Today’s Top News & Analysis

SELC plans to launch medical laboratories group in Egypt and KSA

AfDB approves USD345mn as credit guarantees to Egypt's panda bonds

EBRD provides EUR1bn for the Egyptian private sector in 2023

AMOC 9M 2022/23: Other revenues affects both annual growth and sequential decline

MFPC Q1 2023 standalone: Strong profits on FX gains despite a lower top line

CSAG 9M 2022/23: Stronger operational performance

E-Finance to launch its operations in KSA by Q3 2023

aiBank acquires NBG's LG portfolio

Minister of Petroleum lays the bedrock for North Abu Qir project

MACRO

SELC plans to launch medical laboratories group in Egypt and KSA

Saudi Egyptian Labs Corporation (SELC) is planning to launch a group of medical laboratories in Egypt with a total investment of EGP300mn and in Saudi Arabia with a total of SAR80mn. (Asharq Business)

AfDB approves USD345mn as credit guarantees to Egypt's panda bonds

African Development Bank Group (AfDB) approved USD345mn as partial credit guarantee for first CNY-denominated panda bond sale of USD500mn. Bond proceeds will be used for clean transportation, renewable energy, energy efficiency, financing for MSMEs, and essential health services initiatives, among others. (AfDB)

EBRD provides EUR1bn for the Egyptian private sector in 2023

Egypt’s Minister of International Cooperation revealed that the European Bank for Reconstruction & Development (EBRD) aims to provide financing for the private sector in Egypt worth EUR1bn in 2023 compared to investments of EUR737mn last year. (Economy plus)

Corporate

AMOC 9M 2022/23: Other revenues affects both annual growth and sequential decline

Alexandria Mineral Oils Co. [AMOC] reported its consolidated results for 9M 2022/23, recording net profits of EGP1.39bn (+87% y/y) on revenues of EGP17.7bn (+45% y/y) with a 10% GPM (-1pp y/y), driven by:

· Higher selling prices overshadowing lower sales volumes.

· Other revenues growing 854% y/y to EGP760mn due to FX gains (+1307% y/y), higher interest income (+51% y/y), and greater miscellaneous revenues (+4747% y/y).

The company’s Q3 2022/23 net profits came in at EGP408mn (-31% q/q) on revenues of EGP7bn (+48% q/q) with a 9% GPM (-2pp q/q), driven by:

· Higher sales volumes along with blended COGS/ton increasing at a rate higher than blended selling prices.

· Lower other revenues of EGP331mn (-13% q/q) as a result of only accumulating EGP1.5mn (-99% q/q) in miscellaneous revenues. (Company disclosure)

MFPC Q1 2023 standalone: Strong profits on FX gains despite a lower top line

Misr Fertilizers Production Co.’s (MOPCO) [MFPC] standalone results for Q1 2023 showed net profit increasing by 92% y/y to EGP3.9bn, mainly on the back of enormous FX gains of EGP2bn vs. only EGP872mn a year before. Finance income also contributed to bottom line growth, increasing by 329% y/y to EGP235mn. However, revenues declined by 6.5% to EGP1.5bn on lower urea prices. Accordingly, GPM also declined to 59% from 63% last year. (Company disclosure)

CSAG 9M 2022/23: Stronger operational performance

Canal Shipping Agencies’ [CSAG] 9M 2022/23 preliminary results showed net income of EGP216.9mn (+51% y/y) on revenues of EGP58.5mn (+2% y/y). The increase in bottom line profits is attributable to the increase in investment income from Damietta Container Handling Co. [DCCC] and Port Said Container Handling Co. [POCO], while GPM widened to 41.6% (+13.2pp y/y). (Company disclosure)

E-Finance to launch its operations in KSA by Q3 2023

E-Finance’s [EFIH] CEO announced that the company will launch its operations in Saudi Arabia by Q3 2023. He added that the company is eagerly anticipating the impact of this expansion on its financials this year, as it is expected to serve as a source of foreign currency and to generate higher revenues due to cost differentials. The Saudi Public Investment Fund (PIF) had previously acquired a 25% stake in EFIH in August of last year. (Asharq Business)

aiBank acquires NBG's LG portfolio

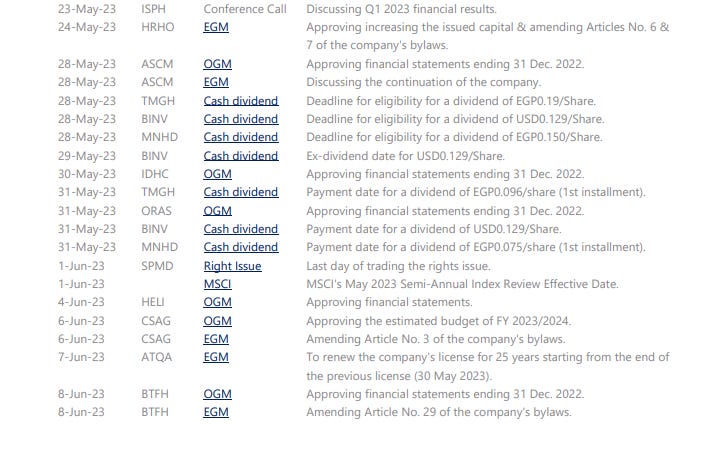

As part of its expansion plan, Arab Investment Bank (aiBank), the commercial banking arm of EFG Hermes Holding [HRHO], decided to acquire the existing letters of guarantee (LGs) portfolio of the National Bank of Greece - Egypt (NBG). The portfolio should provide aiBank with a distinguished clientele base and high credit quality. (Economy plus)

Minister of Petroleum lays the bedrock for North Abu Qir project

Egypt’s Minister of Petroleum laid the bedrock for the North Abu Qir for agri-nutrients project. The new company has a paid-in capital of EGP1bn and an authorized capital of EGP10bn and is owned by Abu Qir Fertilizers [ABUK] (45%), the Egyptian General Petroleum Corporation (45%), and the Egyptian Petrochemicals Holding Company (10%). The company's expected production capacity is 1,200 MT/day of ammonia, 1,830 MT/day of nitric acid, and 2,400 MT/day of ammonium nitrate. (Al-Mal)