FUNDAMENTAL THOUGHTS

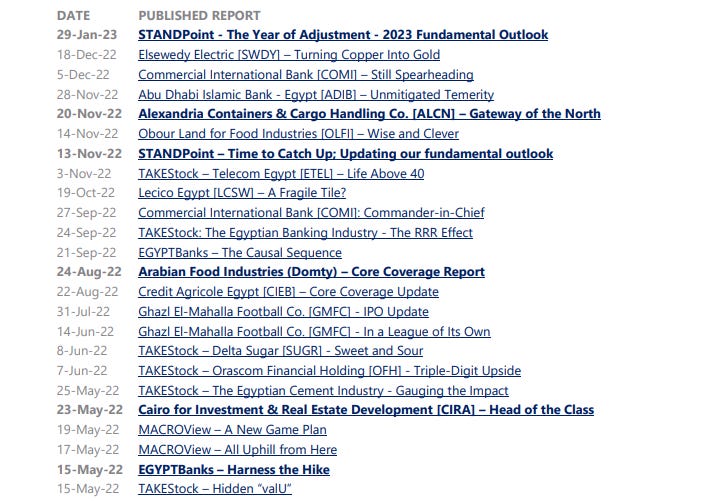

It’s here. We just published the Arabic translation of our STANDPoint annual strategy note, titled “2023: The Year of Adjustment”. The English original version was published this past Sunday, 29 January. As a reminder, besides the usual performance recap of global asset classes in 2022 and earlier, we showed how our previous stock calls have beaten the market indices over the last 2+ years. Also, we jotted down our forecasts for Egypt’s key macro indicators, then ended with our top stock picks for 2023. Here is a summary of the key takeaways from the note:

The Global Scene

· Oil, commodities, and the U.S. dollar topped the performance charts in 2022, their second consecutive annual positive performance in a row.

· Over the past 22 years, emerging markets generated a positive average return higher than gold, albeit with somewhat higher risk.

· 2022 was an ugly year for equities in general, but some emerging markets were unscathed, led by Turkey and Abu Dhabi. The Egyptian pound registered the second worst currency performance, closely behind the Argentine peso.

Egypt’s Macro Backdrop

· A story of “higher inflation for longer” should push the CBE to become more hawkish (albeit less aggressive) until inflation is tamed. Meanwhile, we expect the EGP to pare some of its losses earlier in the year (following the USD overshooting) but will likely be slightly lower in 2023 y/y.

· Egypt’s private sector growth has been negatively impacted by the USD shortage, which once addressed should leave room for a medium-term recovery, somewhat dragged by higher input cost that may pressure companies’ profit margins in the short term.

· A weaker EGP should bode well for Egypt’s external position: We expect a slight BoP surplus in FY23, thanks to a lower CAD and higher FDIs and FPIs.

As a side note, we expect the CBE to raise interest rates by 1% in today’s MPC meeting, then another 1% in the March meeting, which means a cumulative 2% hike for 2023. The rationale is that inflation will stay higher for longer, peaking in Q1 2023 and coinciding with the Ramadan season before moderating in H2 2023.

STANDPoint Portfolio

· Our top picks for 2023:

(1) Abu Dhabi Islamic Bank – Egypt [ADIB] - 12MPT EGP27.4/share.

(2) Orascom Construction [ORAS] - 12MPT EGP146.0/share.

(3) Arab Co. for Asset Management & Development [ACAMD] - 12MPT EGP1.05/share.

(4) Orascom Financial Holding [OFH] - 12MPT EGP0.39/share.

(5) Commercial International Bank – Egypt [COMI] - 12MPT EGP54.5/share.

(6) Taaleem Management Services [TALM] - 12MPT EGP7.8/share.

(7) Egypt Kuwait Holding Co. [EKHO / EKHOA] - 12MPT USD1.9/share / EGP56.8/share.

(8) Telecom Egypt [ETEL] - 12MPT EGP46.7/share.

