Today’s Top News & Analysis

Semi-annual EGX indices review announced

Afrexim Bank renews two loans for The United Bank

BYD assembly plant to suspend operations within weeks

Opay intends to apply for the digital banking license in Egypt

MICH 2022/23: Strong y/y results, weak sequential performance again

BINV invested EGP300mn in EZ International

QIA vs. PIF to acquire a stake in VODE

IFC considers a loan to Al Baraka Bank Egypt

CI Capital concludes a securitized bond issuance for Aman

MACRO

Semi-annual EGX indices review announced

The Egyptian Exchange (EGX) completed the semi-annual review of the Egyptian stock market indices. EGX30 witnessed the addition of four companies: Beltone Financial Holding [BTFH], B Investments Holdings [BINV], Alexandria Containers Handling [ALCN], and Orascom Development Egypt [ORHD]. Meanwhile, the following were excluded: Taaleem Management Services [TALM], Ibnsina Pharma [ISPH], Cleopatra Hospitals [CLHO], and Rameda [RMDA].

On another note, the EGX100 EWI saw the addition of 12 companies including: Arab Co. for Asset Management & Development [ACAMD], Export Development Bank of Egypt [EXPA], Cairo Oils & Soap [COSG], Macro Group [MCRO], Misr Chemical Industries [MICH], and QNB Al Ahli [QNBA]. Also, 12 companies were excluded, such as Al Ezz for Ceramics & Porcelain [ECAP] and Prime Holding [PRMH]. (EGX)

Afrexim Bank renews two loans for The United Bank

African Export-Import Bank (Afrexim Bank) renewed two loan facilities worth around USD1bn for the CBE-owned The United Bank for an additional year. (Asharq Business)

BYD assembly plant to suspend operations within weeks

Due to import difficulties on the back of issues in the FX market, BYD’s assembly plant will temporarily suspend its operations in Egypt within two weeks. (Asharq Business)

Opay intends to apply for the digital banking license in Egypt

OPay, a leading provider of fintech and electronic payments solutions, revealed its intention to apply for a license to establish a digital bank in Egypt with a capital of USD60mn. (Al-Borsa)

CORPORATE

MICH 2022/23: Strong y/y results, weak sequential performance again

Misr Chemical Industries [MICH] reported its unaudited results for 2022/23, recording net profits of EGP543mn (+158% y/y) on higher revenues of EGP868mn (+58% y/y) with a 69% GPM (+13pp y/y), driven by:

· The EGP devaluation which resulted in higher local selling prices and stronger export revenues as well as FX gains as reflected in other income of EGP73mn.

· A 230% y/y increase in investment income to EGP76mn.

· A higher production utilization rate.

Meanwhile, MICH’s Q4 2022/23 net profits declined 30% q/q to EGP108mn on lower revenues of EGP191mn (-13% q/q) with a 66% GPM (-2pp q/q) driven in part by an 89% q/q decrease in other income to EGP4mn. (Company disclosure)

BINV invested EGP300mn in EZ International

Through its subsidiary B Pharma, B Investments Holding [BINV] invested EGP300mn in EZ International which is a joint venture between BINV, The Sovereign Fund of Egypt's (TSFE) Healthcare & Pharma Sub-fund, and El Ezaby Pharmacies. Meanwhile, BINV noted that its stake in B Pharma currently is 60%. (Company disclosure)

QIA vs. PIF to acquire a stake in VODE

Saudi Public Investment Fund (PIF) is competing with Qatar Investment Authority (QIA) to acquire a stake in Vodafone Egypt [VODE], a subsidiary of Telecom Egypt [ETEL]. On a separate note, yesterday ETEL denied receiving any official offers. (Enterprise, Company disclosure)

IFC considers a loan to Al Baraka Bank Egypt

International Finance Corporation (IFC), a subsidiary of The World Bank, is currently considering an USD55mn loan to Al Baraka Bank Egypt [SAUD] for a year. The loan is meant to fund small- and medium-sized enterprises, especially those owned by women. (Al-Borsa)

CI Capital concludes a securitized bond issuance for Aman

CI Capital Holding [CICH] announced the conclusion of an EGP859mn securitized bond issuance for Aman Holding, a subsidiary of Raya Holding for Financial Investments [RAYA]. This securitization is part of a 3-year program with a total of EGP5bn. (Company disclosure)

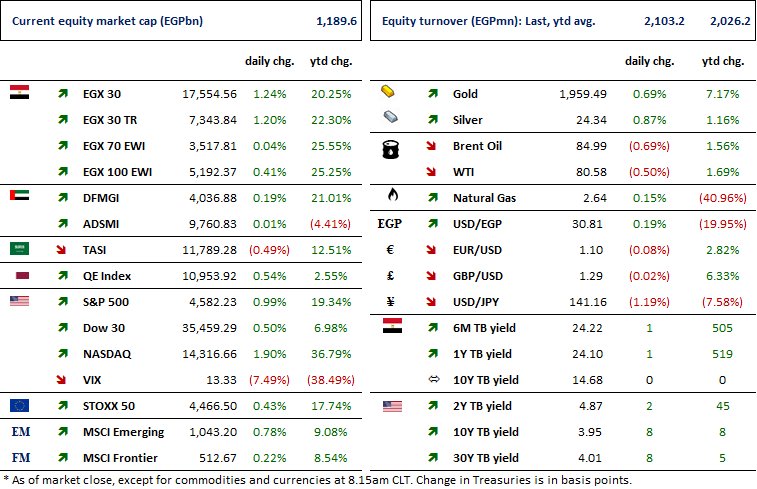

Markets Performance

Key Dates

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

31-Aug-23

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).