Today’s Top News & Analysis

Government to offer 15-23% of ELAB

New 3-year CDs from state-owned banks

Multiple countries cutting oil production until the end of 2023

Kuwait might be interested in an additional stake of AAIB

UK Export Finance to provide Egypt with GBP2bn

ESRS 2022: Good yearly performance despite significant FX loss

Alexandria Containers Handling Co. 8M 2022/23: +182% y/y higher net profits

Orascom Construction achieved financial close on a 500mwh wind farm project

AIH 2022: Lower earnings despite improved margins

BINV 2022: Massive earnings growth

ISPH’s OGM decided not to distribute dividends for 2022

EIPICO approves capital increase and cash dividends

Misr Cement - Qena to pay cash dividends

GIG to acquire up to 100% of AIG Egypt

Macro

Government to offer 15-23% of ELAB

The Egyptian Government will reportedly offer an equity stake of 15-23% of Linear Alkylbenzene Co. (ELAB). Discussions are underway to determine whether the equity stake will be offered to both GCC strategic investors and floated on the EGX or exclusively on the EGX. Ownership of ELAB is split between National Investment Bank (NIB) (34.15%), the Egyptian Petrochemicals Holding Co. (ECHEM) (21.01%), the Egyptian Natural Gas Holding Co. (EGAS) (21.01%), the Ministry of Finance (13.11%), the Egyptian General Petroleum Corporation (EGPC) (10.5%), and Royal Chemicals (0.22%). Part of the equity stakes of NIB, ECHEM, and EGAS will reportedly be offered in the deal. (Al-Mal)

New 3-year CDs from state-owned banks

National Bank of Egypt (NBE) and Banque Misr announced new 3-year CDs that offer either a flat 19% p.a. or a variable declining rate of 22% p.a. for the first year, 18% p.a. for the second year, and 16% p.a. for the third year. The declining rates are thought to reflect a positive view on Egypt's monetary policy going forward. (Hapi)

Multiple countries cutting oil production until the end of 2023

In separate independent statements, multiple countries announced a voluntary production cut of more than 1.65mbpd from May until the end of 2023. Saudi Arabia announced a 500,000bpd reduction, while the UAE, Iraq, Kuwait, Algeria, Oman, and Kazakhstan will cut a total of 650,000bpd. Russia, meanwhile, will continue its current cut of 500,000bpd until the end of 2023, instead of June as previously planned. (Asharq Business)

Kuwait might be interested in an additional stake of AAIB

Kuwait Investment Authority (KIA) is reportedly interested in acquiring an additional stake in Arab African International Bank (AAIB). Currently, both KIA and the Central Bank of Egypt (CBE) own 49.5% stakes in AAIB. In the case of this presumed additional stake, AAIB would be a majority-owned subsidiary of KIA. (Al-Borsa)

UK Export Finance to provide Egypt with GBP2bn

UK Export Finance, the United Kingdom's export credit agency, will provide Egypt with GBP2bn to fund projects and operations in any sector except the oil sector. (Al-Borsa)

Corporate

ESRS 2022: Good yearly performance despite significant FX loss

Ezz Steel [ESRS] released its 2022 consolidated financial statements, posting net profits of EGP4.3bn (+21% y/y) on higher revenues of EGP84bn (+24% y/y) with a GPM of 22% (+2pp y/y), attributable to:

· Higher long steel sales volumes of 3.2mn tons (+11% y/y) on the back of higher local prices and local market demand, which saw local rebar sales volume increase by 15%.

· Local hot-rolled coil (HRC) sales volumes reached 1.1mn tons (+24% y/y).

· Lower export revenues of USD797mn (-38% y/y) were offset by the EGP devaluation.

Meanwhile, ESRS posted weak Q4 2022 results with net profits of EGP571mn (-47% q/q) on revenues of EGP23.3bn (+5% q/q), mainly attributed to:

· Recording an FX loss of EGP2bn vs. EGP308mn in Q3 2022.

· Local rebar sales volumes dropping to 743,000 tons (-20% q/q) on the back of lower local demand.

We note that net profit for 2022 does not include the EGP5.3bn FX loss incurred in the first 2 months within Q1 2023, which we reported on 5 March. The company is very sensitive to further EGP devaluations as its FX balance deficit reached USD861mn and EUR52mn, as of 31 December 2022. (Company disclosure)

Alexandria Containers Handling Co. 8M 2022/23: +182% y/y higher net profits

Alexandria Containers Handling Co.’s [ALCN] 8M 2022/23 results showed that:

· Net profits came in at a strong EGP2.78bn (+182% y/y), in line with Prime Research expectations, +38% vs. market consensus.

· Revenues came in at EGP2.9bn (+88% y/y), -8% vs. Prime Research expectations, +4% vs. market consensus.

