Today’s Top News & Analysis

Egypt to offer 10% of Safi and Wataniya to a strategic investor

A presidential decree to transfer ownership of Misr Insurance Holding to TSFE

The Egyptian government cuts its expected economic growth for FY23

Egypt’s trade deficit shrank in December 2022; exports rose in 2022

82mn tons of gas and petroleum products consumed in FY23

EFG Hermes’s exposure to SVB is limited

CANA's BoD approves a 19% stock dividend

MIPH’s BoD proposes a 512% stock dividend

Macro

Egypt to offer 10% of Safi and Wataniya to a strategic investor

The Egyptian government plans to sell 10% or more of National Co. for Natural Water (Safi) and National Petroleum Co. (Wataniya) to a strategic investor within one month. An Emirati investor is reportedly interested in Wataniya. The promotion of the offering is scheduled to start today. (Asharq Business)

A presidential decree to transfer ownership of Misr Insurance Holding to TSFE

A presidential decree was published in an official gazette to transfer the full ownership of Misr Insurance Holding Co. to The Sovereign Fund of Egypt (TSFE). The state-owned holding company was established in 2006, with its subsidiaries' activities ranging from insurance to investment and real estate. (Al-Mal)

The Egyptian government cuts its expected economic growth for FY23

The Minister of Planning & Economic Development stated that the growth rate expected for Egypt's economy in FY23 has been reduced to 4.2% (-80bps vs. the previous forecast). The lowered expectation comes following a decline in H1 FY23 growth rate to 4.2% vs. 9.0% a year earlier. (Asharq Business)

Egypt’s trade deficit shrank in December 2022; exports rose in 2022

Egypt’s trade deficit declined to USD1.93bn in December 2022 vs. USD4.20bn a year before

(-54% y/y). Meanwhile, Egypt’s exports grew to USD51.6bn in 2022 vs. USD43.6bn in 2021. Turkey came as the first importer from Egypt, recording USD4.0bn. (CNBC Arabia, Al-Mal)

82mn tons of gas and petroleum products consumed in FY23

The Minister of Petroleum & Mineral Recourses revealed that the consumption of gas and petroleum products would reach 50mn tons and 32mn tons in FY23, respectively. (Ministry Statement)

Corporate

EFG Hermes’s exposure to SVB is limited

EFG Hermes Holding [HRHO] stated that the exposure of its subsidiary EFG EV Fintech to Silicon Valley Bank (SVB) does not exceed USD0.2mn (i.e. EGP6.2mn). HRHO owns 50% in EFG EV Fintech through its subsidiary EFG Finance Holding. (Company disclosure)

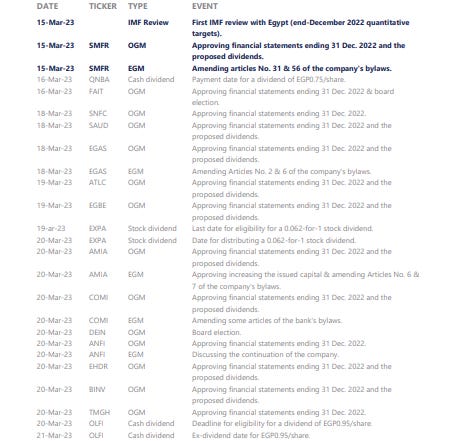

CANA's BoD approves a 19% stock dividend

Suez Canal Bank's [CANA] BoD approved increasing the bank's paid-in capital by EGP700mn to EGP4.3bn through a 19% stock dividend to be funded by its 2022 profits and subject to OGM approval. (Bank disclosure)

MIPH’s BoD proposes a 512% stock dividend

Minapharm Pharmaceuticals’ [MIPH] BoD will propose in an EGM a 512% stock dividend (excluding treasury shares). After the distribution of the stock dividends, MIPH’s paid-in capital will increase by EGP603mn to EGP726mn by distributing 60,298,088 shares at a par value of EGP10.0/share to be financed through retained earnings. (Company disclosure)