Today’s Trading Playbook

KEY THEMES

B Investments [BINV] has posted its 2021 results, reporting a bottom line of EGP123.4mn (-45% y/y). Earnings slipped in light of weak top line performance, as BINV recorded total operating revenues of EGP174.8mn (-41% y/y). Lower bottom line y/y was partially the reason of high comparable base, with 2020’s revenues containing the capital gains related to the partial exit from Total Energies Egypt, amounting to EGP118.1mn. On the other hand, BINV Q3 2021 has witnessed almost zero net earnings, having reported earnings of EGP72.92mn (-53% y/y) in 9M 2021 (+0.6% vs. H1 2021). Normalizing for the impact of Total Energies Egypt partial exist, earnings would have grown by 18% y/y. Still, BINV’s cash position remained healthy at EGP380mn (28% of market cap). In addition, BINV continues to maintain a debt-free balance sheet with a TTM ROAE of 7.0%. BINV’s ROAE is weak when compared to that of other names across the financial sector. However, the annual earnings offers little to be revealed about the valuation potential. BINV’s most important catalyst, however, would be the success of a partial or full divestiture of its fundamentally sound holdings. After the partial exit of Total Egypt and the full exit of BEARD, all eyes are now on Ebtikar’s long-awaited IPO. We remind you that BINV is one of the 15 stocks we picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. BINV is currently traded at 2021 P/E and P/B of 11x and 0.9x respectively. We have an Overweight recommendation on BINV, with our 12MPT of EGP16.7 (ETR +97%).

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

Saudi Arabia has deposited USD5bn with the Central Bank of Egypt (CBE), In parallel, the Saudi sovereign wealth fund is looking to invest USD10bn in Egypt’s healthcare, education, agriculture and financial services sectors. This means that total Saudi deposits at the CBE is going to reach USD10.3bn while GCC countries lined up a total of USD22bn in investment and funding for Egypt so far. These inflows are expected to ease the pressures on the exchange rate and the external funding needs. (SPA, Cabinet statement)

The government has an outline of its long-term strategy to encourage private sector involvement in the economy. The framework will provide a roadmap for reducing the state’s economic activities, charting which industries it will withdraw from and when, as well as ring fencing strategic sectors where it wants to retain a presence. (Cabinet statement)

IMF director Georgieva said that the fund is working currently on a new program for Egypt to protect the poor from food and energy prices based on the data that the fund is about to obtain from the CBE and the Ministry of Finance. (Economy Plus)

CORPORATE NEWS

Arabian Food Industries [DOMT] 2021 net earnings slipped to EGP72mn (-54% y/y) despite 12% growth in total revenues of EGP3.4bn. Earnings slipped on the back of weaker GPM of 22.4% vs. 24.5% a year earlier, which resulted in flat gross profits y/y of EGP753mn. Furthermore, marketing and selling expenses upped 27% y/y. (Company disclosure)

North Cairo Mills [MILS] expects net income of EGP13.8mn and revenues of EGP726.8mn in 2022/23, as per the budget approved by its board on 28 March 2022. (Company disclosure)

Contact Financial Holding’s [CNFN] subsidiary signed a cooperation agreement worth of EGP1.0bn with Nawy, specialized in real estate development to provide financial solutions to the latter’s clients. (Mubasher)

Misr Hotels [MHOT] paid EGP361.3mn out of its loan to National Bank of Egypt.(Mubasher)

A block trade took place on Fawry for Banking Technologies and Electronic Payments’s [FWRY] shares worth EGP1.05bn for a total number of shares of 102.5mn shares at an average share price of EGP10.24/share. (Mubasher)

Credit Agricole [CIEB] is targeting to increase its branches to from 82 to 87 branch during 2022. (Mubasher)

GLOBAL NEWS

Activity in Chinese manufacturing and services simultaneously contracted in March for the first time since the height of the country's COVID-19 outbreak in 2020, adding to the urgency for more policy intervention to stabilize the economy. (Reuters)

Top oil consuming nations may find that one of their main tools to fight high global oil prices – the release of strategic stockpiles - will prove inadequate to soothe markets starved of Russian supply since its invasion of Ukraine. (Reuters)

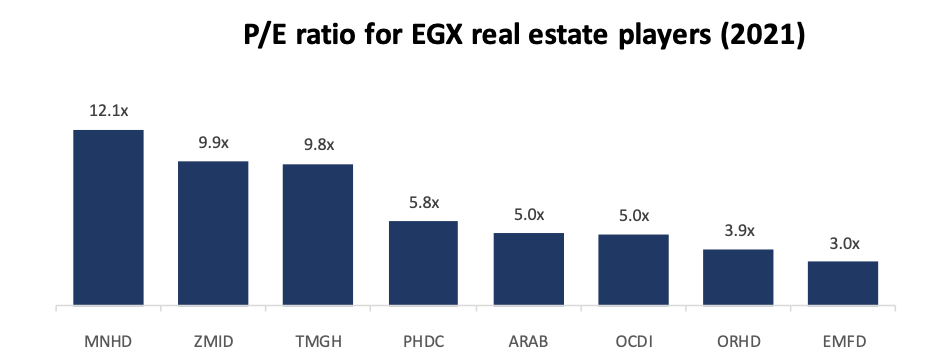

3. Chart of the Day

Hossain Zaman | Equity Analyst

Source: Prime research, Company's disclosure.

EMFD is trading the cheapest based on P/E ratio compared to its peers.