(9) Elsewedy Electric [SWDY] - 12MPT EGP21.0/share.

(10) TMG Holding [TMGH] - 12MPT EGP15.0/share.

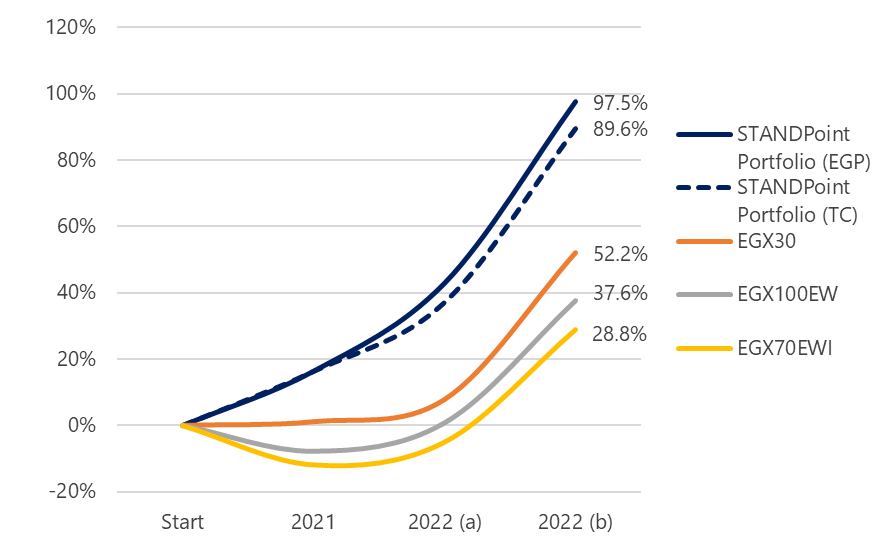

Cumulative relative performance (2021-2023 through 25 January 2023)

As shown above, our STANDPoint Portfolio published as part of our three editions (one in 2021 and two in 2022) has generated a positive cumulative return of 89.6% based on the trading currency of each stock. But if we account for the change in FX rate, the cumulative positive return is even higher at 97.5%. Overall, STANDPoint Portfolio (both in trading currency “TC” and EGP terms) outperformed the market’s main indices over the 2021-2023 ytd period.

That said, going forward we will be tracking the performance of our STANDPoint portfolio after the end of each month. We may choose to make some changes to the portfolio constituents whenever needed, which we will announce in due time so that our clients can replicate its performance.

You may read STANDPoint in both English (STANDPoint: 2023 – The Year of Adjustment) and Arabic (وجهة نظر: 2023 – عام التكيف).

— Amr Hussein Elalfy, MBA, CFA | Head of Research

Today’s Top News & Analysis

At least 20 companies will be up for sale on the EGX

Cabinet approves 13 draft petroleum agreements

The Manufacturing & Extractive Industries index grew 2.2% m/m in November 2022

Egypt’s auto sales volumes declined by 33%+ in 2022 across all segments

Central banks raise interest rates by 25bps following the Fed move

MNT-Halan is now a unicorn after securing USD400mn in funding

Abu Qir Fertilizers discloses progress for its ongoing projects

Alexandria Containers' H1 2022/23 earnings jump 151% y/y

MACRO

At least 20 companies will be up for sale on the EGX

Following Wednesday’s Cabinet meeting, the Prime Minister announced that the number of state-owned companies to be offered on the EGX could exceed 20. The details of the IPO offerings will be released following the next Cabinet meeting. The first batch of companies will be offered within three months, and the rest will be offered throughout 2023. (Asharq Business)

Cabinet approves 13 draft petroleum agreements

Following their meeting on Wednesday, the Cabinet approved 13 draft petroleum agreements for the Egyptian General Petroleum Corporation, the Egyptian Natural Gas Holding Company, and other international firms. The agreements pertain to the exploration and extraction of natural gas and crude oil in the Western Desert and the Mediterranean Sea, among other areas. (Hapi Journal)

