Today’s Top News & Analysis

Qatar to invest USD1.5bn in industrial projects in 2024

Egypt studies issuing Indian debt

PHAR Q3 2023: FX losses mute the net profit growth

EAST Q1 2023/24 prelim.: Declined revenues and net profits

OLFI Q3 2023: GPM decline and FX losses lower the net profits

DOMT Q3 2023: Strong net profits on higher revenues and other income

RACC Q3 2023: Extraordinary net profits on higher revenues and FX gains

RMDA Q3 2023: Lower net profits on lower GPM and higher net finance expenses

AMOC Q1 2023/24: Strong revenues but slow net profit growth

GBCO Q3 2023: Net profit growth muted by FX losses and net finance expenses

MACRO

Qatar to invest USD1.5bn in industrial projects in 2024

Qatar is expected to invest USD1.5bn through 2024 in Egyptian industrial projects. Meanwhile, the Egyptian and Qatari governments agreed in March 2022 that Qatar should invest USD5bn through the coming period. (Enterprise)

Egypt studies issuing Indian debt

The Egyptian government studies issuing new financing from India after it issued the Samurai and Panda bonds with a total of around USD1bn. (Asharq Business)

CORPORATE

PHAR Q3 2023: FX losses mute the net profit growth

EIPICO [PHAR] posted its consolidated 9M 2023 results recording a 54% y/y growth in net profits to EGP643mn on:

· Higher revenues of EGP3.7bn (+37% y/y).

· Better gross profit margin of 46% (+2pp y/y).

· Improved SG&A-to-revenues ratio to 16% (-2pp y/y).

· Posting a 72% y/y higher FX gains of EGP178mn.

Regarding Q3 2023, PHAR recorded a 19% y/y growth in net profits to EGP134mn (-58% q/q) on:

· Higher revenues of EGP1.4bn (+48% y/y, +10% q/q).

· Improved SG&A-to-revenues ratio of 14% (-3pp y/y, -1pp q/q).

However, the net profits growth was muted by:

· The flat gross profit margin of 43.2%.

· Posting FX losses of EGP25mn vs. FX gains of EGP22mn last year. (Company disclosure)

EAST Q1 2023/24 prelim.: Declined revenues and net profits

Eastern Co. [EAST] posted its Q1 2023/24 preliminary results recording a 20% y/y decline in net profits to EGP1.1bn on a drop in revenues and gross profit margin to EGP3.1bn (-32% y/y) and 31% (-20pp y/y). (Company disclosure)

OLFI Q3 2023: GPM decline and FX losses lower the net profits

Obour Land Food Industries [OLFI] posted its consolidated results for 9M 2023 recording a 6% y/y decline in bet profits despite a 59% y/y increase in revenues on the higher white cheese average price of EGP54/kg (+67% y/y). The decline in net profits is attributable to:

· Lower gross profit margin to 20% (-1.5pp y/y) due to the higher costs of local raw materials derived by the EGP devaluation.

· Higher FX losses of EGP203mn vs. only EGP33mn last year.

· Higher finance expense of EGP111mn vs. only EGP24mn last year.

Regarding Q3 2023, OLFI posted a 34% y/y decline in net profits to EGP96mn despite the 53% y/y increase in revenues to EGP2.1bn on higher white cheese average price of EGP58/kg (+58% y/y). However, the net profit decline is due to:

· A lower gross profit margin of 18% (-2pp y/y).

· FX losses massively growing to EGP103mn vs. only EGP10mn a year before.

· Higher finance expense of EGP47mn vs. only EGP9mn last year. (Company disclosure: 1, 2)

DOMT Q3 2023: Strong net profits on higher revenues and other income

Arabian Food Industries (Domty) [DOMT] posted its consolidated 9M 2023 results recording a 118% y/y growth in net profits to EGP354mn on the higher revenues and other income of EGP5.3bn (+48% y/y) and EGP80mn (+81% y/y), respectively. Meanwhile, the gross profit margin came in flat at 24.4% (+0.6pp y/y).

Regarding Q3 2023, DOMT posted a 98% y/y growth in net profits to EGP102mn on the higher revenues and other income of EGP2bn (+52% y/y) and EGP32mn (+80% y/y), respectively. However, the gross profit margin dropped by 1.1pp y/y to 21.7%. (Company disclosure)

RACC Q3 2023: Extraordinary net profits on higher revenues and FX gains

Raya Contact Center [RACC] reported its 9M 2023 consolidated net profits of EGP137mn vs. only EGP10mn last year, on:

· Higher revenues of EGP1.4mn (+64% y/y).

· Better gross profit margin of 35% (+3.7pp y/y).

· Recording EGP69mn in FX gains vs. only EGP1mn last year.

