Today’s Top News & Analysis

IMF’s loan third tranche is expected within weeks

A regasification vessel to arrive in Egypt by mid-June

SWDY Q1 2024: Strong net profits on higher FX gains

CCAP: Debt purchase offer is 85% subscribed

OFH Q1 2024: Wider gross loss leads to net losses

MACRO

IMF’s loan third tranche is expected within weeks

Sources said that the third tranche of the International Monetary Fund’s (IMF) loan is expected to be received by Egypt within weeks, amounting to USD820mn. We note that the IMF’s loan currently amounts to USD8bn after it was expanded from USD5bn previously. (Enterprise)

A regasification vessel to arrive in Egypt by mid-June

Sources said that an LNG regasification vessel is expected to arrive in Egypt by mid-June to cover the increasing demand for electricity through the summer months. (Asharq Business)

CORPORATE

SWDY Q1 2024: Strong net profits on higher FX gains

Elswedy Electric [SWDY] recorded a 37% y/y growth in net profit to EGP4bn in Q1 2024, thanks to FX gains of EGP3.1bn. We note that profits after excluding the one-time items fell by 17% y/y to EGP1.6bn only. Regarding SWDY’s performance, came as follows:

· Higher revenues of EGP45bn (+36% y/y), the revenues mix came in as follows:

· Wires & cables segment recorded revenues of EGP28bn (+57% y/y), contributing 62% of total revenues.

· The turnkey projects segment recorded revenues of EGP12bn (+7% y/y), contributing 27% of total revenues.

· Better gross profit margin of 22% (+4pp y/y), supported by the increase in the wires & cables margins to 24% (+4pp y/y). (Company disclosure)

CCAP: Debt purchase offer is 85% subscribed

Qalaa Holdings [CCAP] announced that the total subscribed amount for the debt purchase offer reached USD17.5mn out of USD21.6mn. In addition, CCAP main shareholders, Citadel Partners covered their stake of USD6.6mn, leading to a total subscription of 85%. (Company disclosure)

OFH Q1 2024: Wider gross loss leads to net losses

Orascom Financial Holding [OFH] posted net losses of EGP22mn in Q1 2024 on a wider gross loss of EGP15mn vs. EGP0.57mn last year. However, OFH's revenues grew by 146% y/y to EGP2mn. (Company disclosure)

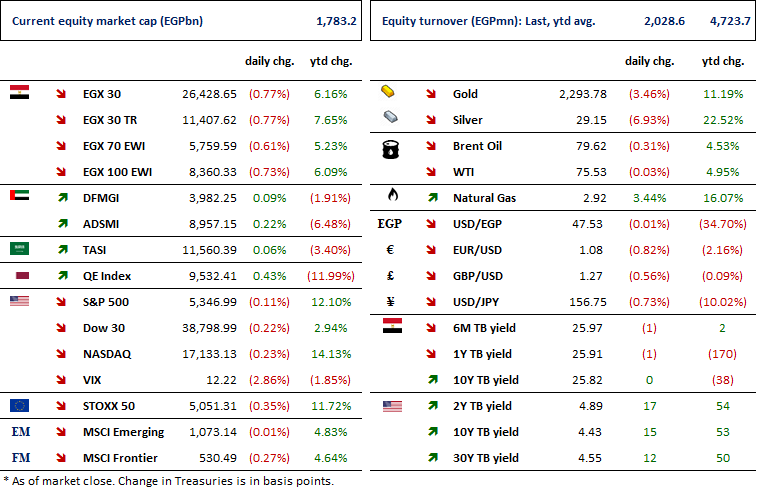

MARKETS PERFORMANCE

Key Dates

9-Jun-24

BINV: OGM / Approving financial statements ending 31 Dec. 2023 and the proposed dividends.

BINV: EGM / Amending Article No. 19 of the company's bylaws.

CCAP: OGM / Approving financial statements ending 31 Dec. 2023.

10-Jun-24

HELI: Cash dividend / Deadline for eligibility for a dividend of EGP1.34/Share.

11-Jun-24

GBCO: Conference Call / Discussing Q1 2024 financial results.

12-Jun-24

EGCH: EGM / Amending Article No. 4 of the company's bylaws.

IDHC: EGM / Amending Article No. 3 of the company's bylaws.

13-Jun-24

HELI: Cash dividend / Payment date for a dividend of EGP1.34/Share.

23-Jun-24

EGTS: OGM / Approving financial statements ending 31 Dec. 2023.

AIH: Stock dividend / Last date for eligibility for a 0.099-for-1 stock dividend.

24-Jun-24

AIH: Stock dividend / Date for distributing a 0.099 for-1 stock dividend.

BTFH: EGM / Amending Article No. 4 of the company's bylaws.

ELSH: Cash dividend / Deadline for eligibility for a dividend of EGP0.15/Share.

27-Jun-24

ELSH: Cash dividend / Payment date for a dividend of EGP0.075/Share (1st installment)

30-Jun-24

HELI: Cash dividend / Payment date for a dividend of EGP0.07/share (3rd installment).