Today’s Top News & Analysis

Egypt targets 60% electricity generation from renewable energy sources by 2040

Egypt and Oman to launch a joint investment fund

European Union and France to provide Egypt with EUR60mn to expand grain silos

China Energy’s green hydrogen plant close to being a reality

Madinet Masr Q1 2023: Earnings growth driven by high-margin sales

ISPH Q1 2023: Higher net profits on higher revenues and higher GPM

EFIC standalone Q1 2023: Are the good days over?

Edita to sign an acquisition agreement next week

ATLC Q1 2023: A mixed bag of profit growth drivers

MACRO

Egypt targets 60% electricity generation from renewable energy sources by 2040

Egypt’s Minister of Electricity & Renewable Energy announced that the country is aiming to accelerate the production of electricity generation from renewable energy sources to reach 42% by 2030 and 60% by 2040. (Arab Finance)

Egypt and Oman to launch a joint investment fund

The head of the General Authority for Investment & Free Zones announced that The Sovereign Fund of Egypt (TSFE) is studying the launch of a joint investment fund with Oman. Furthermore, sources allege that Omani Investment Authority is planning to invest USD5bn in Egypt over the next three years. The authority is planning to invest USD1bn this year to cooperate with KSA-based ACWA Power in wind energy projects. (Arab Finance, Daily News Egypt)

European Union and France to provide Egypt with EUR60mn to expand grain silos

European Union and France agreed to provide Egypt with EUR60mn facilities to expand the storage capacity of grain silos by at least 420,000 tons, the majority of which will be for wheat. This will increase the storage capacity of wheat by 12%. (CNBC Arabia)

China Energy’s green hydrogen plant close to being a reality

The head of the Suez Canal Economic Zone announced the MoU signed with China Energy for the green hydrogen plant will be finalized soon. Investments in the plant are worth c.USD7bn with a production capacity of 1.2mn tons of green ammonia and 210,000 tons of green hydrogen annually. We had reported on 9 March 2023 that investments in the green hydrogen plant were estimated to reach USD5.1bn. (Economy Plus)

