Today’s Top News & Analysis

New natural gas discovery offshore the Mediterranean

More investments are planned for the North Sinai electric grid

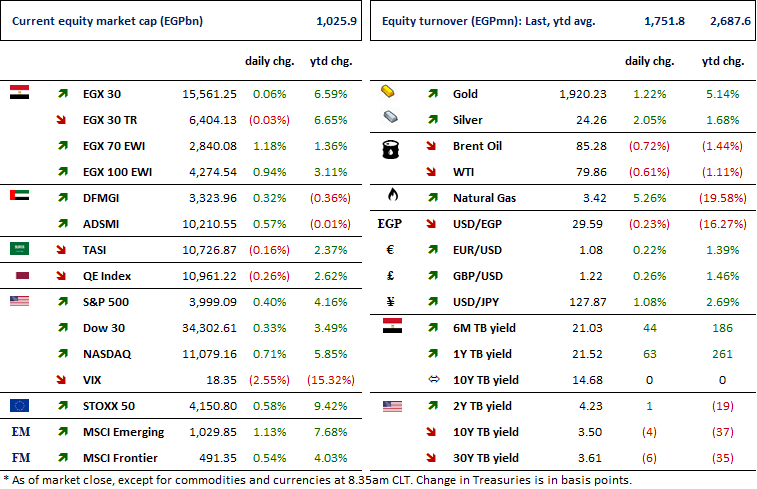

Another oversubscribed treasury bills bid

Palliser Capital attempts to block a merger between Capricorn Energy and NewMed Energy

Damietta and Port Said Container Handling companies to be listed next week

NERIC to start manufacturing electronic railway carriages

MIH intends to sell land to investors

HCCD reportedly negotiates sale of assets to GCC investors

Remco's EGM to discuss the sale of Stella di Mare Hotel; a 10% share buyback

Alexandria Container & Cargo Handling Co. BoD approves cash dividends

Sidpec eyeing full takeover of ETHYDCO

KABO denies paying a second loan to EXPA

Cleopatra to invest for development

MACRO

New natural gas discovery offshore the Mediterranean

Italy’s Eni and U.S. Chevron announced the discovery of an offshore natural gas field in the Eastern Mediterranean sea. The field is located in the Nargis-1 well, and development will be linked to the already existing infrastructure in the Nargis offshore concession. Ownership of the site is split between Eni (45%), Chevron (45%), and Egypt’s Tharwa Petroleum Co. (10%). (Reuters)

More investments are planned for the North Sinai electric grid

The Ministry of Electricity & Renewable Energy has invested a total of EGP1.6bn, having been enhancing the electric capabilities of the North Sinai region since 2014. More than 23,000 subscriptions have been registered with the introduction of prepaid meters. The ministry is currently embarking on new projects to further improve the efficiency and reach of the electric grid, with EGP500mn in investments. (Al-Borsa)

Another oversubscribed treasury bills bid

With over EGP140bn of submitted bids (a coverage ratio of 11x), the CBE has accepted EGP87bn for 91 days treasury bills with an average yield of 20.5%. Meanwhile, 273 days bills have seen a just as strong demand where the CBE accepted EGP10.7bn on an average yield of 21.5%. (CBE, Al-Borsa)

Palliser Capital attempts to block a merger between Capricorn Energy and NewMed Energy

LSE-listed Capricorn Energy intends to merge with Israel’s NewMed Energy whose unitholders are expected to own c.90% of the merged entity through a share swap. Meanwhile, Palliser Capital, Capricorn’s third largest shareholder, called for a general meeting to oust the board of directors and thwart the attempt. The vote is planned to take place on 1 February, but the effort might prove futile as the vote to approve the merger is scheduled just hours before the GM to restructure the board. If the merger goes through, the merged entity NewMed would assume control of Capricorn’s oil and gas operations in Egypt’s Western Desert. (Arab Finance)

Damietta and Port Said Container Handling companies to be listed next week

Prime Minister Mustafa Madbouly said that Port Said Container Handling Co. [POCO] and Damietta Container Handling Co. [DCCC] will be listed next week for a strategic investor. We think that Qatar Investment Authority (QIA) might be interested in acquiring a stake in the two terminals companies. (Al-Mal)

