Today’s Top News & Analysis

State-owned banks issue new USD CDs

Egypt's FDIs reach USD7.9bn in 9M FY23

IMF expects lower growth and higher inflation for the Egyptian economy in 2024

A potential real estate merger

The NSPO aquires 20% of TAQA

MACRO

State-owned banks issue new USD CDs

In a trial to attract existing foreign currency liquidity and fight dollarization, state-owned National Bank of Egypt (NBE) and Banque Misr issued new high yield 3-year CDs. The first is a 7% p.a with interest paid quarterly in USD, and the second is a 9% p.a. with interest paid in advance in local currency. (Asharq Business)

Egypt's FDIs reach USD7.9bn in 9M FY23

Egypt's net foreign direct investments (FDIs) grew by 8.1% y/y to USD7.95bn in 9M FY2022/23. Moreover, the Egyptian government targets growth in FDIs of 10% to USD13bn over the next 3 years. (Economy plus)

IMF expects lower growth and higher inflation for the Egyptian economy in 2024

IMF has downgraded its forecast for the Egyptian economy growth in 2024 to 4.1% down from 5%. Lower growth expectations is mostly due to lack of FX rate flexibility. Moreover, the IMF has increased its inflation forecasts from 18% to 32% in 2024. (Enterprise)

A potential real estate merger

TheSovereign Fund of Egypt (TSFE) has reportedly proposed a merger between El Nasr Housing & Development with Maadi Development & Construction, ahead of selling the shares to a potential strategic investor. (Enterprise)

CORPORATE

The NSPO aquires 20% of TAQA

Silverstone Capital Investments Ltd. gave 20% of its stake in TAQA Arabia [TAQA] in a block trade to settle the debt of its parent company, Qalaa Holdings [CCAP] (a 61.56% stake), to one of CCAP’s creditors, the National Service Projects Organization (NSPO). The deal was worth EGP1.6bn for 270,470,760 shares, equivalent to EGP6.02/share. CCAP now holds an effective stake of 24.12% in TAQA through its wholly-owned subsidiaries, Citadel Capital for International Investments Ltd. (a 0.60% stake in TAQA) and Trimstone Assets Holding Ltd. (a 5.59% stake in TAQA), and Silverstone (a 29.13% stake in TAQA). It's worth noting that CCAP has the right to repurchase the 20% stake from the NSPO within 4 years. Furthermore, we can anticipate TAQA to witness more shareholder restructuring as CCAP is presently negotiating with Egyptian banks to settle their debts in exchange for a stake in TAQA. (EGX disclosure)

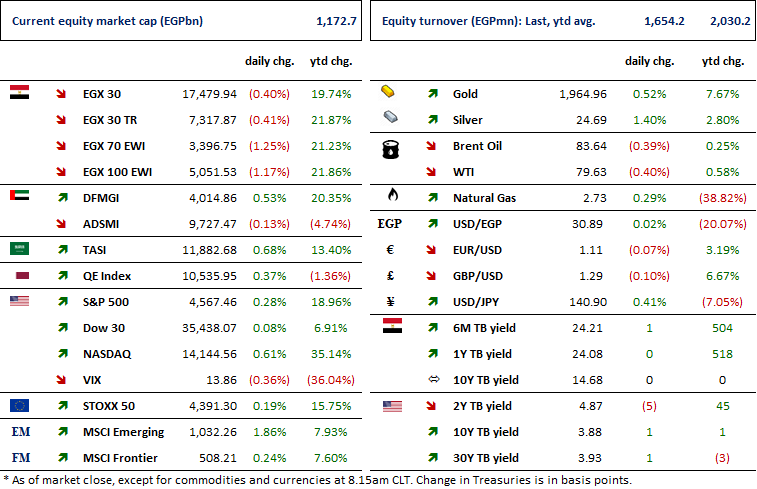

Markets Performance

Key Dates

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

MICH: BoD meeting / Follow up on production, sales and exports.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).

1-Aug-23

IFAP: EGM / Amending Article No. 4 of the company's bylaws.

2-Aug-23

ESRS: EGM / To approve the position of ESRS as a guarantor for its subsidiaries.

3-Aug-23

5-Aug-23

IRAX: EGM / To approve the voluntary de-listing from the EGX and purchasing the shares of those wishing to exit their position following the de-listing procedures.

10-Aug-23

MSCI / MSCI's August 2023 Quarterly Index Review Announcement.

16-Aug-23

DOMT: EGM / Amending Articles No. 3 & 4 of the company's bylaws.

17-Aug-23

EGTS: OGM / Approving financial statements ending 31 Dec. 2022.

31-Aug-23

PHAR: Cash dividend / Payment date for a dividend of EGP1.00/share (2nd installment).