Today’s Top News & Analysis

Blackouts to end by July's third week

OLFI: To invest EGP350mn through 2024; double exports to USD40mn

ETEL: Still studying the acquisition of Egypt Trust

ABUK: Halts operations temporarily

SKPC: Paused operations on gas supply cut

AMOC: 2025 Budget & MDDU Feasibility Study Suspension

Banque Misr and NBE lower FX markups after CIB

MACRO

Blackouts to end by July's third week

The MP said that it is planned to end the electricity blackouts by the third week of July in response to importing fuel worth USD1bn until the end of the year. Additionally, he said that there will be another USD180mn dedicated to importing 300 tons of mazut next week. (Enterprise)

CORPORATE

OLFI: To invest EGP350mn through 2024; double exports to USD40mn

Obour Land Food Industries [OLFI] announced in a statement its plans to invest at least EGP350mn through 2024 to increase the milk production capacities and establish a new processed cheese factory. In addition, OLFI plans to double its export revenues to USD40mn through 2024. (Company disclosure)

ETEL: Still studying the acquisition of Egypt Trust

Telecom Egypt [ETEL] stated that it did not fully acquire Egypt Trust, adding that the transaction is still under study. (Company disclosure)

ABUK: Halts operations temporarily

Abu Qir Fertilizers & Chemical Industries [ABUK] announced halting operations in its three factories in response to a cut in gas supplies due to the heat wave hitting the country. (Company disclosure)

SKPC: Paused operations on gas supply cut

Sidi Kerir Petrochemicals [SKPC] announced yesterday that its factories stopped operations on feedstock supply cut. (Company disclosure)

AMOC: 2025 Budget & MDDU Feasibility Study Suspension

Alexandria Mineral Oils Company [AMOC] released 2025 financial budget targeting revenues of EGP42bn and earnings of EGP660mn. In addition, BoDs approved the suspension of all decisions related to the feasibility study prepared by the French company AXENS regarding the development of the MDDU unit. (Company disclosure)

Banque Misr and NBE lower FX markups after CIB

Banque Misr and the National Bank of Egypt (NBE) follow the Commercial International Bank (CIB) [COMI] in lowering their FX markups for credit cards to 5% vs. 10% earlier. Banque Misr's FX spending is now equivalent to EGP300,000/month, considered the highest category of cards in Egypt. Meanwhile, NBE's FX spending is equivalent to EGP240,000/month. (Enterprise)

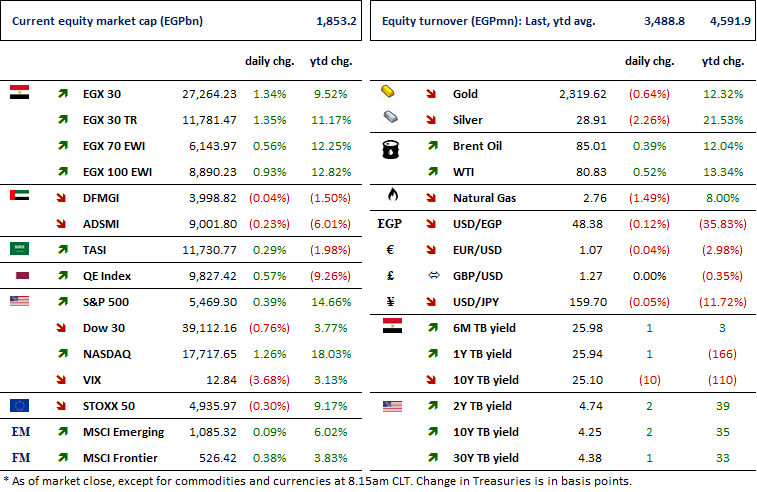

MARKETS PERFORMANCE

Key Dates

27-Jun-24

ELSH: Cash dividend / Payment date for a dividend of EGP0.075/Share (1st installment)

RMDA: Cash dividend / Payment date for a dividend of EGP0.020/Share (1st installment)

29-Jun-24

MICH: BoD meeting / Follow up on production, sales and exports.

30-Jun-24

HELI: Cash dividend / Payment date for a dividend of EGP0.07/share (3rd installment).

1-Jul-24

MOIL: OGM / Approving financial statements ending 31 Dec. 2023 and netting contracts.

3-Jul-24

EXPA: OGM / Approving increasing the issued capital by distributing EGP0.33/share worth of stock dividends.

EXPA: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the bank's bylaws.

4-Jul-24

7-Jul-24

ZMID: OGM / Discussing netting contracts.

10-Jul-24

ADIB: Stock dividend / Last date for eligibility for a 0.2-for-1 stock dividend.

11-Jul-24

ADIB: Stock dividend / Date for distributing a 0.2 for-1 stock dividend.

18-Jul-24

MPC Meeting / Determining the CBE's policy rate.

EMFD: EGM / Approving increasing the issued capital & amending Articles No. 6 & 7 of the company's bylaws.

31-Jul-24

TMGH: Cash dividend / Payment date for a dividend of EGP0.11/Share (2nd installment)