Today’s Top News & Analysis

EGX to establish Taswyat for futures clearing

An Australian consortium plans to invest USD875mn in a phosphoric acid plant

Dana Gas to add 80bn cubic ft. of natural gas from Egypt

North Geisum oil field expansion will increase production by 375%

ABUK 9M 2022/23: FX gains add fuel to the top-line fire

EFIC Q1 2023: Better sequentially yet weaker y/y

EAST Q3 2022/23: Sequentially weak quarter yet strong y/y

JUFO Q1 2023: Higher net profits on higher revenues and wider margins

HDBK Q1 2023: Skyrocket profitability margins

CANA Q1 2023: High growth associated with even higher risk

PHDC Q1 2023: Lower earnings despite higher revenues due to higher financing cost

AMER Q1 2023: Margins push net income higher

ARCC Q1 2023: expectations' exceeding growth

MBSC Q1 2023: Higher margins offset lower sales

BINV Q1 2023: FX gains drive earnings; portfolio companies performance broadly strong

MTIE Q1 2023: Higher profitability on higher revenues and margins

CERA Q1 2023: Bottom line picking up

AIH Q1 2023: Non-operating cost casts shadows on the bottom line

OIH could invest USD1.2bn in Uzbekistan

MOIL's EGM approves decreasing authorized capital

MACRO

EGX to establish Taswyat for futures clearing

The EGX will launch Taswyat Clearing Services Co., a clearing and settlement company for future contracts in conjunction with the futures exchange launch. The Egyptian Exchange Holding Co. for Market Development wholly owns the company with a paid-in capital of EGP100mn. (Daily News Egypt)

An Australian consortium plans to invest USD875mn in a phosphoric acid plant

An Australian consortium, including Lionsbridge, a Wesson Group subsidiary, and Westech, is reportedly planning to invest USD875mn to establish a phosphoric acid plant in the Safaga economic zone. The consortium will establish a company named Osiris to implement the project. The first phase will start once the necessary approvals are granted, costing USD312mn with a production capacity of 346,000 tons annually. The second phase will cost USD563mn and will double production capacity. (Asharq Business)

Dana Gas to add 80bn cubic ft. of natural gas from Egypt

UAE-based Dana Gas expects to begin drilling in 11 new wells across Egypt. The new wells are expected to add c.80bn cubic ft. of natural gas production and reserves. The company allocated investments worth USD100mn to drill the new wells. (Asharq Business)

North Geisum oil field expansion will increase production by 375%

The Minister of Petroleum & Mineral Resources inaugurated the expansion of the North Geisum field in Petrogulf Misr’s concession area in the Eastern Desert. The expansion increased the field’s production from 4,000bpd to 19,000bpd and increased reserves from 118mn bbl. to 203mn bbl. during H1 2023. (Al-Mal)

Corporate

ABUK 9M 2022/23: FX gains add fuel to the top-line fire

Abu Qir Fertilizers [ABUK] announced its full financials for 9M 2022/23. Below are our main takeaways:

· Net income increased by 86% y/y to EGP12.9bn on the back of:

(1) Higher global urea prices, coupled with EGP devaluation, which pushed ABUK’s revenues to jump 44% y/y to EGP17.3bn. However, GPM declined by 3.7pp y/y to 62.6%.

(2) Gigantic FX gains of EGP3.8bn due to the EGP devaluation.

(3) Interest income of EGP1.3bn.

· Also, sequential growth was strong, with net earnings growing by 27% q/q to EGP5.7bn as most of the FX gains were recorded in Q3, whereas top-line revenues declined by 5% q/q to EGP6bn on sequentially lower global urea prices.(Company disclosure)

EFIC Q1 2023: Better sequentially yet weaker y/y

Egyptian Financial & Industrial Co.’s [EFIC] consolidated financials for Q1 2023 showed net income declining by 6% y/y to EGP222mn in spite of a 15% y/y increase in revenues. The revenue increase came on the back of export revenues of granulated SSP amounting to EGP813mn. However, the huge increase in USD-based cost outpaced revenue growth due to the EGP devaluation. This pushed GPM down to 32% from 46% a year before. Still, the huge net financing income of EGP76mn helped mitigate the lower operating profit. On a sequential basis, net income came in 53% higher q/q and GPM increased to 32% vs. 22% in Q4 2022. (Company disclosure)

EAST Q3 2022/23: Sequentially weak quarter yet strong y/y

Eastern Co. [EAST] reported Q3 2022/23 net profits of EGP1.8bn (+35% y/y, -14% q/q) due to:

· Higher revenues of EGP4.7bn (+10% y/y, -12% q/q).

