Today’s Top News & Analysis

Suez Canal revenues increase 45.6% y/y in January 2023

Minister of planning expects GDP growth of 4.8%-5%

Qatar offered to acquire 50%+ of Damietta and Port Said Container Handling Co.’s

Suez Canal Bank submits listing documents for its c.24% stock dividend

The CI Capital-Misr Capital merger is close to its final stage

Banque du Caire receives a USD100mn European/British loan facility

EGX indices gets a rebalance

MACRO

Suez Canal revenues increase 45.6% y/y in January 2023

The chairman of Suez Canal Authority (SCA) has announced that the canal's revenues increased 45.6% y/y in January reaching USD717mn. While the number of ships increased to 1953 ship (+21.3% y/y). (Economy plus)

Minister of planning expects GDP growth of 4.8%-5%

Minister of Planning declared her expectations for GDP growth in the current fiscal year to be around 4.8%-5% against 6.6% in FY2021/22. The Minister also stated that the government targets increasing private sector's contribution to economy to 65% over the next 3 years. (Al-Borsa news)

CORPORATE

Qatar offered to acquire 50%+ of Damietta and Port Said Container Handling Co.’s

Maha Capital, a subsidiary of the Qatar Investment Authority (QIA), has reportedly made an offer to the Holding Co. for Maritime & Land Transport (HCMLT) to acquire more than 50% of Damietta Container Handling Co. [DCCC] and Port Said Container Handling Co. [POCO]. However, HCMLT would like to maintain majority stakes in the two companies. In similar news, Admiral Tarek Shahin, the CEO of POCO, said that EFG Hermes Holding [HRHO], CI Capital Holding [CICH], and another investment bank are competing to float the company on the EGX in an IPO. (Al-Mal: 1, 2)

Suez Canal Bank submits listing documents for its c.24% stock dividend

Suez Canal Bank [CANA] has submitted to the EGX the documents to list 69.6mn stock dividends at a par value of EGP10/share. The bank had previously announced increasing its paid-in capital from EGP2.9bn to EGP3.6bn by EGP695.7mn through a c.24% stock dividend distribution to be financed from retained earnings. (Company disclosure)

The CI Capital-Misr Capital merger is close to its final stage

According to a reliable source, the merger between CI Capital Holding [CICH] and Misr Capital's operations is close to its final stage, pending a few legal procedures. (Al-Mal)

Banque du Caire receives a USD100mn European/British loan facility

Banque du Caire [BQDC] received a USD100mn loan from British International Investment (BII) and the European Bank for Reconstruction & Development (EBRD). The loan aims to support BQDC's capital base through second-tier enforcement, which would allow the bank to capture further growth opportunities. (Asharq Business)

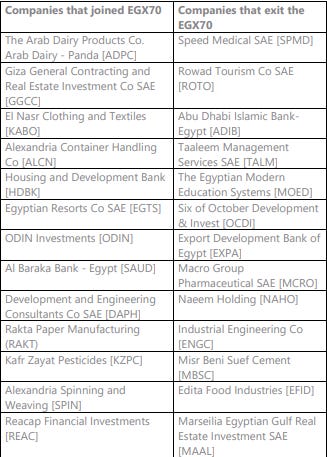

EGX indices gets a rebalance

The EGX30 index semiannuall rebalancing has been done yesterday, with Alexandria Container and Cargo Handling Co. [ALCN], Housing and Development Bank [HDBK], and QNB AlAhli [QNBA] going out of the index and replaced by Edita Food Industries [EFID], Taaleem Management Services [TALM], and Abu Dhabi Islamic Bank [ADIB]. As for the EGX70 index, 13 companies were replaced. The rebalanced indices will be effective starting 1 February 2023 trading session. (EGX)