Today’s Top News & Analysis

June's urban CPI rises 35.7% y/y, above our expectation

A GCC party to invest USD1bn in the pre-IPO fund

UK's Actis may acquire Gabal El-Zeit wind farm

EIB invests EUR4bn in Egypt until 2030

Record tourism figures in H1 2023

Cement producers are asking to extend production quota for a third year

QNBA Q2 2023: strong core profitability despite no FX gains

EFG Holding targets EGP4bn of investments in Egypt in 2023

RAYA's subsidiary partners with Jumia

Kima's EGM postpones the new plant's deal, wants to reach a better deal

EGX disregarded some transactions executed on TAQA yesterday

Egytran's shareholders approve acquisition of NOSCO

MACRO

June's urban CPI rises 35.7% y/y, above our expectation

The annual headline urban CPI recorded 35.7% y/y increase in June 2023 (vs. 32.7% y/y in May 2023). Meanwhile, the monthly headline urban CPI increased by 2.1% in June against 2.7% in May. As for annual core inflation, it increased by 41% in June against 40.3% in May. This comes above our forecasts of 32.9% for June's annual urban CPI and 38.6% for the annual core CPI. (CBE)

A GCC party to invest USD1bn in the pre-IPO fund

An unnamed GCC party is currently considering investing USD1bn in The Sovereign Fund of Egypt's (TSFE) pre-IPO fund, according to sources. (Al-Mal)

UK's Actis may acquire Gabal El-Zeit wind farm

The UK leading global investor in sustainable infrastructure Actis has reportedly reached an initial agreement with The Sovereign Fund of Egypt (TSFE) to acquire the state-owned 580-MW Gabal El Zeit wind farm, one of other 32 companies included in TSFE's pre-IPO fund. Actis's offer is said to be the best among other four acquisition bids by other international firms. (Al-Borsa)

EIB invests EUR4bn in Egypt until 2030

The Minister of International Cooperation announced yesterday that European Investment Bank (EIB) is to invest EUR4bn in Egyptian development projects until 2030, including the Nexus for Water, Food & Energy (NWFE) climate adaptation program. (Cabinet)

Record tourism figures in H1 2023

The Minister of Tourism announced that Egypt received over 7mn tourists in H1 2023, a new record that puts the country back on track with the ministry's target of 15mn tourists in 2023. (Ministry of Tourism)

Cement producers are asking to extend production quota for a third year

Several cement producers have submitted requests to the Egyptian Competition Authority (ECA) to extend the cement production quota for a third year, according to sources. This comes as a result of almost 30mn tons of excess capacity in the market which puts pressure on cement prices. We expect for the quota to be extended for a third year, yet at 6-9% lower quota than last year as a result of decreasing demand in the market. (Al-Borsa)

CORPORATE

QNBA Q2 2023: strong core profitability despite no FX gains

Qatar National Bank Al Ahli [QNBA] announced Q1 2023 standalone results. Here are our main takeaways:

· Although net income increased by 57% on a y/y basis, it came in lower by 17% q/q to EGP3.7bn. This can mainly be attributed to the high base effect of last quarter given an EGP1.09bn of FX gains.

· Net interest income (NII) came higher by 10% q/q to EGP7.2bn (+57% y/y). Accordingly, annualized NIM came in as high as 6.04% in Q2 2023.

· The bank booked 24% q/q higher provisions of EGP1.1bn.

· The bank managed to grow its loan book by 10% ytd to EGP254bn, mainly fueled by corporate loans. NPL ratio upped a bit to 4.85%, which induced the bank’s -1.8% cost of risk (CoR) to maintain a coverage ratio of 121%.

· The bank’s deposits grew 13% ytd to EGP461bn, with GLDR maintained at 55%.

· The bank still resorts to Treasury bills investments, raising its balance by 33% ytd to EGP90bn, which in turn caused the effective tax rate to increase to back to 33%.

· Annualized ROAE normalized back to 26.8% in Q2 2023 vs. 33.7% in Q1 2023.