· Other revenues of EGP174mn vs. EGP14mn only last year.

· Higher financing income of EGP383mn (+217% y/y, +44% q/q).

Meanwhile, GPM decreased by 2pp y/y and by 7pp q/q to 41%. (Company disclosure)

JUFO Q1 2023: Higher net profits on higher revenues and wider margins

Juhayna Food Industries’ [JUFO] Q1 2023 net profits rose to EGP339mn (+135% y/y) due to the following:

· Higher revenues of EGP3.4bn (+42% y/y), driven by an increase in prices and despite a decline in volumes due to a lower consumer purchasing power and the inflationary effect. Additionally, export sales hit EGP286mn, contributing 8% of total revenues vs. 4% in Q1 2022.

· GPM increased by 3pp y/y to 30% due to a high GPM from export sales and the use of low-priced raw materials purchased at a lower exchange rate.

· SG&A-to-revenues ratio decreased by 3pp y/y to 15% due to savings on marketing spend and improved distribution efficiency.

Still, earnings growth came despite a higher interest expense of EGP51mn (+152% y/y) and FX losses of EGP27.5mn vs. FX gains of EGP3mn in Q1 2022. (Company disclosure)

HDBK Q1 2023: Skyrocket profitability margins

Housing & Development Bank [HDBK] announced Q1 2023 results, where net income increased by 107% y/y (+163% q/q) to EGP1.3bn on the back of a 110% y/y (+36% q/q) increase in net interest income (NII) to EGP2bn.

· This brings HDBK’s annualized NIM and ROAE to 9.2% and 50.5%, respectively, which are both the highest among listed banks this earnings season.

· On the balance sheet side, HDBK continues to record strong growth in deposits, increasing by 8% ytd to EGP96.4bn, with a GLDR of 41%.

· Meanwhile, loan growth came in tepid at only 3% ytd to EGP39.1bn with an NPL ratio of 7.8% and a coverage ratio of 104%.

We have recently updated our 12MPT for HDBK up to EGP24.1/share. The bank is currently traded at an annualized P/E of 1.8x and a P/E of 0.9x. (Bank disclosure)

CANA Q1 2023: High growth associated with even higher risk

Suez Canal Bank [CANA] announced Q1 2023 results. Here are our main takeaways:

· Net income increased by 161% y/y to EGP251mn on the back of:

(1) A 90% y/y increase in net interest income (NII) to EGP707mn.

(2) Almost 7x y/y higher gains from financial investments to EGP500mn.

(3) A 228% increase in net fees and commissions to EGP224mn.

· This came despite:

(1) Booking provisions of EGP378mn to maintain coverage ratio above the 100% mark.

(2) Reporting one-off FX losses that caused other operating expenses to increase by 119% y/y to EGP206mn.

(3) A leap in effective tax rate to 59% from 47% a year before.

· Deposits grew by 15% ytd to EGP75.5bn with GLDR maintained at 48%.

· Loans also grew by 14% ytd to EGP36.5bn, where NPL ratio reached 5.6% and coverage ratio came at 125%.

As a result, annualized ROAE rose to 18%, but CAR is now at 13% -- barely a notch above the CBE’s minimum requirement which is very risky. CANA is currently traded at an annualized P/E of 3.5x and a P/BV of 0.6x. (Bank disclosure)

PHDC Q1 2023: Lower earnings despite higher revenues due to higher financing cost

Palm Hills Developments’ [PHDC] Q1 2023 net income came in at EGP252.7mn (-14% y/y) despite 22% y/y higher revenues of EGP3.5bn and a stable GPM of 32%. This was mainly due to higher financing cost. Meanwhile, new residential and commercial sales grew by 22% y/y to EGP6.8bn in Q1 2023 from selling 786 units during the year. New Sales can be broken down into:

· West Cairo new sales grew to EGP4.7bn (+65% y/y, 69% contribution) by selling 558 units.

