Today’s Top News & Analysis

Two Saudi investors eye USD500mn investments in Egypt

Domestic gas production falls to three-year low

Egypt intends to allow the opening of bank accounts via mobile phone in 2024

Egypt and Saudi Arabia consider the use of local currencies in trade

CBE intends to license FIntech companies to join “InstaPay”

CIRA FY2022/23: Finance expense trim the net profits

MACRO

Two Saudi investors eye USD500mn investments in Egypt

Two high-profile Saudi investors, namely Al Lami Group and Batterjee Holding, are separately eyeing investments and acquisitions in Egypt worth USD500mn. Al Lami Holding Group is aiming to invest some USD 500 mn in Egypt over the next two years in tourism and real estate. Where Batterjee is eyeing a potential acquisition of an EGX-listed pharma company. (Enterprise)

Domestic gas production falls to three-year low

Egypt’s natural gas production fell to 4.7 bn cubic meters/day in September, down 6% from August, to hit its lowest level since April 2020. (Enterprise)

Egypt intends to allow the opening of bank accounts via mobile phone in 2024

It has been reported that the Central Bank of Egypt intends to allow the opening of bank accounts for customers via a mobile phone application that it will launch during the next year for Egyptians inside and outside the country. (Asharq business)

Egypt and Saudi Arabia consider the use of local currencies in trade

Egypt and Saudi Arabia are studying the possibility of using local currencies in part of their trade exchange during the coming period, according to the Egyptian Ministry of Trade and Industry. (Asharq business)

CBE intends to license FIntech companies to join “InstaPay”

The Central Bank of Egypt reportedly intends to provide a license to Fintech companies to enable them to link their cards to the real-time payments network and the “InstaPay” application, similar to bank cards, during the next year. (Asharq business)

CORPORATE

CIRA FY2022/23: Finance expense trim the net profits

CIRA Education [CIRA] posted its FY2022/23 results with EGP123mn (-67% y/y) in net profits despite a 36% y/y growth in revenues to EGP2.3bn. The major decline in net profits is attributable to:

The lower gross profit margin of 44% (-7pp y/y).

Net finance expense growing massively to EGP400mn (+216% y/y). (Company disclosure)

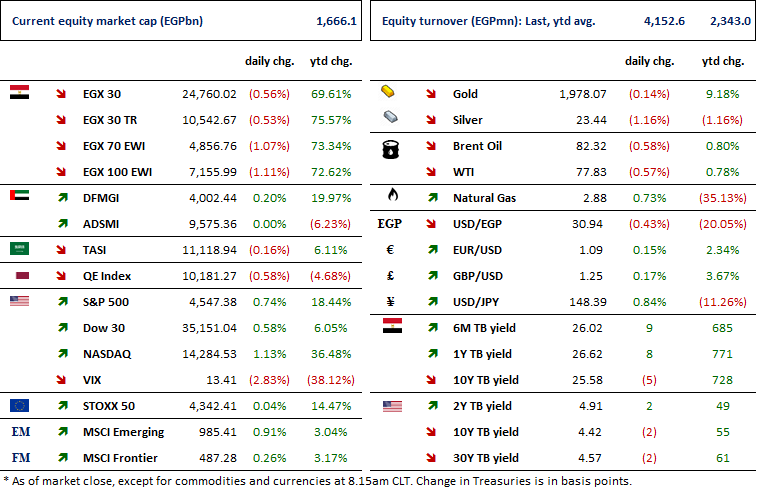

MARKETS PERFORMANCE

Key Dates

23-Nov-23

EGAL: Cash dividend / Payment date for a dividend of EGP6.5/share.

CSAG: OGM / Approving financial statements ending 30 June 2023 and the proposed dividends.

CSAG: EGM / Approving increasing the issued capital & amending Article No. 3 of the company's bylaws.

TALM: OGM / Approving financial statements ending 31 August 2023 and the proposed dividends.

EFID: Conference Call / Discussing Q3 2023 financial results.

26-Nov-23

EFID: EGM / Discussing capital reduction & amending Articles No. 3, 6 & 7 of the company's bylaws.

27-Nov-23

ETEL: EGM / Amending Article No. 5 of the company's bylaws.

EFID: Cash dividend / Deadline for eligibility for a dividend of EGP0.428/Share.

DOMT: Cash dividend / Deadline for eligibility for a dividend of EGP0.20/Share.

30-Nov-23

DOMT: Cash dividend / Payment date for a dividend of EGP0.20/share.

EFID: Cash dividend / Payment date for a dividend of EGP0.428/share.

ZMID: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).