NERIC to start manufacturing electronic railway carriages

National Egyptian Railway Industries Company (NERIC) is reportedly to start the manufacturing process of electronic railway carriages for the new metro line in its plant in Port Said incorporation with the Korean "Hyundai Rotem" in H1 of 2023. NERIC is expected to provide 340 carriages as per its contract with Cairo Metro. (Al-Borsa)

MIH intends to sell land to investors

Mettallurgical Industries Holding (MIH) reportedly intends to sell land of a subsidiary "Delta Steel Mill Company" to investors as a part of its plan to exploit its assets base to maximize its resources. (AL-Borsa)

CORPORATE

HCCD reportedly negotiates sale of assets to GCC investors

Holding Co. for Construction & Development (HCCD) is reportedly negotiating the sale of some assets to GCC investors. The negotiations include acquiring part of HCCD's land bank along with co-partnering in Helio Park New Cairo project owned by HCCD's subsidiary Heliopolis Housing & Development [HELI]. (Asharq Business)

Remco's EGM to discuss the sale of Stella di Mare Hotel; a 10% share buyback

Remco for Tourism Villages Construction's [RTVC] BoD held last Thursday called for an extraordinary general meeting (EGM) to approve the sale of Stella di Mare Hotel to TOLIP Hotels & Resorts for EGP700mn. The EGM will also look into approving a share buyback of as much as 10% of the company’s shares. (Company disclosure)

Alexandria Container & Cargo Handling Co. BoD approves cash dividends

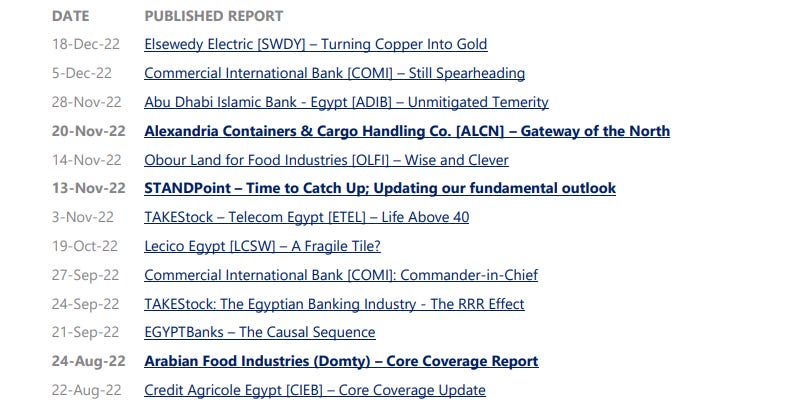

Alexandria Container & Cargo Handling’s [ALCN] BoD approved a cash dividend payment of EGP1.11/share to shareholders, implying a 5% yield. (Company disclosure)

Sidpec eyeing full takeover of ETHYDCO

Sidi Kerir Petrochemicals (Sidpec) [SKPC] is considering a full acquisition of the Egyptian Ethylene Production Company (ETHYDCO). SKPC already owns 20% of ETHYDCO, and the remaining 80% will likely be obtained through a share swap. Given the higher production capacity of ETHYDCO, the share swap ratio could be close to 2:1 in favor of ETHYDCO. ETHYDCO’s other major shareholders include ECHEM, GASCO, Al Ahly Capital Holding, National Investment Bank, and Banque Misr. (Al-Borsa)

KABO denies paying a second loan to EXPA

El Nasr Clothing & Textiles [KABO] denied paying its EGP61mn long-term loan owed to Export Development Bank [EXPA], stating it did not decide anything regarding this loan yet. On a separate note, KABO announced earlier that another EGP9mn long-term loan had been paid to EXPA on 3 January 2023. (Company disclosures: 1, 2)

Cleopatra to invest for development

Cleopatra Hospitals’ [CLHO] CEO, Dr. Ahmed Ezz El-deen, reported that CLHO plans investing EGP3bn dedicated for the development of four hospitals in the next six years. (Economy Plus)