· East Cairo new sales fell to EGP808mn (-55% y/y, 12% contribution) by selling 98 units.

· North Coast and Alexandria new sales grew to EGP1.3bn (+45% y/y, 19% contribution) by selling 130 units. (Company disclosure)

AMER Q1 2023: Margins push net income higher

Amer Group's [AMER] Q1 2023 net income rose 24% y/y to EGP27.8mn vs. EGP22.4mn a year ago. Revenues rose 3.3% y/y to EGP390.4mn, while GPM expanded to 44.2% (+13.2pp y/y). (Company disclosure)

ARCC Q1 2023: expectations' exceeding growth

Arabian Cement Co.’s [ARCC] Q1 2023 net profits quadrupled y/y to EGP243mn compared to EGP58.8mn a year before. Revenues grew 61% to EGP1.7bn, which can be broken into:

· Local sales growing slightly by 4% to EGP971mn from selling 669,376 tons of cement and clinker (-32% y/y) with an average blended selling price of EGP1,451/ton (+55% y/y).

· Export sales growing exceptionally 8x to EGP574.9mn from selling 609,520 tons of cement and clinker (+290% y/y) with an average price of EGP943/ton (+105%) on the back of a stronger USD/EGP FX rate.

· Transportation services growing by 178% y/y to EGP164.3mn on the back of more export volumes.

GPM came in at 26.6% (+4.8pp y/y), which is attributable to the recently stronger prices of cement products. (Company disclosure)

MBSC Q1 2023: Higher margins offset lower sales

Misr Beni Suef Cement’s [MBSC] Q1 2023 results showed a higher net income of EGP61.4mn (+29% y/y) vs. EGP47.7mn a year before. This was despite lower revenues of EGP276.3mn (-37% y/y) as GPM widened to15.8% (+3.7pp y/y) on a higher cement selling prices. (Company disclosure)

BINV Q1 2023: FX gains drive earnings; portfolio companies performance broadly strong

B Investments Holding’s [BINV] net income skyrocketed to EGP331mn in Q1 2023 vs. only EGP22mn in Q1 2022 due mainly to booking an FX gain of EGP584mn vs. EGP21mn a year before, thanks to revaluation of proceeds received from the Giza Systems exit. Meanwhile, total revenues more than quadrupled to EGP64.5mn on higher share of profits from portfolio companies and finance income. Such Q1 2023 earnings performance came in despite booking EGP33mn in performance fees and higher income taxes. In terms of portfolio companies’ performance:

· Madinet Masr’s [MNHD] net income rose 153% y/y to EGP304mn on 25% higher net revenues of EGP1.05bn and almost double EBITDA margin of 42.5%.

· B Healthcare Investments saw revenues from The Egyptian IVF Center grow 37% y/y to EGP34.6mn, driven in part by 8.5% higher number of IVF cycles.

· Gourmet’s revenues rose 19% y/y to EGP297mn, driven by new store openings and higher prices.

· Ebtikar’s revenues (re-branded as Basata Holding for Financial Payments) rose 10% y/y to EGP164mn on 20% higher throughput value of EGP13.7bn.

· Revenues at Tamweel Investment Holding, Tamweel Mortgage Finance, and Tamweel Finance Co. all rose 86%, 87%, and 85% y/y, respectively. However, net profits only rose in the latter by 35% y/y to EGP9.3mn but fell in the first two by 6% and 12% to EGP26.5mn and EGP18.8mn, respectively.

Meanwhile, BINV’s BOD approved another DPS of EGP1 (or the equivalent in USD) and a 25% stock dividend, both to be approved by the next GM. (Company disclosure)

MTIE Q1 2023: Higher profitability on higher revenues and margins

MM Group for Industry & International Trade [MTIE] reported Q1 2023 net profits of EGP153mn (+202% y/y). The increase in net profits came in due to the following:

· Higher revenues of EGP2.5bn (+28% y/y).

· A wider GPM of 11% (+2pp y/y).

· FX gains of EGP26mn compared to FX losses of EGP5mn.

