Negotiations & Backing Down

Stocks mentioned: ETEL, VODE, AMER, SPMD, EFIH, EGAS, GSSC, RMDA, IDHC, DSCW, CNFN, MPRC

Today’s Top News & Analysis

Ras El-Hekma Land to get transferred to Ras El-Hekma for Urban Development

Ministry of Environment negotiates IMF for USD1.2bn in green financing

ETEL backed down offers to sell its stake in VODE

AMER Q1 2024: Net profits slice more than half on weak operations and higher finance expense

EFIH Q1 2024: Doubled revenues; more than doubled net profits

CNFC Q1 2024: Slowdown in portfolio transfer activities

EGAS Q1 2024: Better revenues yet GL is booked; investment income saves the day again

SPMD 2023: Lower net losses despite revenues halving

GSSC 9M 2023/24: Strong net profits on non-operational income

MPRC Q1 2024: Earnings leapt 125% y/y

FRA approves RMDA's capital increase

IDHC to be delisted from EGX

DSCW to distribute cash dividends next month

MACRO

Ras El-Hekma Land to get transferred to Ras El-Hekma for Urban Development

After the announcement of receiving the second and final tranche of Ras El-Hekma's dues, the Cabinet's spokesman said that Ras El-Hekma's land will be transferred to Ras El-Hekma for Urban Development shortly. (Enterprise)

Ministry of Environment negotiates IMF for USD1.2bn in green financing

The Minister of Environment said that negotiations started with the International Monetary Fund (IMF) to lend Egypt a USD1.2bn loan dedicated to green financing. (Enterprise)

CORPORATE

ETEL backed down offers to sell its stake in VODE

Sources said that Telecom Egypt [ETEL] backed down from selling its stake in Vodafone Egypt [VODE], which is said to be 45% of ETEL's stake in VODE. The sources added that the offers are not lucrative to the stake's value where it is expected to generate EGP3bn in revenues in 2024. (Asharq Business)

AMER Q1 2024: Net profits slice more than half on weak operations and higher finance expense

Amer Group [AMER] posted a 57% y/y decline in net profits to EGP12mn in Q1 2024 due to:

· Weaker revenues of EGP265mn (-32% y/y).

· Higher SG&A-to-revenues ratio of 33% (+6.2pp y/y).

· Higher finance expense of EGP48mn (+13% y/y).

However, the gross profit margin grew to 53% (+9pp y/y).

Results imply a TTM P/E of 26x. (Company disclosure)

EFIH Q1 2024: Doubled revenues; more than doubled net profits

e-Finance for Digital and Financial Investments [EFIH] posted a 64% y/y increase in net profits to EGP463mn in Q1 2024 due to the doubled revenues of EGP1.1bn and the better gross profit margin of 55% (+5pp y/y). We note that the net profits are enhanced more than revenues, this is in reflection of the growth in net finance income to EGP143mn (+36% y/y).

Results imply a TTM P/E of 32x. (Company disclosure)

CNFC Q1 2024: Slowdown in portfolio transfer activities

Contact Financial Holding [CNFN] reported a 68% y/y decline in the consolidated normalized net income to EGP57.4mn in Q1 2024 due to a challenging macroeconomic environment that led to a slowdown in portfolio transfer activities. (Company disclosure)

EGAS Q1 2024: Better revenues yet GL is booked; investment income saves the day again

Egypt Gas [EGAS] posted a 48% y/y growth in net profits to EGP139mn in Q1 2024 despite booking more than doubled gross loss of EGP194mn. The growth in net profits was driven by non-operational activities having a 21% y/y higher investment income of EGP826mn.

Results imply a TTM P/E of 16x. (Company disclosure)

SPMD 2023: Lower net losses despite revenues halving

Speed Medical [SPMD] posted a -42% y/y decline in net losses to EGP84mn despite the revenues halving to EGP60mn. Meanwhile, the gross losses widened to EGP19mn. (Company disclosure)

GSSC 9M 2023/24: Strong net profits on non-operational income

General Co. for Silos & Storage [GSSC] posted a 42% y/y growth in net profits to EGP76mn in 9M 2023/24 due to:

· A 19% y/y growth in revenues to EGP875mn.

· 6pp y/y improvement in the gross profit margin to 33%.

· Lower SG&A-to-revenues ratio of 9% (+1.3pp y/y).

However, the non-operational activities were the stronger driver for the net profits growth with a net finance income of EGP40mn (+87% y/y).