Regarding Q3 2023, RACC turned into profitability posting EGP52mn vs. net losses of EGP5mn last year, on:

· A 53% y/y growth in revenues to EGP471mn.

· Better gross profit margin of 36% (+6.1pp y/y).

· Booking EGP29mn in FX gains vs. EGP1mn FX losses last year.

We note that RACC had 68% of its revenues in both 9M 2023 and Q3 2023 as offshore revenues (USD). (Company disclosure)

RMDA Q3 2023: Lower net profits on lower GPM and higher net finance expenses

Rameda [RMDA] reported 9M 2023 consolidated net profits of EGP192mn (-4% y/y) despite the 27% y/y increase in revenues to EGP1.4bn, due to:

· The lower gross profit margin of 47% (-2.4pp y/y).

· A 63% y/y decrease in other income to EGP2mn.

· A 243% y/y increase in the net finance expenses to EGP87mn.

Regarding Q3 2023, RMDA posted an 8% y/y growth in net profits to EGP76mn on higher revenues of EGP546mn (+43% y/y). However, the net profits growth was muted by:

· A lower gross profit margin of 49% (-2.4pp y/y).

· Booking EGP30mn in net finance expenses vs. only EGP8mn last year. (Company disclosure)

AMOC Q1 2023/24: Strong revenues but slow net profit growth

Alexandria Mineral Oils Co. [AMOC] reported its consolidated Q1 2023/24 net profits with a slow y/y growth of 5% to EGP412mn despite an 18% y/y growth in revenues to EGP7bn. Meanwhile, the gross profit margin slightly decreased to 9.9% (-0.6pp y/y). (Company disclosure)

GBCO Q3 2023: Net profit growth muted by FX losses and net finance expenses

GB Corp [GBCO] posted its 9M 2023 results reporting a 22% y/y decline in net profits to EGP1.4bn on:

· A 15% y/y decline in revenues to EGP19.5bn.

· A 5pp y/y decline in the gross profit margin to 22%.

· 79% y/y increase in FX losses to EGP474mn.

· 57% y/y increase in net finance expenses to EGP753mn.

Regarding Q3 2023, performance was better posting an 8% y/y growth in net profits to EGP705mn (+29% q/q) on the higher revenues of EGP8.8bn (+22% y/y, +46% q/q). However, the gross profit margin dropped to 22% (-7pp y/y, -0.1pp q/q). Meanwhile, the net profit growth was muted by:

· Booking FX losses of EGP216mn vs. only EGP41mn last year.

An 84% y/y increase in net finance expenses to EGP314mn. (Company disclosure)

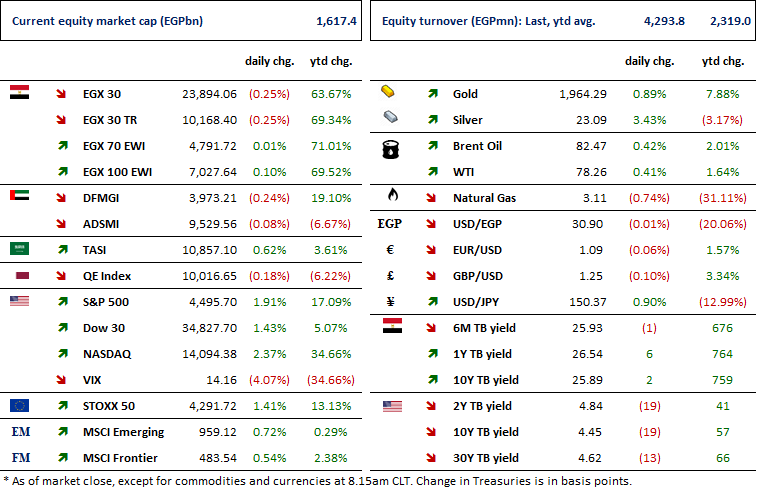

MARKETS PERFORMANCE

Key Dates

20-Nov-23

EGAL: Cash dividend / Deadline for eligibility for a dividend of EGP6.5/Share.

23-Nov-23

EGAL: Cash dividend / Payment date for a dividend of EGP6.5/share.

CSAG: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

CSAG: EGM / Approving increasing the issued capital & amending Article No. 3 of the company's bylaws.

TALM: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

EFID: Conference Call / Discussing Q3 2023 financial results.

26-Nov-23

EFID: EGM / Discussing capital reduction & amending Articles No. 3, 6 & 7 of the company's bylaws.

27-Nov-23

ETEL: EGM / Amending Article No. 5 of the company's bylaws.

EFID: Cash dividend / Deadline for eligibility for a dividend of EGP0.428/Share.

30-Nov-23

EFID: Cash dividend / Payment date for a dividend of EGP0.428/share.

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).