· A gain of EGP26mn from the fair value of financial investments through the amortized cost. (Company disclosure)

CERA Q1 2023: Bottom line picking up

The Arab Ceramic Co.’s (Ceramica Remas) [CERA] net profit rose more than 5x to EGP20.2mn in Q1 2023 vs. EGP3.8mn in Q1 2022. Revenues recorded EGP307.4mn (+47.5% y/y), while GPM expanded to 15.9% vs. 6.9% (+9pp y/y) a year before. (Company disclosure)

AIH Q1 2023: Non-operating cost casts shadows on the bottom line

Arabia Investments Holding [AIH] announced Q1 2023 results, where net income declined by 75% y/y to EGP9.2mn due to:

(1) A 13% y/y decline in revenues to EGP278mn.

(2) A 1pp y/y decline in GPM to 26%.

(3) A 135% y/y increase in financing cost to EGP22mn.

(4) A 102% y/y increase in expected credit losses to EGP9.2mn.

(5) Booking contingent provisions of EGP2mn.

This comes despite capital gains of EGP3mn and FX gains of EGP2.3mn. (Company disclosure)

OIH could invest USD1.2bn in Uzbekistan

Orascom Investment Holding's [OIH] CEO revealed OIH's intention to invest around USD1.2bn in Uzbekistan in renewables, hospitality, food production and mining sectors. (Enterprise)

MOIL's EGM approves decreasing authorized capital

Maridive & Oil Services' [MOIL] EGM approved decreasing the company's authorized capital from USD1bn to USD940mn. (Company disclosure)

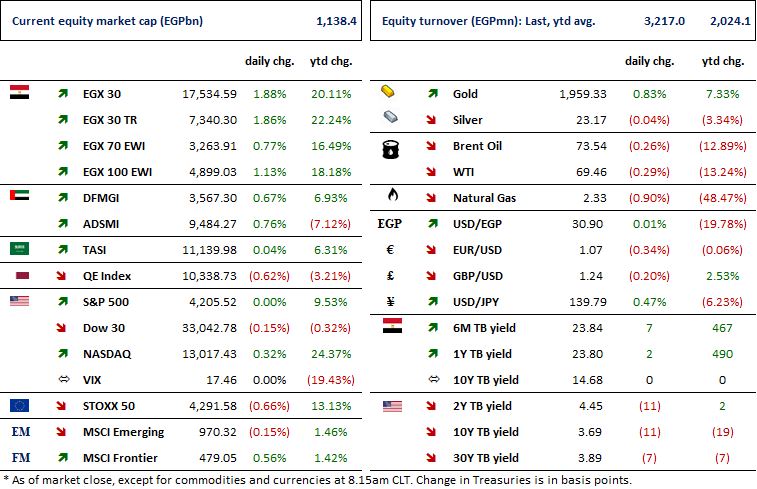

Markets Performance

Key Dates

31-May-23

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (1st installment).

ORAS: OGM / Approving financial statements ending 31 Dec. 2022.

BINV: Cash dividend / Payment date for a dividend of USD0.129/Share.

MNHD: Cash dividend / Payment date for a dividend of EGP0.075/share (1st installment).

1-Jun-23

BTFH: Capital increase / Last day for eligibility for the capital increase.

SPMD: Right Issue / Last day of trading the rights issue.

MSCI: MSCI's May 2023 Semi-Annual Index Review Effective Date.

4-Jun-23

HELI: OGM / Approving financial statements.

5-Jun-23

JUFO: Cash dividend / Deadline for eligibility for a dividend of EGP0.15/Share.

6-Jun-23

BTFH: Capital increase / Capital increase subscription starting date.

JUFO: Cash dividend / Ex-dividend date for EGP0.15/Share.

CSAG: OGM / Approving the estimated budget of FY 2023/2024.

CSAG: EGM / Amending Article No. 3 of the company's bylaws.

7-Jun-23

ATQA: EGM / To renew the company's license for 25 years starting from the end of the previous license (30 May 2023).

8-Jun-23

JUFO: Cash dividend / Payment date for a dividend of EGP0.15/Share.

BTFH: OGM / Approving financial statements ending 31 Dec. 2022.

BTFH: EGM / Amending Article No. 29 of the company's bylaws.

15-Jun-23

ZMID: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

17-Jun-23

MICH: EGM / Amending Article No. 6 of the company's bylaws for increasing the authorized capital from EGP400mn to EGP1bn.

18-Jun-23

MOIL: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

MOIL: EGM / Discussing the continuation of the company.