Today’s Top News & Analysis

New tourism licenses halted temporarily

Only ministry-affiliated electricity companies to pay the regulated natural gas price

Suez Canal witnessed the highest daily transit rate in its history

SAUD's BoD withdraws its dividends proposal

Fawry and Orascom Financial Holding deny any relation to SVB

Delta Sugar denies receiving acquisition offers

MCRO to buy back 1.4% more treasury shares at a 15% to market

AMER 2022: Turns into the red

MPCO 2022: Net losses on higher fodder prices

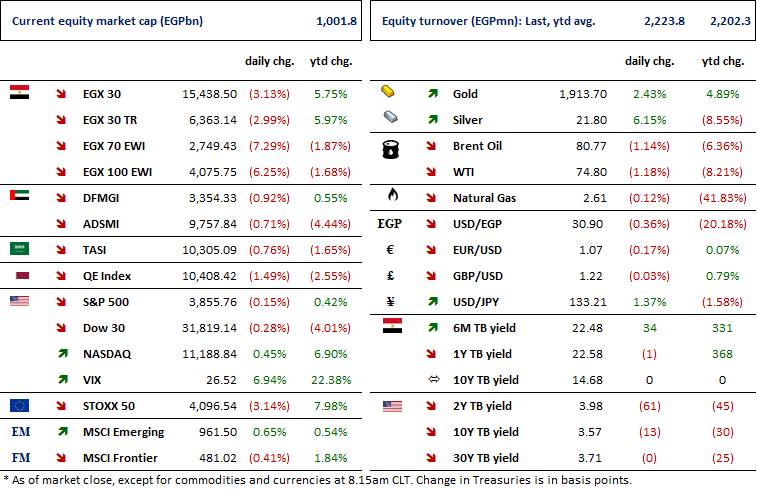

Macro

New tourism licenses halted temporarily

The Egyptian Ministry of Tourism & Antiquities will not issue tourism licenses for new companies wishing to enter the market for a period of one year. The ministry stated that Egypt does not need new tourism companies during this period. (Al-Mal)

Only ministry-affiliated electricity companies to pay the regulated natural gas price

The Cabinet set the regulated price of natural gas for electricity generation at USD3/MMBtu for only the electricity companies affiliated with the Ministry of Electricity & Renewable Energy. The previous price was also USD3/MMBtu but for both ministry-affiliated electricity companies and other companies as well. (Al-Borsa)

Suez Canal witnessed the highest daily transit rate in its history

The Suez Canal recorded its highest daily transit rate on Monday, with 107 ships (without wait time) from both directions carrying a combined 6.3mn tons. The Suez Canal Authority is currently developing its southern sector, which will increase navigational safety rates in the sector by 28% and increase the canal’s capacity by six additional ships. (Economy Plus)

Corporate

SAUD's BoD withdraws its dividends proposal

Al Baraka Bank - Egypt's [SAUD] BoD decided to retract its previous 2022 dividend proposal of EGP1.03/share which would have implied a payout ratio of 42%. The BoD is now proposing not to distribute any cash dividends to the bank’s shareholders, subject to an OGM approval on 18 March 2023. (Bank disclosure)

Fawry and Orascom Financial Holding deny any relation to SVB

Fawry [FWRY] and Orascom Financial Holding [OFH] denied any relation with U.S.-based Silicon Valley Bank (SVB). (Company disclosures: 1, 2)

Delta Sugar denies receiving acquisition offers

Delta Sugar [SUGR] denied receiving any acquisition offers in light of some news citing ADQ Holding’s negotiations with the Egyptian government to acquire 15-20% of SUGR. Last July, SUGR also denied receiving any acquisition offer from GCC funds. (Company disclosure, CNBC Arabia)

MCRO to buy back 1.4% more treasury shares at a 15% to market

Macro Group Pharmaceuticals’ [MCRO] BoD approved buying back 8.1mn shares or 1.4% of its issued shares between 16-22 March 2023 at EGP3.70/share, a 15% premium to market price. MCRO’s treasury shares already bought prior to this amounted to 7.15mn shares or 1.2% of issued shares. The share buyback program, set to support MCRO's stock price by taking treasury shares to 2.6% of issued shares, will be financed internally. (Company disclosure)

AMER 2022: Turns into the red

Amer Group Holding Co. [AMER] reported a consolidated net loss of EGP194mn in 2022 compared to a net profit of EGP8mn the year before. Revenues fell to EGP870mn vs. EGP1.4bn a year before (-37% y/y), while GPM narrowed to 37.3% (-6pp y/y). (Company disclosure)

MPCO 2022: Net losses on higher fodder prices

Mansoura Poultry’s [MPCO] 2022 net loss came in at EGP33.8mn compared to a net profit of EGP0.6mn in 2021 despite a 2% y/y growth in revenues to EGP143mn. Gross loss came at EGP25mn compared to gross profit of EGP10mn in 2021, driven by higher fodder costs. (Company disclosure)