Today’s Trading Playbook

Nouran Ahmed | Equity Analyst

KEY THEMES

Obour Land Food Industries [OLFI] has announced its consolidated Q1 2022 figures last Thursday. Below are our main takeaways for the quarter:

Exceptional top line improvement: Revenues grew 39% y/y to EGP924mn, posting a double-digit growth that we believe was due to both higher volumes and prices. White cheese volumes sold grew 23% y/y to 30,000 tons, whereas white cheese average prices rose to EGP28.5/kg (+15% y/y).

Margins pressured: Despite earnings growing by 30% y/y, margins came under pressure. We believe the GPM decline is a reflection to a worldwide rally in global commodity prices with higher skim milk powder (SMP) prices. GPM and NPM slipped by 1.9pp and 0.7pp to 22% and 10%, respectively.

Top line diversity attempts: Despite all attempts to diversify, OLFI's top line is still dominated by the cheese segment which continues to seize the largest contribution to revenues (94% of total revenues or EGP868mn). To the contrary, the juice & milk segment showed a decline in contribution to total revenues to represent 6% vs. 8% a year earlier, albeit with segment revenues increasing 4% y/y.

Overweight and 12MPT maintained: OLFI is trading at 2022e P/E of 6.8x. In view of Q1 2022 results, we maintain our Overweight rating for OLFI, with our 12MPT of EGP8.6/share (+42%). OLFI is one of the 15 stocks we had picked in our STANDPoint 2022 strategy outlook published on 30 January 2022.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

S&P and Fitch Ratings have both affirmed Egypt’s BB and B+ credit ratings with a stable outlook, despite surging food and energy prices caused by the war in Ukraine putting pressure on the country’s finances, the two ratings agencies said last week. (Enterprise)

Egypt’s budget deficit is expected to narrow to 6.8% by the end of the current fiscal year,the IMF said in its latest Fiscal Monitor Report. (IMF)

Egypt has signed major agreements with international companies to produce green energy in the Suez Canal Economic Zone in a step that could help turn the zone into a green energy hub. (Enterprise)

US conglomerate Honeywell is looking to invest around USD200mn in petrochemicals and the production of green fuels for aircraft in Egypt. (Ministry of Petroleum)

UAE-based fintech platform FlexxPay is expanding to Egypt. Meanwhile, Last week, China-backed fintech player OPay received preliminary approval from the Central Bank of Egypt (CBE) to issue pre-paid cards in partnership with Masria Digital Payments (MDP). Other Africa-focused fintechs such as Churpy and ImaliPay have said recently they are preparing to set up shop in Egypt. (Enterprise)

Around 55,000 tons of Indian wheat will be loaded from India’s Kandla Port for shipment to Egypt on Friday. (Argus media)

CORPORATE NEWS

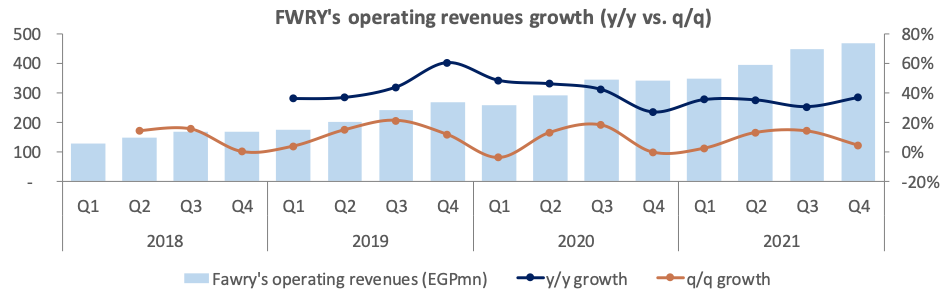

Fawry’s [FWRY] net earnings grew 13% to EGP186mn in 2021, implying a net margin of 11%. Such earnings growth came on the back of double-digit top line growth of 34% y/y to EGP1.66bn vs. EGP1.2bn a year before. Around 56% of revenue growth was driven by banking services, of which revenues grew 135% y/y to EGP411mn, contributing 25% to revenues (vs. 14% a year before). Total throughput value increased by 61.5% to EGP131bn in 2021, up from EGP81bn a year before. FWRY is currently trading at 2021 EV/EBITDA of 30x and P/E of 87x. (Company disclosure)

Abu Qir Fertilizers' [ABUK] latest OGM minutes suggested that the additional 10% local quota, which was placed back in November, is now canceled. As a way of background, back in November 2021, the Egyptian government revised local nitrogen fertilizers prices upward. The new regime back then necessitated fertilizers, in addition to their monthly quota, to sell an additional 10% of their output in the “free” local market, where prices are not subsidized. (Company disclosure)

SODIC’s [OCDI] consolidated net income in Q1 2022 surged 126% y/y, yet dropped 56% q/q to EGP226mn, while revenue increased 40% y/y (-67%q/q) to EGP1.19bn. Furthermore, GPM upped to 42% (+9pp y/y). OCDI’s excellent y/y KPIs are supported by a better delivery mix and improvement in operating profitability, though q/q performance drop was due to lower recorded Q1 2022 revenue vs. Q4 2021. Meanwhile, OCDI accounted for EGP3.74bn (+102%y/y) of gross contracted sales, representing 573 units sold. (Company disclosure)

Integrated Diagnostics Holdings [IDHC] net earnings in 2021 came at EGP1.5bn (+145% y/y) in line with our expectations. Stupendous bottom line growth came in light of 97% y/y growth in top line to EGP5.3bn. Furthermore, GPM improved to 54% (+3pp y/y). Growth in revenues took place on the back of 24% y/y growth in number of tests, coupled with a 53% growth in blended prices. IDHC is currently traded at 2021 P/E of 7.7x. We have an Overweight rating on IDHC, with our 12MPT of EGP28.9/share (+ETR 51%). IDHC is one of the 15 stocks we had picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. (Company disclosure)

Abu Auf is postponing its IPO to the second half of 2022, due to the market changes upon the Russia-Ukraine war. (Enterprise)

GLOBAL NEWS

The European Central Bank should raise interest rates soon and has room for up to three hikes this year, ECB policymaker Martins Kazaks told Reuters, joining a chorus of policymakers calling for a swift exit from stimulus. (Reuters)

The Bank of Japan is set to maintain ultra-low interest rates on Thursday and hold off from major tweaks to its dovish policy guidance, as rising raw material costs force it to focus on underpinning a fragile economic recovery. (Reuters)

3. Chart of the Day

Youssef Ghazy | Equity Analyst

Source: company reports.

Fawry's [FWRY] Q4 2021 results showed a notable y/y growth in revenue of 37% compared to Q4 2020. Meanwhile, Sequential growth came at 4% compared to Q3 2021.