Today’s Top News & Analysis

Blackouts extended temporarily to 3 hours/day

World Bank to give Egypt a DPF

President ratifies a new law for hospital privatization

China tightens controls on fertilizer exports to safeguard domestic supply

CIB lowers FX markup fees for credit cards

MACRO

Blackouts extended temporarily to 3 hours/day

The Egyptian government has temporarily extended the power blackouts to three hours/day in response to the electricity's increased consumption due to the heat wave. It was originally planned to have the three hours cut only for Sunday and Monday, but then it was extended to the end of the week. (Reuters)

World Bank to give Egypt a DPF

The World Bank will give Egypt a Development Policy Financing (DPF) worth USD700mn dedicated to supporting the shift towards private sector participation, better macroeconomic and fiscal resilience, and a greener growth trajectory. This fund is a part of a three-year USD6bn financing package announced back in March. (Enterprise)

President ratifies a new law for hospital privatization

Egypt's President ratified a law that allows private entities to set up, manage, and operate health facilities and public hospitals for periods between 3 and 15 years. As of today, this law is in effect, in favor of maturing the operations of the healthcare sector, whereas the operated facilities will get back into the state's ownership later. (Enterprise)

China tightens controls on fertilizer exports to safeguard domestic supply

China, a key global supplier of nitrogen and phosphate fertilizers, has imposed stricter controls on its fertilizer exports. The move aims to protect domestic farmers' access to affordable fertilizers amidst global supply concerns. This is expected to support international urea prices, benefiting major fertilizer producers as ABUK, EGCH, MFPC, and EKHO. (Bloomberg)

CORPORATE

CIB lowers FX markup fees for credit cards

Commercial International Bank (CIB) [COMI] announced lowering the FX markup fees for credit cards to 5% vs. 10% before. This will allow COMI's customers to spend local FX transactions equivalent to EGP75,000-100,000/month vs. only EGP50,000/month earlier. (Enterprise)

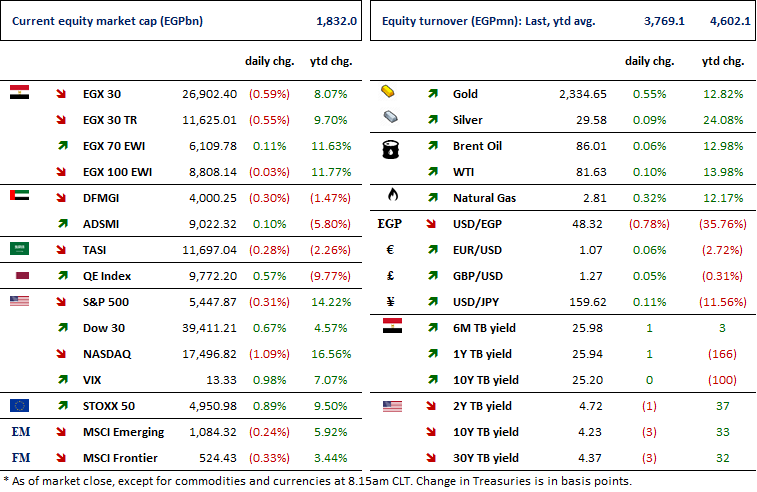

MARKETS PERFORMANCE

Key Dates

27-Jun-24

ELSH: Cash dividend / Payment date for a dividend of EGP0.075/Share (1st installment)

RMDA: Cash dividend / Payment date for a dividend of EGP0.020/Share (1st installment)

29-Jun-24

MICH: BoD meeting / Follow up on production, sales and exports.

30-Jun-24

HELI: Cash dividend / Payment date for a dividend of EGP0.07/share (3rd installment).

1-Jul-24

MOIL: OGM / Approving financial statements ending 31 Dec. 2023 and netting contracts.

3-Jul-24

EXPA: OGM / Approving increasing the issued capital by distributing EGP0.33/share worth of stock dividends.

EXPA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the bank's bylaws.

4-Jul-24

7-Jul-24

ZMID: OGM / Discussing netting contracts.

18-Jul-24

MPC Meeting / Determining the CBE's policy rate.

EMFD: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

31-Jul-24

TMGH: Cash dividend / Payment date for a dividend of EGP0.11/Share (2nd installment)