Today’s Top News & Analysis

Egypt’s Economic Conference kicks off today

S&P Global affirms Egypt’s rating

Fuel prices were kept unchanged

Emirati Remco has reportedly acquired a stake in Ediata

Orascom Investment is looking to invest in the Moroccan market

Elsewedy Electric is looking to raise EGP5bn in debt

Shareholders of Misr Cement Qena approved cash dividends

Telecom Egypt denied receiving any offers regarding its stake in Vodafone Egypt

PIF is looking to take part in EGAL's indented capital increase

MACRO

Egypt’s Economic Conference kicks off today

The Egyptian Economic Conference 2022 kicks off today at Al-Massa Hotel in the New Administrative Capital to discuss the situation and future of Egypt’s economy amid unusual global economic atmosphere. (Egypt today)

S&P Global affirms Egypt’s rating

S&P Global Ratings has affirmed Egypt’s BB credit rating with a stable outlook on the back of expectations that fresh financial support from the IMF and the GCC will help meet external funding needs. (Enterprise)

Fuel prices were kept unchanged

The fuel pricing committee has fixed gasoline prices, according to its latest quarterly meeting. (Official release)

QIA is interested in Damietta Port

Qatar Investment Authority (QIA) representatives visited Damietta Port last week to explore investment opportunities. (Enterprise)

CORPORATE

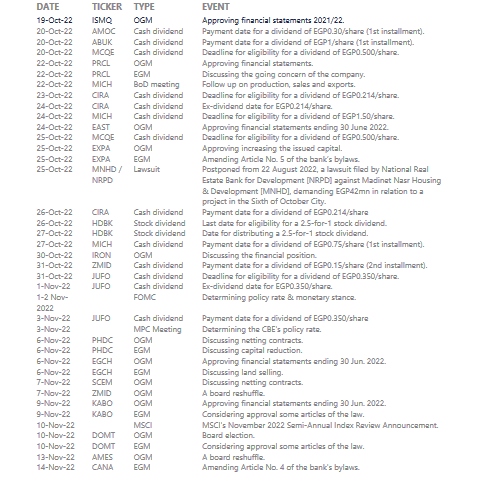

Emirati Remco has reportedly acquired a stake in Edita

It has been reported that Kingsway Fund has sold 3% of its stake in Edita Food Industries [EFID] to Emirati Remco Investments at EGP9.6/share. On a separate note, EFID announced the launch of its second cake production line in Morocco plant. Meanwhile, EFID’s BoD has approved to continue its share buyback program of 3.8% of its shares. The company will repurchase 28mn shares over the next three months, taking its treasury shares to 4.8% of total outstanding share as the company aims to support its share price. (Bloomberg Alsharq) (Company disclosure)

Orascom Investment is looking to invest in the Moroccan market

Orascom Investment Holding [OIH] intends to invest up to USD100mn in the Moroccan market. OIH's investment priorities are in the agri-industrial, EV charging, and renewable energy sectors. (Enterprise)

Elsewedy Electric is looking to raise EGP5bn in debt

Elsewedy Electric [SWDY] is looking to raise EGP5bn in debt from a consortium of banks led by Banque Misr. The loan will be directed to seven subsidiaries, and will be used to finance the high working capital needs for SWDY, in view of soaring commodity prices globally. (Shorouk News)

Shareholders of Misr Cement Qena approved cash dividends

Misr Cement Qena [MCQE] shareholders approved cash dividends distribution of EGP0.5/share, implying a dividend yield of 3.4%. (Company disclosure)

Telecom Egypt denied receiving any offers regarding its stake in Vodafone Egypt

Telecom Egypt [ETEL] denied receiving any official offer from any party regarding its stake in Vodafone Egypt [VODE]. (Company disclosure)

PIF is looking to take part in EGAL's intended capital increase

The Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund, is reportedly awaiting the FRA approval on Egypt Aluminum's [EGAL] intended capital increase, in order for PIF to take part. (Economy plus)