· QNBA is currently traded at a P/E of 2.8x and a P/BV of 0.7x. (Bank disclosure)

EFG Holding targets EGP4bn of investments in Egypt in 2023

EFG Holding's [HRHO] direct investments manager announced that the company targets new investments of EGP4bn in Egypt during 2023. EGP2bn of which will be directed to SMEs investments, while another EGP1bn will be specified for healthcare and education sectors. (Asharq Business)

RAYA's subsidiary partners with Jumia

In a statement released yesterday, Raya Holding [RAYA] announced a strategic partnership between its subsidiary Raya Trade and the e-commerce platform Jumia to strengthen their operations in the local and regional electronics and home appliances markets and to expand their services and customer base. (Company disclosure)

Kima's EGM postpones the new plant's deal, wants to reach a better deal

Egyptian Chemical Industries’ (Kima) [EGCH] EGM decided to furtherly negotiate the new plant's implementation offer by Tecnimont, the Italian engineering and construction company. The offer for the new ammonium nitrate and nitric acid plant amounted to a total of USD297mn (EGP1.6bn and USD245mn). However, the EGM postponed approving this price in attempts to reach a better deal. (Company disclosure)

EGX disregarded some transactions executed on TAQA yesterday

The EGX decided to disregard the effects of some transactions on TAQA Arabia’s [TAQA] shares yesterday. These transactions were not reflected on the intraday closing price as a result. The price range of all transactions that occurred yesterday varied from EGP13/share to EGP125/share. A total of 801,301 shares were traded at a value of EGP15.7mn, with the stock closing at EGP20/share (+3900% than the opening price). (EGX)

Egytran's shareholders approve acquisition of NOSCO

Egytran's [ETRS] shareholders approved the acquisition of 99.99% of NOSCO at a share swap ratio of 1 share of ETRS to 0.0447 of NOSCO. To recap, the independent financial adviser had valued NOSCO at EGP58.033/share and ETRS at EGP2.594/share. The acquisition should benefit ETRS by increasing its operational fleet from 25 trucks to almost 162 trucks and also increasing its market share in the specialized road transportation segment to almost 80%, according to management. (Company disclosure)

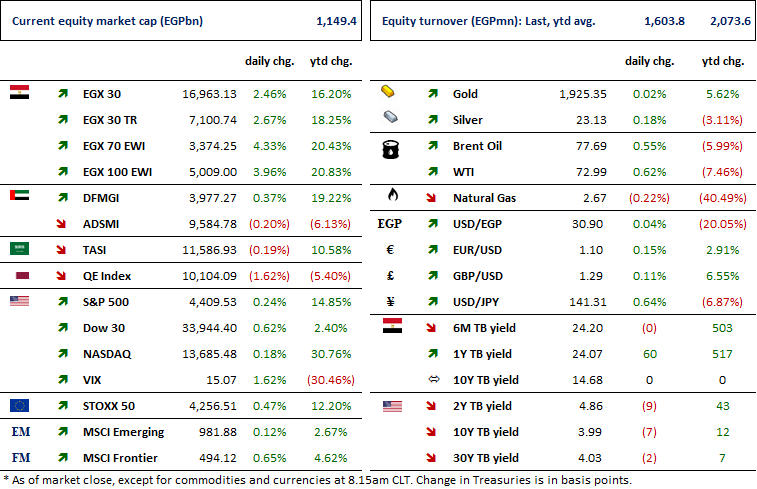

Markets Performance

Key Dates

12-Jul-23

OCDI: OGM / Discussing netting contracts.

MPRC: Cash dividend / Payment date for a dividend of EGP0.50/Share.

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

19-Jul-23

PACH: OGM / Board election.

29-Jul-23

SAUD: EGM / Amending some articles of the bank's bylaws.

30-Jul-23

HRHO: Stock dividend / Last date for eligibility for a 0.25-for-1 stock dividend.

31-Jul-23

HRHO: Stock dividend / Date for distributing a 0.25 for-1 stock dividend.

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).