The Manufacturing & Extractive Industries index grew 2.2% m/m in November 2022

Egypt’s Manufacturing & Extractive Industries Index (excluding crude oil and petroleum products) improved by 2.2% m/m in November 2022 and by 2.2% y/y. The m/m gain was partly driven by ready-made garments (+6.9% m/m), due to the cold weather, and by the chemical pharmaceuticals and medicinal preparations sector (+1.3% m/m). (CAPMAS)

Egypt’s auto sales volumes declined by 33%+ in 2022 across all segments

Egypt’s auto sales volumes, according to Automotive Marketing Information Council (AMIC), declined to c.185,000 vehicles in 2022 (-36% y/y) as:

· Passenger car sales volume fell to c.134,000 vehicles (-38% y/y).

· Truck sales volume fell to c.34,000 (-33% y/y).

· Bus sales volume fell to c.17,000 (-33%). (Al-Borsa)

Central banks raise interest rates by 25bps following the Fed move

Several central banks raised their benchmark interest rates following the U.S. Federal Reserve’s 25bps hike yesterday. The Central Bank of Bahrain, the Central Bank of the UAE, and the Saudi Central Bank have all hiked their interest rates by 25bps as well to maintain their local currencies peg. Meanwhile, the market should brace for more rate hikes in the future. (Al-Borsa: 1, 2, 3, 4)

CORPORATE

MNT-Halan is now a unicorn after securing USD400mn in funding

MNT-Halan, a small- and micro-business lender that also provides payments, consumer finance and e-commerce services, secured funding of USD400mn, raising its value to more than USD1bn, technically what the market calls a “unicorn”. These funds were financed by:

(1) UAE-based Chimera Investments which acquired an equity stake of at least 20% worth more than USD200mn.

(2) International investors, including the International Finance Corporation (IFC), funding primary capital worth USD60mn.

(3) Loan book securitization worth USD140mn. (Reuters)

Abu Qir Fertilizers discloses progress for its ongoing projects

After announcing the cancellation of the Abu Qir III expansion tender on 25 January 2023, Abu Qir Fertilizers [ABUK] said yesterday that it has not abandoned the implementation of the project and is studying other alternatives with better economic gains. Also, ABUK is currently preparing a a study to raise the capacity at Abu Qir I.

As for North Abu Qir for Agri-nutrients project, ABUK announced the signing of the shareholder agreement with the Egyptian General Petroleum Corporation and the Egyptian Petrochemicals Holding Co. Meanwhile, all implementation steps are being undertaken in parallel. (Company disclosure)

Alexandria Containers' H1 2022/23 earnings jump 151% y/y

Alexandria Container & Cargo Handling Co.'s [ALCN] H1 2022/23 results showed a 151% increase y/y in net profit, reaching EGP1.8bn (39% above our expectations) on revenues of EGP2bn (+78% y/y), exceeding our expectations by 14%. The growth in revenues came from:

· Handling 379,459 TEUs during the period (6% below our expectations), split between:

o 378,708 trade containers with an average fee of EGP5,258/container (20% above our expectations).

o 751 transit containers with an average fee of EGP345/container (36% below our expectations)

· Blended average fee reached EGP5,247/TEU (21% above our expectations), mainly due to the EGP weakening during the period.

· GPM came in at 76.1% (+11.2pp y/y), the highest in the last five years.

· Other revenues increased from EGP8.4mn last year to EGP223.3.7mn, mainly due to an FX gain of EGP218.9mn during the period.

On 20 November 2022, we had published a Core Coverage report on ALCN with an Overweight rating and a 12MPT of EGP16.9/share. The stock price has rallied by 88% from EGP13.05/share on 20 November to an intraday high of EGP24.49/share on 5 January 2023 before paring its gains to close yesterday at EGP17.77/share, still up 36%. (Company disclosure)