1. Today’s Trading Playbook

KEY THEMES

Yesterday, CI Capital Holding [CICH] posted its 2021 results which showed a bottom line of EGP681mn (+44% y/y). This robust growth was backed by a strong IB platform performance, thanks to (1) merchant banking gains amid Taaleem Management Services [TALM] exit, (2) advisory fees registered in Q3 2021 for the conclusion of BLOM Bank Egypt’s sale to Bank ABC at a total value of USD425mn, and (3) Investment Banking Advisory concluding several high-profile transactions in Q4 2021, including e-Finance [EFIH] IPO, Abu Qir Fertilizers [ABUK] follow-on offering, and Aldar-ADQ consortium’s acquisition of an 85.5% stake in SODIC [OCDI].

Meanwhile, NBFS platform growth in 2021 came a bit tamer, with a slight decline in leasing revenues of 4% y/y due to a recognition of losses from revaluation of legacy securitization portfolio. In our opinion, we think this is the blessing of diversification within the NBFS platform. CICH’s TTM ROAE stood at 20.7%, successfully restoring its pre-COVID-19 levels (i.e. 21%) in 2019. CICH is currently traded at a 2021 P/E and P/BV of 6.2x and 1.25x, respectively. In view of 2021 results, we maintain our 12MPT at EGP6.0/share (+40%). The company is one of the 15 stocks we picked in our STANDPoint 2022 strategy outlook published on 30 January 2022. We believe CICH could benefit from the EGP devaluation in the sense of improving turnover and liquidity in Egypt’s capital market. On the other hand, the current favorable atmosphere form M&As should provide a booster to the IB platform recovery. Meanwhile, First Abu Dhabi Bank’s attempted acquisition of EFG Hermes Holding [HRHO] should pull the attention towards other undervalued opportunities within the NBFS universe in Egypt, including CICH.

Now, on to the top news and analysis for the day.

2. Top News & Analysis

MACRO NEWS

According to expectations, the Egyptian government has officially requested support from the IMF to mitigate the impact of the war in Ukraine on its economy. Both two sides confirmed that they are now in talks on a new program, though it remains unclear what kind of assistance the IMF is willing to offer. (IMF)

The CBE has officially launched the national system for the instant payments network and the “InstaPay” application, which is the first licensed application that allows banking sector customers to conduct financial transactions electronically instantly. (Economy Plus)

CORPORATE NEWS

EFG Hermes Holding [HRHO] posted 2021 net income of EGP1.5bn (+12% y/y) on higher group revenues of EGP6.1bn (+12%). Revenue growth was led by NBFI (+41% y/y to EGP2.0bn), while investment bank revenues slipped to EGP3.8bn (-6% y/y). Earnings growth was also led by NBFI which turned profitable with EGP344mn, while investment bank’s earnings fell 22% y/y to EGP1.1bn. Q4 2021 marks the first quarter that HRHO consolidates its recently-acquired aiBank (a 51% stake), contributing EGP38mn to earnings for November and December 2021 alone, implying a 5% ROE. ROAE reached 10.3% on a restated basis. (Company disclosure)

Separately, HRHO’s Egypt Education Fund and RX Healthcare, its healthcare arm, are studying new investments and acquisitions. The education fund plans to invest some USD30-40mn over the next 18 months in two different transactions. Meanwhile, RX Healthcareis looking into 2-3 majority stake acquisitions of pharmaceuticals companies in transactions valued at between USD200-500mn apiece. Furthermore, HRHO’s renewable energy platform plans to reach a second close worth about USD550mn for its Vortex Energy IV fund within the next two years. On a side note, HRHO’s valU eyes entry to the Saudi market before the end of H1 2022, marking its first cross-border expansion. (Enterprise)

Abu Dhabi Wealth Fund (ADQ) is eyeing a stake in Abu Qir Fertilizers [ABUK], Misr Fertilizers Production Co. (MOPCO) [MFPC], and Alexandria Container & Cargo Handling [ALCN]. This comes within the context of ADQ’s USD2bn program to capture lucrative investment opportunities in Egypt. (Bloomberg)

Abu Qir Fertilizers [ABUK] has proposed a cash dividend distribution of EGP2.0/share,implying a dividend yield of 8%, pending shareholders’ approval in the OGM that will be held on 16 April 2022. (Company disclosure)

Misr Fertilizers Production Co. (MOPCO) [MFPC] proposed a cash dividend distribution of EGP7.0/share, implying a dividend yield of 6.5%, pending shareholders’ approval. (Company disclosure)

A block trade has taken place on Fawry [FWRY] with 151.09mn shares changing hands at a total value of EGP1.47bn and an average price of EGP9.72/share. Post the aforementioned trade, Banque Misr announced it upped its stake in FWRY to 15.78%. (Mubasher)

Egyptian Resorts Co.’s [EGTS] 2021 results showed consolidated net losses of EGP4.48mn vs. net losses of EGP44.55mn, where revenue slumped to EGP134mn (-37%y/y) compared to EGP211mn a year earlier. (Mubasher)

El-Kahera Housing & Development’s [ELKA] 2021 results showed consolidated net losses of EGP11.95mn vs. a net profit of EGP243mn year earlier, where revenues jumped to EGP2,106mn (81%y/y) with a lower GPM of 15% (-13pp. y/y). ELKA’s net losses are a result of higher cost of revenues. (Company disclosure)

Bank du Caire’s [BDQC] net earnings in 2021 grew to EGP3.6bn vs. EGP3.2bn a year earlier (12.5% y/y). This came on the back of net interest income growth of EGP10.5bn (+4% y/y). ROAE stood at 20% by the end of 2021. (Mubasher)

GLOBAL NEWS

A sharp sell-off in U.S. Treasuries has increased concerns about low levels of liquidity in the USD23.5tn market, potentially amplifying losses for investors which already had a dire start to the year. (Reuters)

The Russian President said on Wednesday that the world's largest natural gas producer would soon require "unfriendly" countries to pay for their fuel in Russia's currency, the rouble. (Reuters)

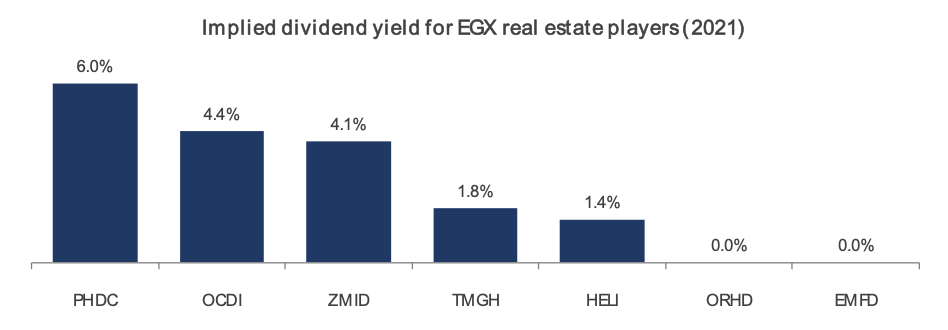

3. Chart of the Day

Hossain Zaman

Source: Prime Research.

PHDC's implied 2021 dividend yield is the highest compared to its peers.