Corporate

Madinet Masr Q1 2023: Earnings growth driven by high-margin sales

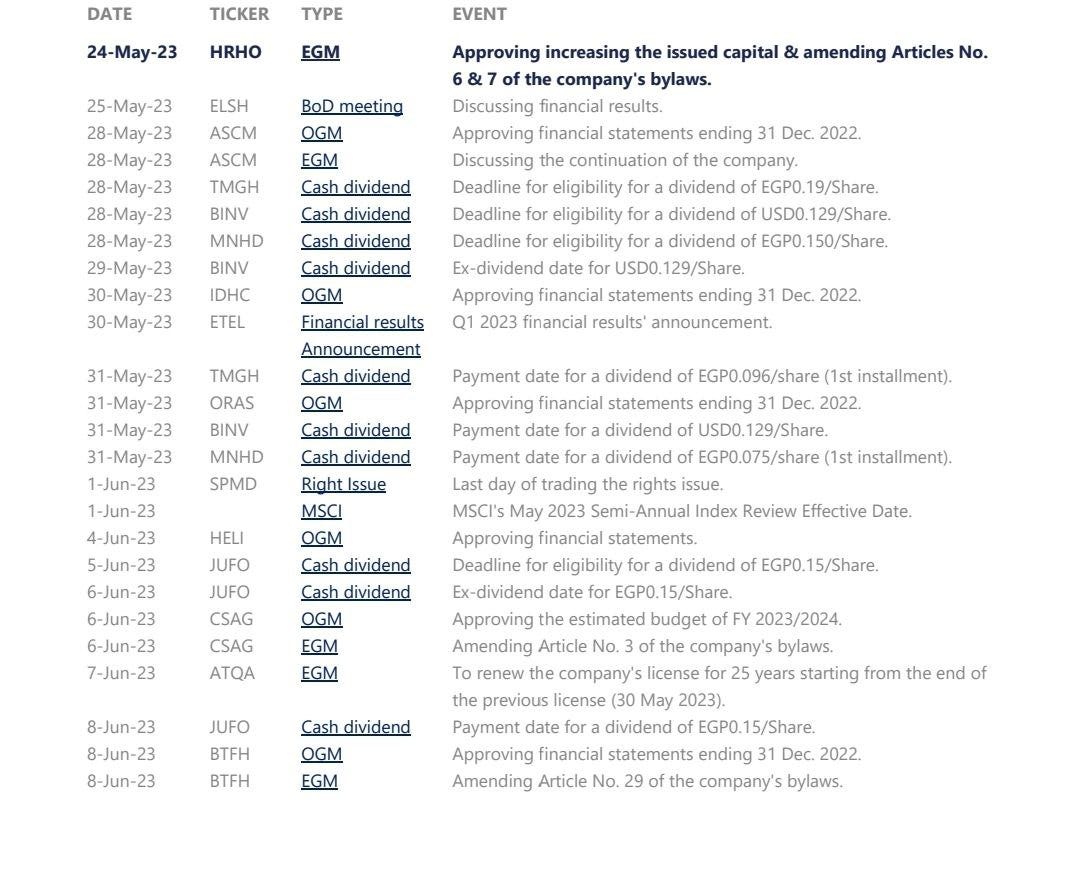

Madinet Masr’s [MNHD] Q1 2023 net income came in at EGP304.4mn compared to EGP120.2mn (+153% y/y) on revenues of EGP1bn (+24% y/y). GPM recorded 57.1% (+23.9pp y/y) on a higher margin units sales. Contracted sales grew to EGP1.8bn (+12.8% y/y), with another EGP544mn of contract sales from the acquisition of EgyCan Properties and Minka Developments, which were not consolidated in MNHD results. Delivery of units shrank by 23.5% y/y to 276 units during the year compared to 361 units in 2021. (Company disclosure)

ISPH Q1 2023: Higher net profits on higher revenues and higher GPM

Ibnsina Pharma [ISPH] reported Q1 2023 net profits of EGP73mn (+22% y/y) on higher revenues of EGP6.8bn (+28% y/y) as gross profit margin reached 8% (+0.6pp y/y).

· This comes despite a 116% increase in financing cost to EGP198mn. Also, financing income declined by 64% y/y to EGP14mn.

· However, FX gains of EGP35mn (growing almost 5x y/y) and a decline in other expenses to EGP2.4mn (-84% y/y) helped mitigate the effect of the sharp increase in financing cost.

· As for the company’s sales mix: (1) Retail sales increased by 11% y/y, contributing 47% of total revenues. (2) Wholesale segment expanded by 62.5% y/y, contributing 33.5% of total revenues. (Company disclosure)

EFIC standalone Q1 2023: Are the good days over?

Egyptian Financial & Industrial Co. [EFIC] announced Q1 2023 standalone results, where net income declined by 11% y/y to EGP87mn despite revenues increasing by 24% y/y to EGP383mn. Due to the EGP devaluation, raw material cost more than the doubled. Accordingly, gross profit declined by 18% y/y to EGP121mn, leading to a drop in GPM to 31% from 48% a year before. Although net financing income increased by 134% to EGP55mn, it was not enough to offset the decline in gross profit. (Company disclosure)

Edita to sign an acquisition agreement next week

News reported that Edita Food Industries [EFID] will sign an agreement next week to fully acquire a frozen bakeries company. The deal will be worth EGP380mn, yet, the company’s name is not disclosed. It is worth mentioning that EFID’s BoD approved the acquisition back in February 2023. (Al-Borsa)

ATLC Q1 2023: A mixed bag of profit growth drivers

Al Tawfeek for Financial Lease [ATLC] announced the results for Q1 2023, where net income increased by 38% y/y to EGP36mn on the back of:

(1) Topline growth of 40% y/y to EGP232mn, while maintaining the GPM at 31%.

(2) 288% y/y higher interest income of EGP3.5mn.

(3) 259% y/y higher FX gains of EGP3.6mn. (Company disclosure)