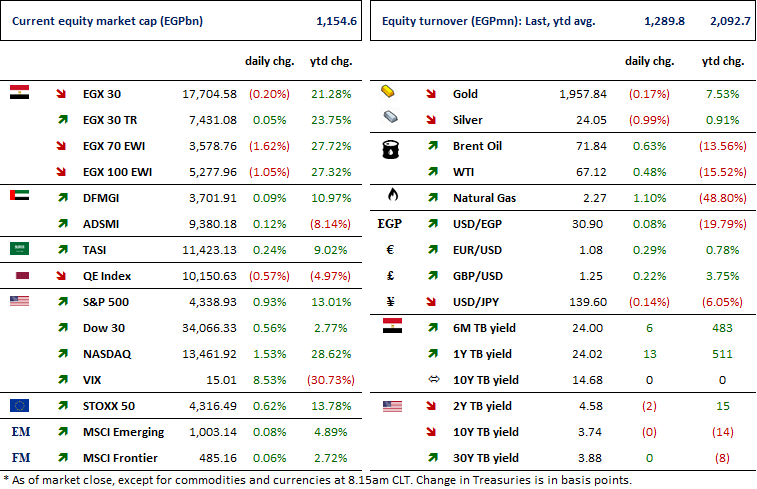

Markets Performance

Key Dates

14-Jun-23

EXPA: Right Issue / Last day for eligibility for subscription in the rights issue.

15-Jun-23

ZMID: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

17-Jun-23

MICH: EGM / Amending Article No. 6 of the company's bylaws for increasing the authorized capital from EGP400mn to EGP1bn.

18-Jun-23

MOIL: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

MOIL: EGM / Discussing the continuation of the company.

19-Jun-23

SUGR: Cash dividend / Deadline for eligibility for a dividend of EGP2.550/Share.

EXPA: Capital increase / Capital increase subscription starting date.

EXPA: Right Issue / First day of trading the rights issue.

20-Jun-23

SUGR: Cash dividend / Ex-dividend date for EGP2.550/Share.

22-Jun-23

AREH: OGM / Approving financial statements ending 31 Dec. 2022.

HELI: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

SUGR: Cash dividend / Payment date for a dividend of EGP2.550/Share.

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

25-Jun-23

MCQE: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.

4-Jul-23

ISPH: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

ISPH: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.