Results imply a TTM P/E of 30x. (Company disclosure)

MPRC Q1 2024: Earnings leapt 125% y/y

Egyptian Media Production City company [MPRC] posted a 125% y/y increase in earnings to EGP372mn in Q1 2024. Results imply a TTM P/E of 4x. (Company disclosure)

FRA approves RMDA's capital increase

The Financial Regulatory Authority (FRA) approved Rameda's [RMDA] capital increase from EGP375mn to EGP378mn through issuing new shares dedicated to the reward system. (FRA disclosure)

IDHC to be delisted from EGX

Integrated Diagnostics Holding Co [IDHC] BoD approved delisting the company from the EGX, however, it will still be traded in London's exchange. The BoD agreed to keep the delisted shares as treasury shares once the EGM approves the proposal. (Company disclosure)

DSCW to distribute cash dividends next month

Dice Sport & Casual Wear [DSCW] will distribute EGP0.1679/share cash dividends on 2 June 2024, implying a yield of 13%. (Company disclosure)

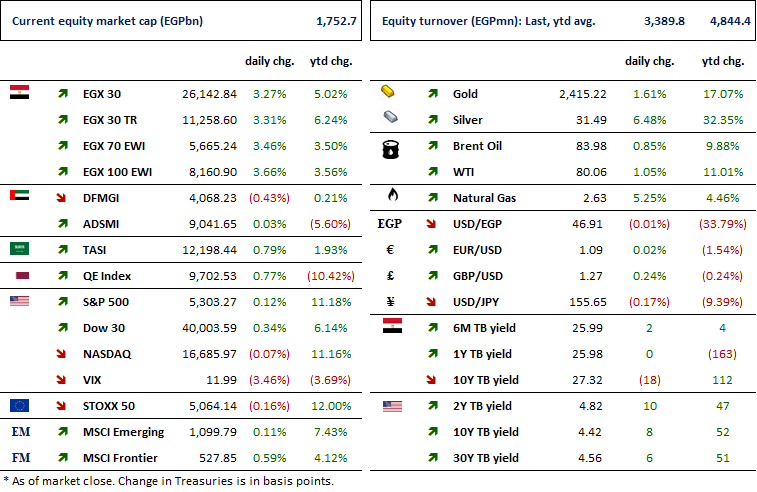

Markets Performance

Key Dates

20-May-24

ORAS: OGM / Approvig financial statements ending 31 Dec. 2023 and the proposed dividends.

23-May-24

HELI: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

MPC Meeting / Determining the CBE's policy rate.

26-May-24

OIH: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

SKPC: Cash dividend / Deadline for eligibility for a dividend of EGP1.25/Share.

OFH: OGM / Approving financial statements ending 31 Dec. 2023.

MCRO: OGM / Approving financial statements ending 31 Dec. 2023.

CICH: Cash dividend / Deadline for eligibility for a dividend of EGP0.2169/Share.

SWDY: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

27-May-24

TMGH: Cash dividend / Deadline for eligibility for a dividend of EGP0.22/Share.

MASR: Cash dividend / Deadline for eligibility for a dividend of EGP0.20/Share.

ZMID: Cash dividend / Deadline for eligibility for a dividend of EGP0.150/Share.

29-May-24

SKPC: Cash dividend / Payment date for a dividend of EGP0.75/Share (1st installment)

CICH: Cash dividend / Payment date for a dividend of EGP0.2169/Share.

AMIA: Stock dividend / Last date for eligibility for a 0.10-for-1 stock dividend.

SWDY: Cash dividend / Payment date for a dividend of EGP0.50/Share.

30-May-24

MASR: Cash dividend / Payment date for a dividend of EGP0.10/Share (1st installment)

AMIA: Stock dividend / Date for distributing a 0.10 for-1 stock dividend.

CCAP: OGM / Discussing agenda items.

TMGH: Cash dividend / Payment date for a dividend of EGP0.11/Share (1st installment)

ZMID: Cash dividend / Payment date for a dividend of EGP0.05/Share (1st installment)

ETEL: Earnings Announcement / Announcing Q1 2024 financial results.

2-Jun-24

CSAG: OGM / Approving the estimated budget of FY 2024/2025.

DSCW: Cash dividend / Deadline for eligibility for a dividend of EGP0.167/Share.

3-Jun-24

MSCI / MSCI's May 2024 Semi-Annual Index Review Effective Date.

5-Jun-24

DSCW: Cash dividend / Payment date for a dividend of EGP0.167/Share.

6-Jun-24

ALCN: OGM / Approving the use of Corporate reserve shown in the audited financial statements.

ALCN: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

8-Jun-24

ESRS: OGM / Approving financial statements ending 31 Dec. 2023 and netting contracts.

ESRS: EGM / Discussing capital reduction.

9-Jun-24

BINV: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

BINV: EGM / Amending Article No. 19 of the company's bylaws.

CCAP: OGM / Approving financial statements ending 31 Dec. 2023.