Today’s Top News & Analysis

Abu Qir Metro gets EUR250mn in financing

Alstom to invest EUR300mn in new factories

CCAP Q1 2023: Weak bottom-line output despite great topline performance

Madinat Masr completes its acquisition of Egycan

CAED Q3 2022/23: Strong revenue growth but lower net profits

MACRO

Abu Qir Metro gets EUR250mn in financing

The Abu Qir metro redevelopment project got a EUR250mn financing from the Asian Infrastructure Investment Bank (AIIB). This is part of a EUR1.6bn financing from several sources including EBRD, European Investment Bank, and French Development Agency. (Enterprise)

Alstom to invest EUR300mn in new factories

French Alstom is planning to invest EUR300mn over the upcoming three years in two new factories in Borg El-Arab to produce electrical systems and metro and monorail rolling stock. (Enterprise)

CORPORATE

CCAP Q1 2023: Weak bottom-line output despite great topline performance

Qalaa Holdings [CCAP] released its Q1 2023 financial statements showing lower net profits of EGP73mn (-84% y/y) despite revenues growing 62% y/y to EGP30bn (+7% q/q) and a GPM of 36% (+13pp y/y, -3pp q/q). The top-line growth was mainly driven by:

· Egyptian Refining Co. (ERC) revenues growing 71% y/y to EGP23bn (+8% q/q, 77% revenue contribution) as a result of greater fuel oil and jet fuel sales volumes with a gross refining margin of USD3.7mn/day (+37% y/y, -24% q/q).

· TAQA Arabia [TAQA] revenues growing 27% y/y to EGP3bn (10% revenue contribution), and EBITDA growing 34% y/y to EGP273mn, with all three key business segments (Gas, Power, and Petroleum) contributing to the growth.

Some of CCAP’s weak points in Q1 2023 were:

· TAQA posted a 5% q/q decline in revenues and a 33% q/q decline in EBITDA due to poor performance across all three segments.

· Finance costs increased 93% y/y to EGP2bn (+17% q/q).

· The group’s Q1 2023 net profits were only 2% of the net profits attributed to minority interest.

We note that CCAP applied a different accounting standard which allows it to reclassify FX losses incurred from the devaluation of the EGP to other comprehensive income. As such, Q1 2022 financials were restated for comparison purposes. Thus, CCAP reported an FX gain of EGP350mn in Q1 2023 vs. an FX loss of EGP37.7mn in restated Q1 2022. The company also stated that it is actively trying to restructure its debt obligations and could offer its assets as repayments, similar to what happened with TAQA with an option to buy them back later. Meanwhile, CCAP outlined that it is currently studying investing in medium-sized, export-driven, and environmentally-friendly projects. (Company disclosure)

Madinat Masr completes its acquisition of Egycan

Madinat Masr Housing & Development [MNHD] completed its acquisition of Egycan Properties in a deal worth EGP195mn. (Al-Mal)

CAED Q3 2022/23: Strong revenue growth but lower net profits

Cairo Educational Services [CAED] reported Q3 2022/23 net profits of EGP11mn (-4% y/y, +2% q/q), despite double-digit growth in revenues of 15% y/y reaching EGP32mn (+0.5% q/q). Gross profit margin declined by 2pp y/y to 52% (+1.3pp q/q). (Company disclosure)

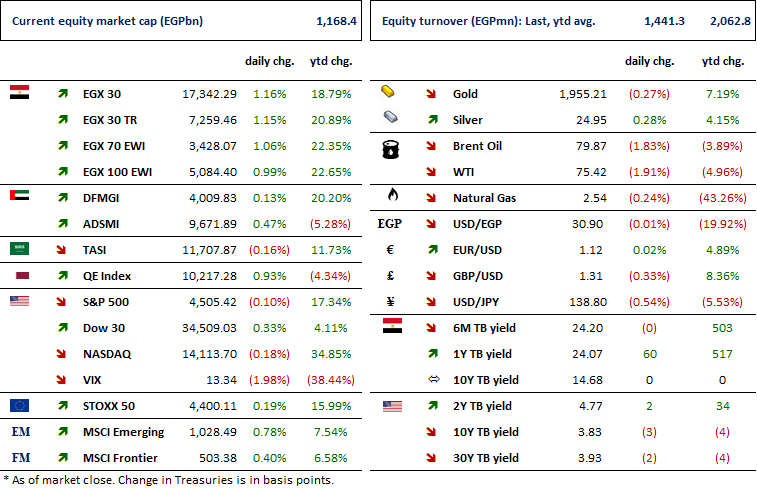

Markets Performance

Key Dates

16-Jul-23

SKPC: BoD / Discussing the auditor's report regarding the FV of SKPC and ETHYDCO.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

19-Jul-23

PACH: OGM / Board election.

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.