Such results came from handling 510,345 containers (-3% y/y, in line with Prime Research expectations) with an average revenue/container of EGP5,705/TEU or USD227/TEU (+21% y/y,

-8.5% vs. Prime Research expectations). GPM came at 77.3% (+12.5pp y/y, -2.7pp vs. Prime Research expectations). The strong growth in profits is attributable to a higher FX rate paired with a higher margin despite lower volumes.

We had added ALCN to our STANDPoint Portfolio due to its high-margin business model and its USD-linked revenues. We have an Overweight / Medium Risk rating on ALCN which we released in our Core Coverage Update titled Breaking Higher Waves with a 12MPT of EGP26.1/share, implying a potential upside of 36%. (Company disclosure)

Orascom Construction achieved financial close on a 500mwh wind farm project

Gulf of Suez 2 wind farm project, which is built and operated by Orascom Construction [ORAS] with a consortium of ENGIE, Toyota Tsusho, and EURUS Energy Holdings, have achieved financial close. Funding was provided by a consortium of international banks, including Japan Bank for International Corporation (JBIC), Sumitomo Mitsui Banking Corporation, the Norinchukin Bank, Société Générale S.A., and the European Bank for Reconstruction and Development (EBRD). The consortium will operate and maintain the wind farm under a 25-year Power Purchase Agreement (PPA) with the Egyptian Electricity Transmission Company (EETC) and will generate 500mwh of electricity. (Company disclosure)

AIH 2022: Lower earnings despite improved margins

Arabia Investments Holding [AIH] recorded net earnings after minority of EGP69mn in 2022

(-27% y/y). Earnings dropped given a 25% lower top line of EGP1.3bn and lower other revenues of EGP13mn vs. EGP61mn a year earlier. We note that GPM improved to 21% vs. 16% a year earlier. AIH is currently traded at a 2022 P/E of 6x. (Company disclosure)

BINV 2022: Massive earnings growth

B Investments’ [BINV] net profit after minority grew to EGP846mn in 2022 vs. only EGP105mn a year earlier. The massive improvement in net earnings came supported by the sale proceeds from Total Energy – Egypt recording EGP1.4bn. We note that BINV’s top line grew to EGP1.5bn in 2022 vs. EGP163mn a year earlier. With a 2022 ROAE of 34%, BINV is now traded at a P/E and a P/VV of 4x and 0.9x, respectively. (Company disclosure)

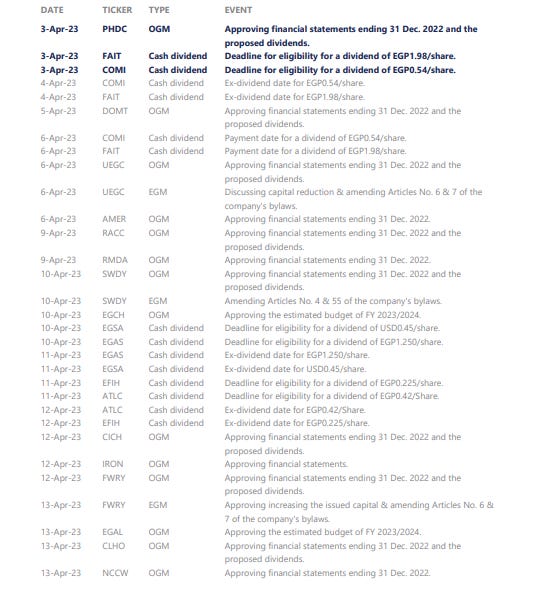

ISPH’s OGM decided not to distribute dividends for 2022

Ibnsina Pharma’s [ISPH] OGM decided not to distribute any dividends from 2022 net profits. (Company disclosure)

EIPICO approves capital increase and cash dividends

EIPICO’s [PHAR] EGM approved the capital increase of EGP496mn (+50%) offering 49,585,250 new shares at a par value of EGP10/share without any issuance premium. In addition, PHAR’s OGM approved the distribution of a cash dividend of EGP2.0/share, to be distributed in two equal installments in April and August 2023. (Company disclosure)

Misr Cement - Qena to pay cash dividends

Misr Cement – Qena’s [MCQE] BoD agreed to pay a cash dividend of EGP0.75/share, implying a 3.7% yield. (company disclosure)

GIG to acquire up to 100% of AIG Egypt

Kuwait-listed Gulf Insurance Group (GIG) has signed a deal with AIG MEA Holdings Limited to acquire its stake in its local subsidiary AIG Egypt which amounts to 95%. The EGP197mn deal is expected to contribute to the growth of the insurance industry in Egypt. Meanwhile, GIG launched a mandatory tender offer to acquire up to 1.2mn shares or 100% of AIG Egypt at c.EGP164.15/share. (Ahram Online, Economy Plus)