Today’s Top News & Analysis

Egypt's PMI reaches its highest since August 2021

FY25 budget approved

A new government to be formed

35% m/m better auto sales in April 2024

ETEL studies selling and renting its towers

FRA approves ATLC's EGP121mn rights issue

MACRO

Egypt's PMI reaches its highest since August 2021

Egypt’s Purchasing Manager’s Index (PMI) for the non-oil private sector saw its reading in May 2024 reaching its highest since August 2021 at 49.6 due to the softening of inflationary pressures. However, still in contraction territory. (S&P Global)

FY25 budget approved

Yesterday, the House of Representatives approved the FY25 budget with an economic growth of 4.2%. Whereas the headline inflation is expected to drop to an average of 17.9% vs. 35.7% in FY24. Finally, the budget deficit is expected to be 7.3% of the GDP. (Enterprise)

A new government to be formed

Yesterday, the Egyptian President accepted the government's resignation and appointed the MP to form a new government including the needed expertise. (Enterprise)

35% m/m better auto sales in April 2024

According to the Automotive Marketing Information Council (AMIC), Egypt’s auto sales increased by 35% m/m in April 2024 to 5,700 vehicles. The volumes came as follows:

· Passenger car sales drove the rise by a 66% m/m increase to 4,600 units.

· Truck sales decreased by 14% m/m to 789 units.

Bus sales decreased by 37% m/m to 329 units. (Enterprise)

CORPORATE

ETEL studies selling and renting its towers

Telecom Egypt [ETEL] has been studying the sale and renting of its towers, adding that it did not receive any official offers showing interest in its towers. ETEL stated this in response to the circulating news about the Saudi Public Investment Fund's (PIF) interest in acquiring towers in Egypt. (Company disclosure)

FRA approves ATLC's EGP121mn rights issue

The Financial Regulatory Authority (FRA) approved Al Tawfeek for Financial Lease's [ATLC] capital increase of c.EGP121mn at a par value of EGP2.5/share through a rights issue to be paid in cash or through the conversion of credit balances owed to certain shareholders. This 27.7% capital increase of c.49mn shares should run from 24 June through 23 July. (FRA disclosure)

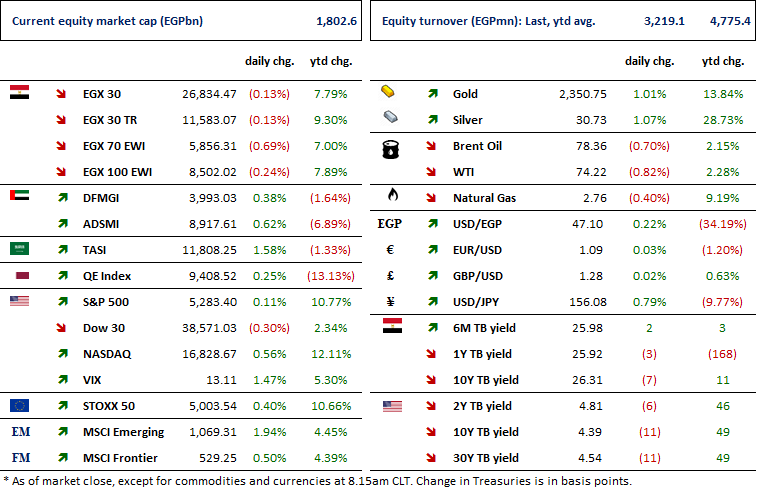

MARKETS PERFORMANCE

Key Dates

4-Jun-24

Egypt PMI / May 2024 reading.

5-Jun-24

DSCW: Cash dividend / Payment date for a dividend of EGP0.167/Share.

6-Jun-24

ALCN: OGM / Approving the use of Corporate reserve shown in the audited financial statements.

ALCN: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

8-Jun-24

ESRS: OGM / Approving financial statements ending 31 Dec. 2023 and netting contracts.

ESRS: EGM / Discussing capital reduction.

9-Jun-24

BINV: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

BINV: EGM / Amending Article No. 19 of the company's bylaws.

CCAP: OGM / Approving financial statements ending 31 Dec. 2023.

10-Jun-24

HELI: Cash dividend / Deadline for eligibility for a dividend of EGP1.34/Share.

11-Jun-24

GBCO: Conference Call / Discussing Q1 2024 financial results.

12-Jun-24

EGCH: EGM / Amending Article No. 4 of the company's bylaws.

IDHC: EGM / Amending Article No. 3 of the company's bylaws.

13-Jun-24

HELI: Cash dividend / Payment date for a dividend of EGP1.34/Share.

23-Jun-24

EGTS: OGM / Approving financial statements ending 31 Dec. 2023.

24-Jun-24

BTFH: EGM / Amending Article No. 4 of the company's bylaws.