Today’s Top News & Analysis

Exports of building materials reach USD3.2bn in 5M 2023

Ministry of Supply buys 3.6mn tons of wheat since April 2023

MSMEDA to help Gastec and Cargas in natural gas car conversions

A UAE-based company is interested in Cleopatra Hospitals

ESRS responds again to the circulating news regarding its acquisition of EZDK

FRA grants CIB's subsidiary mortgage and factoring licenses

EFG Holding concludes another securitization for ValU

Contact partners up with Vodafone

Raya Foods considers offers to increase capital by EGP350mn

MACRO

Exports of building materials reach USD3.2bn in 5M 2023

Egypt’s exports of building materials reached USD3.2bn in 5M 2023 vs. exports worth USD7bn throughout 2022. (Al-Borsa)

Ministry of Supply buys 3.6mn tons of wheat since April 2023

Ministry of Supply & Internal Trade announced buying 3.6mn tons of wheat from the beginning of the season (last April) until now, where the government targets buying 4mn tons of wheat this year. (CNBC Arabia)

MSMEDA to help Gastec and Cargas in natural gas car conversions

The Micro, Small & Medium Enterprise Development Agency (MSMEDA) signed two agreements with Cargas and Gastec for the ninth phase of their car conversion project. The project aims for Cargas and Gastec to each convert 8,500 cars to run on natural gas, at a combined value of EGP200mn (EGP100mn each). Meanwhile, the Egyptian Natural Gas Holding Company (EGAS) and the Egyptian General Petroleum Corporation (EGPC) signed a MoU with MSMEDA to support natural gas conversion SME projects around the country. The goal is to help SMEs expand in compressed natural gas (CNG) refueling stations and natural gas car conversion centers while providing financing options, training, and technical support. These efforts will help the country reach its target of converting 100,000 cars/year in 2023. We note that TAQA Arabia [TAQA], through its TAQA Gas subsidiary Master Gas, currently has 61 CNG stations and 17 conversion centers, whereby they converted 8,141 cars in 2022 with ambitions of increasing this rate in 2023 and beyond (31,500 total vehicles converted till the end of 2022). (Al-Borsa, Company disclosure)

CORPORATE

A UAE-based company is interested in Cleopatra Hospitals

Burjeel Holdings, a UAE-based company, is interested in acquiring an indirect stake in Cleopatra Hospitals [CLHO], estimated to be a c.25% stake with a total investment exceeding USD70mn. (Al-Mal)

ESRS responds again to the circulating news regarding its acquisition of EZDK

Ezz Steel Co. [ESRS] released another statement regarding the reported valuation and purchase of the Egyptian government’s stake in its subsidiary Al Ezz Dekheila Steel Co. (EZDK) [IRAX]. The company reiterated that it still has not formally presented any offer to acquire an additional stake since the last statement on 8 May 2023. (Company disclosure)

FRA grants CIB's subsidiary mortgage and factoring licenses

Commercial International Bank [COMI] announced that the FRA has granted the bank's subsidiary, Commercial International for Finance Company (CIFC), mortgage and factoring licenses. This comes in line with CIFC's original schedule to start operations in Q2 2023. (Bank disclosure)

EFG Holding concludes another securitization for ValU

EFG Holding [HRHO] concluded the fifth issuance of securitization bonds for its consumer finance arm ValU. The issuance is worth EGP1.42bn and is part of a EGP4bn securitization program. (Al-Borsa)

Contact partners up with Vodafone

Contact Credit Technologies, the digital consumer finance arm of Contact Financial Holding [CNFN], signed an agreement with Vodafone Egypt to provide consumer finance services for the latter's customers. In addition to providing a "lending as a service" system to allow Vodafone's customers to apply for instant credit. (Al-Borsa)

Raya Foods considers offers to increase capital by EGP350mn

Raya Foods, a subsidiary of Raya Holding for Financial Investments [RAYA], is currently considering offers from investors to increase its paid-in capital by EGP350mn to fund its expansion plans in 2023-2024. (Al-Mal)

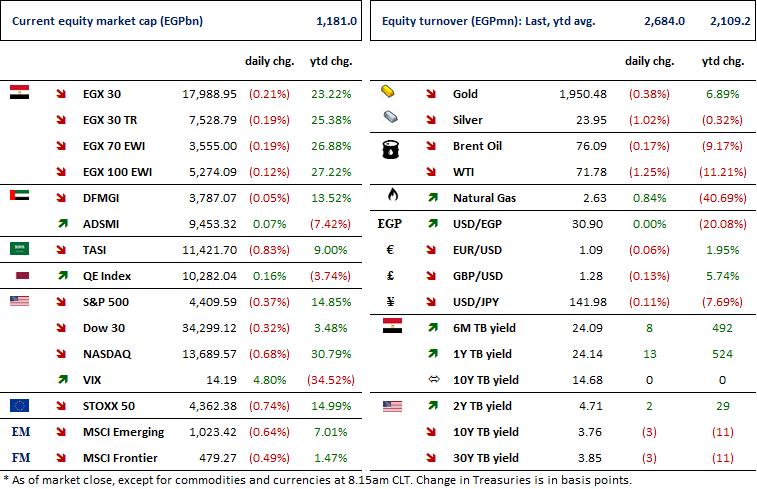

Markets Performance

Key Dates

20-Jun-23

SUGR: Cash dividend / Ex-dividend date for EGP2.550/Share.

22-Jun-23

AREH: OGM / Approving financial statements ending 31 Dec. 2022.

HELI: Cash dividend / Payment date for a dividend of EGP0.10/share (2nd installment).

SUGR: Cash dividend / Payment date for a dividend of EGP2.550/Share.

25-Jun-23

MCQE: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

26-Jun-23

BINV: OGM / Approving financial statements ending 31 Mar. 2023 and the proposed dividends.

4-Jul-23

ISPH: OGM / Approving financial statements ending 31 Dec. 2022 and the proposed dividends.

ISPH: EGM / Discussing capital reduction & amending Articles No. 6 & 7 of the company's bylaws.

5-Jul-23

Egypt PMI: June 2023 reading.

6-Jul-23

CCAP: OGM / Approving financial statements ending 31 Dec. 2022.

CCAP: EGM / Discussing the continuation of the company.

BTFH: Capital increase / Capital increase subscription closing date.

9-Jul-23

EGCH: EGM / Approving the final cost of the nitric acid and ammonium nitrate project.

ETRS: EGM / Approving increasing the issued capital & amending Articles No. 7, 8 & 47 of the company's bylaws.

MPRC: Cash dividend / Deadline for eligibility for a dividend of EGP0.50/Share.

10-Jul-23

MPRC: Cash dividend / Ex-dividend date for EGP0.50/Share.

MCRO: EGM / Amending Article No. 3 of the company's bylaws.

12-Jul-23

MPRC: Cash dividend / Payment date for a dividend of EGP0.50/Share.

13-Jul-23

EXPA: Right Issue / Last day of trading the rights issue.

18-Jul-23

RMDA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

EFIC: Cash dividend / Payment date for a dividend of EGP1.5/share (2nd installment).

EXPA: Capital increase / Capital increase subscription closing date.

31-Jul-23

TMGH: Cash dividend / Payment date for a dividend of EGP0.096/share (2nd installment).