1. Today’s Trading Playbook

KEY THEMES

An exceptional MPC meeting was held this morning, which resulted in raising key lending and deposit rates by a 100bps to 10.25% and 9.25%, respectively. The move was targeted to combat the overwhelming inflationary pressures arising from the situation in global commodity market, given that inflation target by the CBE going into Q4 2022 remained 9% at maximum. This surprising move came three days before the scheduled meeting on Thursday, 24 March, suggesting that the CBE is opting for more "flexibility" as mentioned in its press release. We had projected the CBE to hike its rates by 50bps this Thursday and a total of 200-300bps in 2022. However, with the ongoing fast and significant depreciation in the FX rate, we will likely see at least 400bps. State-owned banks just issued this morning 18% certificates of deposits, which should support EGP-denominated assets. We will have to revise our inflation projection again given the significant movement on exchange rate. We note that the EGP has weakened by c.10% this morning as well, with the USD/EGP trading at around 17.5 (at the time of writing). We believe that such a movement in the EGP explains to a great extent the quick pace upon which the CBE responded, as FX rate remains the boldest inflation driver. We note that weaker EGP was the second theme we picked in our annual strategy STANDPoint published on 30 January 2022. Yesterday, we wrote here that such inflationary pressure is predicted to be met with a tight monetary action by the CBE this week. Our predictions are still in place regarding at least 200-300bps to be hiked in 2022, including today’s hike. Also, we reiterate that as a reflection on the market, such a policy response should favor companies with resilient balance sheets, while denting the profitability of high-leveraged names. Also, companies with skin in the export market should be in focus.

POSITIVE: Benefitting from weak EGP only— ABUK, EKHO, MFPC, EGCH, EFIC, SKPC, ESRS, MICH, EGAL, SWDY, ORAS, MOIL, ALCN, CSAG, LCSW, CERA, ECAP, cement exporters, AMOC, CCAP, ORWE, DSCW, SUGR, RACC, EGSA, and ETEL. Banks will benefit from higher interest rate and Treasury yields. Also loan book will grow strongly driven by USD-denominated loans.

NEGATIVE: Generally, consumer names, except for ORWE. Neutral to bad for NBFS; most resilient segments remain consumer finance and microfinance.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

President Abdel-Fattah El-Sisi yesterday instructed the government to immediately put together a package of measures to soften the economic and social impact of rising inflation caused by the Russia-Ukraine conflict. Meanwhile, the Ministry of Finance has revised downwards its fiscal targets for FY23 as rising commodities prices put pressure on public finances, according to figures published. The government now sees the budget deficit contracting to 6.3% of GDP in FY23 from an expected 6.9% in FY22. Preliminary figures released by the ministry in January had targeted a 6.1% deficit in the coming fiscal year. (Spokesman of the Presidency)

British American Tobacco Co. decided to raise the prices of cigarettes for a number of its products, with an increase ranging from EGP1-3. (Al-Mal)

The three largest state-owned banks in Egypt have set up an USD85mn FinTech Fund with the aim of accelerating innovation in the sector. (Economy Plus)

The Central Bank of Egypt’s monthly statistical bulletin revealed that foreign holding of treasury bills increased to EGP334.1bn (USD21.3bn) at the end of January 2022,compared to EGP321.8bn (USD20.5bn) at the end of December 2021. (CBE)

CORPORATE NEWS

Madinet Nasr Housing & Development’s [MNHD] rights issue oversubscribed at a coverage ratio of 97.5%. It is worth noting that MNHD approved raising capital by issuing 374mn shares with an EGP1/share. (Arab Finance)

Palm Hills Developments [PHDC] has raised its stake at International Company for Leasing [ICLE] from 9.6% to 15.3% with a total value of EGP47mn and average price of EGP41/share. Such a deal implies a 2021 P/E and P/B for ICLE of 10.0x and 1.17x, respectively. We note that this compares to TTM P/E and P/B for AT Lease [ATLC] of 4x and 1.16x, respectively. We note that in 2021 ATLC booked EGP64mn of securitization gains, which helped the company to achieve a bottom line of EGP134mn (+81% y/y). (Mubasher)

Sidi Kerir Petrochemicals [SKPC] is reportedly mulling the establishment of a polylactic acid factory. (Mubasher)

Cleopatra Hospitals Group’s [CLHO] EPS has surged 33% to EGP0.2/share on the back (1)30% y/y growth in revenues, (2) GPM improvement to 37% (+2pp y/y), and (3) lower impairment losses and higher other revenues. We note that top line growth came in view of stronger volumes y/y. CLHO is currently trading at 2021 P/E of 23x, far from its long-term historical average of more than 30x. (Company disclosure)

Ibnsina Pharma’s [ISPH] net earnings in 2021 upped to EGP314mn (+39% y/y) on higher top line of EGP21.7bn (+16% y/y) as well as reversal of credit provisions worth of EGP45mn. BoD has suggested a DPS of EGP0.10, implying a 3% yield. ISPH is currently traded at 2021 P/E of 9x. (Company disclosure)

GB Auto [AUTO] disclosed that it has not entered into any definitive agreements regarding its subsidiary GB Capital. This disclosure came after news circulated about First Abu Dhabi Bank’s intention to acquire GB Capital. (Company disclosure, Shorouk news)

GLOBAL NEWS

China kept its benchmark interest rate for corporate and household lending unchanged on Monday, as expected, although analysts say the case for monetary stimulus is building amid mounting external risks to an already slowing economy. (Reuters)

Saudi Arabia regained the spot as China's top crude supplier in the first two months of 2022, having been leapfrogged by Russia in December, while Russian shipments dropped 9% as a cut in import quotas led independent refiners to scale back purchases. (Reuters)

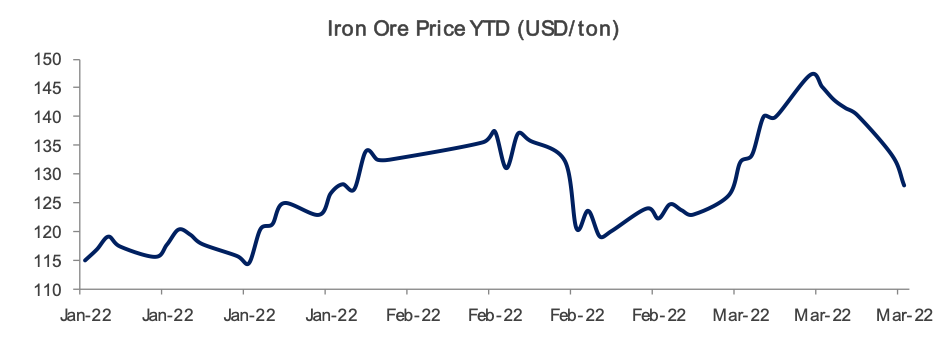

3. Chart of the Day

Source: Bloomberg.

The iron ore price fell as surging COVID-19 infections in China, the world’s biggest steel producer and metals consumer, fanned worries over the country’s economic growth prospects.