Fundamental Thoughts

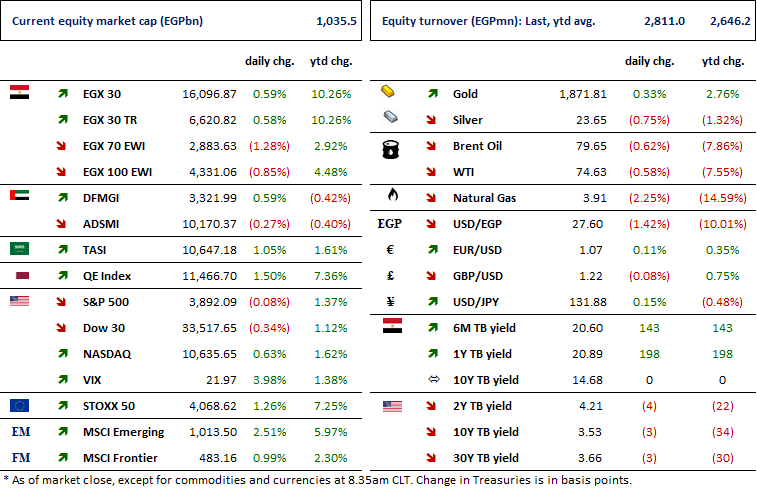

Having risen by as much as 1.7% intraday, EGX 30 pared most of its gains to close the day up only 0.6%, still above the 16,000 mark. On the other hand, EGX 70 EWI took a similar trend, rising as much as 0.7% intraday before turning all the way south to end the day down 1.3%, erasing its earlier gains in the last 1.5 hours of trading. With EGP2.8bn traded, foreign investors turned net buyers for the first time so far in 2023. It was Arab individual investors who were mostly net sellers on the day. With the USD rising yesterday to EGP27.6, the EGP is now down more than 10% ytd (-43% since March 2022, -68% since November 2016), pulling EGX 30 USD down 1.1% ytd (vs. +10.3% ytd for EGX 30 in EGP terms).

Earlier today, the CAPMAS reported Egypt’s headline inflation figures for December 2022, which rose to 21.3% from 18.7% in November 2022, coming in higher than our expectation of 19% and market consensus of 20.5%. Save for exceptional meetings, investors will look forward to the Central Bank of Egypt’s Monetary Policy Committee 2023 schedule with the first of this year’s eight meetings to be held on 2 February. By that time, January inflation figures will not have been published, so the MPC will likely base its decision on December inflation and the impact of a stronger USD on overall local prices, all against the backdrop of global events. We note that the MPC meeting will be held just a day after the end of the U.S. Fed’s first meeting in 2023 (scheduled for 31 January and 1 February).

Meanwhile, the main headline news of yesterday has been the Egyptian government’s move to ration its spending for the rest of this fiscal year (FY23). Such rationing decisions will relate to some renewable energy and water desalination projects with UDS components, provided that they have not been agreed to. What this means is that projects that have already been approved will be business as usual. On the flip side, this might mean some delay in new awards in the construction and infrastructure sector in the coming period, which would impact Orascom Construction [ORAS] and Elsewedy Electric [SWDY]. Elsewhere, several corporate actions tend to lead the corporate headline news, ranging from M&A (i.e. PACHIN [PACH]) to capital increases (Speed Medical [SPMD] and Banque du Caire [BQDC]) and share buyback programs (MM Group [MTIE]).

— Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

Headline inflation accelerated to 21.3% in December 2022

Cabinet to postpone new projects and ration overall government spending

EGP155bn invested so far in the high-yield 25% CDs

GB Lease closes its third issuance of securitized bond

Compass Capital approved for due diligence on PACHIN

MM Group to end its share buyback program by February 2023

Speed Medical to increase its paid-in capital by 50%; selling a stake in Speed Hospital

Banque du Caire to increase authorized capital and paid-in capital

MACRO

Headline inflation accelerated to 21.3% in December 2022

According to CAPMAS, Egypt’s headline inflation accelerated to 21.3% in December 2022, up from 18.7% in November 2022. This is higher than our expectation of 19% and market consensus of 20.5%. (Asharq Business)

Cabinet to postpone new projects and ration overall government spending

The Cabinet will ration public spending in entities included in the state's general budget until the end of FY23, thus postponing any projects that have a USD component and have not started yet. The only exceptions are the Ministry of Health, entities responsible for managing food commodities or petroleum products, the Ministries of Defense and Interior, and the repayment of debt. We think this will negatively affect construction and infrastructure projects in general due to their high USD requirement to complete. (Cairo 24)

EGP155bn invested so far in the high-yield 25% CDs

Depositors have reportedly poured EGP155bn into the high-yield 25% CDs issued by National Bank of Egypt (NBE) (EGP105bn) and Banque Misr (EGP50bn). (Enterprise)

CORPORATE

GB Lease closes its third issuance of securitized bond

GB Lease, a subsidiary of GB Auto [AUTO], closed a securitized bond worth EGP1.7bn, backed by a receivables portfolio of EGP2.4bn. The bond was comprised of three tranches with credit ratings ranging from AA+ to A. (Company disclosure)

Compass Capital approved for due diligence on PACHIN

Paints & Chemical Industries’ (PACHIN) [PACH] BoD approved for Compass Capital to start its due diligence process on PACH to reach a final acquisition price. To recap, PACH had received five acquisition offers in the last six months, with only three remaining on the table: Eagles Chemicals offer to acquire 76-100% of the company at EGP29.5/share and UAE-based National Paints Holding offer to buy up to 100% at EGP29/share. We think the bidding war for PACH is not only for its operating value but for the inherent value in its Al-Qouba land plot, the value of which could be maximized if its purpose is changed from industrial to residential. (Company disclosure)

MM Group to end its share buyback program by February 2023

MM Group for Industry & International Trade [MTIE] will end its share buyback program on 20 February 2023. We note that MTIE’s BoD had approved to kick off the company’s share buyback program on 21 August 2022 for up to 5% of its outstanding shares at market price. According to our calculation, MTIE has bought back so far 2.3mn shares or 0.24% of total issued shares, leaving some 46mn shares to be bought back through 20 February 2023 or the equivalent of 11 trading days based on the stock’s 3m average traded volume of 4.2mn shares. (Company disclosure)

Speed Medical to increase its paid-in capital by 50%; selling a stake in Speed Hospital

Speed Medical [SPMD] will hold an EGM on 2 February 2023 to discuss several agenda items, the most important of which are:

· Increasing its paid-in capital by 50% or EGP111mn through a rights issue, offering 554,572,240 new shares at a par value of EGP0.2/share to be funded in cash or through outstanding shareholders’ loans.

· SPMD will discuss selling its total stake in Speed Hospital in Obour City. (Company disclosure)

Banque du Caire to increase authorized capital and paid-in capital

Banque du Caire [BQDC] has submitted the documents to double its authorized capital from EGP10bn to EGP20bn. The bank will also increase its paid-in capital by 110% from EGP5.25bn to EGP10bn, or by EGP4.75bn in cash to be funded by existing shareholders and distributed over 2.375bn shares at a par value of EGP2/share. (Mubasher: 1, 2)